Your credit score and report. Always free, forever.

Your credit score and report. Always free, forever.

See your credit score and credit report in 3 minutes and learn how to improve it. 100% free for Canadians.

Join 24 million ClearScore members

![Report Icon]()

Get your credit score and report for free

![Investment Icon]()

Watch your credit score grow

![Search Icon]()

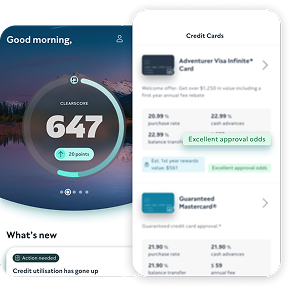

Explore offers tailored to you

![Shield Icon]()

Know your data is safe

When we say free, we mean forever

ClearScore is always free for Canadians no card required, no trial ticking down. Sign up in under 3 minutes with no impact to your credit score.

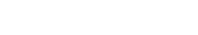

Go beyond your credit score

Not all credit score apps are created equal. With ClearScore Credit Health, you see the full picture of your finances. Learn how your credit score, credit report, and credit history affect the way lenders see you and discover what you can do to access the credit you deserve.

Avoid unnecessary credit checks

Compare as many personalized offers as you like, and check your approval chances, all without harming your credit score. Apply for credit cards, loans, mortgages and more with just a couple clicks.

Stop fraud in its tracks

Each week, we scan your credit report for early fraud detection whether someone opens a card or loan in your name or your data appears on the dark web so you can act fast to protect your information.

We work with Canada’s most trusted lenders

What's the word?

Free and Easy

![5 stars white]()

It’s easy to sign up and I was able to get my credit report fast and free.

Jebi

Credit Guru

![5 stars white]()

The best app to review your credit score. They have every detail you need. And above all it’s free.

Tandin Wangchuck

User friendly app

![5 stars white]()

Easy to use. Great to have something to view your entire credit status and be able to see how likely you get approved for another credit card or a loan.

King Leung

Informative

![5 stars white]()

Helps keep track of your credit score. It shows on the app how we can do better to increase our credit score. It's really a useful and handy app.

Customer

Clearscore FAQs

We get your credit score and report directly from TransUnion – one of Canada’s top credit bureaus. Your score is out of 900, so it’s easy to understand. Just so you know, other credit bureau’s have their own scoring system. That’s where access to your full credit report comes in – it can help you understand exactly what’s impacting your score and why.

No. We run a soft inquiry and it has zero impact on your score or future applications. You can check your credit score and report, and compare as many offers as you like, without impacting your score.

We believe everyone deserves clear, no-cost access to their credit information so they can make smarter financial decisions. Charging for a score would run against that mission. If you later choose a credit card, loan, or other product through ClearScore, the lender pays us a commission. That revenue lets us keep the core service free for every user. Your best interest first: Our offer rankings are driven by what fits your profile and potential savings—commission never changes the order.

We work with some Canada’s leading lenders to bring you credit cards, loans, mortgages, and more. We search the market so you don’t have to – instead, you can focus on picking the right product for you.

ClearScore is regulated in Canada and uses the fancy 256-bit encryption which is the same encryption Canadian banks rely on. We never sell or rent your data to advertisers, and you can delete your account (and all data) whenever you choose.

We get your credit score and report directly from TransUnion – one of Canada’s official credit bureaus. However, scores can differ because: Lenders use different bureaus (TransUnion vs. Equifax) Each source updates at its own schedule ClearScore shows your most recent TransUnion data, refreshed weekly. See something wrong? Start a dispute with the bureau.