Your credit score & report. Always free, forever.

It takes just 3 mins to join the 20 million people who already trust ClearScore to help them improve their financial future.

Your free credit score & report, updated weekly

Help and support improving your score

Join over 20 million happy ClearScore members

See your approval chances before applying for credit

Unlike some other providers, when we say free, we mean forever. No 30 day trials, we give you your credit score and report for free, forever.

And because keeping up to date is so important, we show you your new report every single week.

You’ll see clear, personalized insights about your credit score and tips on how to improve it. By improving your credit score, you have a better chance of getting better credit offers and saving money.

Over 20 million people globally already trust ClearScore to help them with their financial future.

The higher your credit score, the more likely you are to see credit card and loan offers. You could even get lower interest rates and save money. We bring you exclusive offers with your approval odds, helping you feel clearer about credit.

FAQs

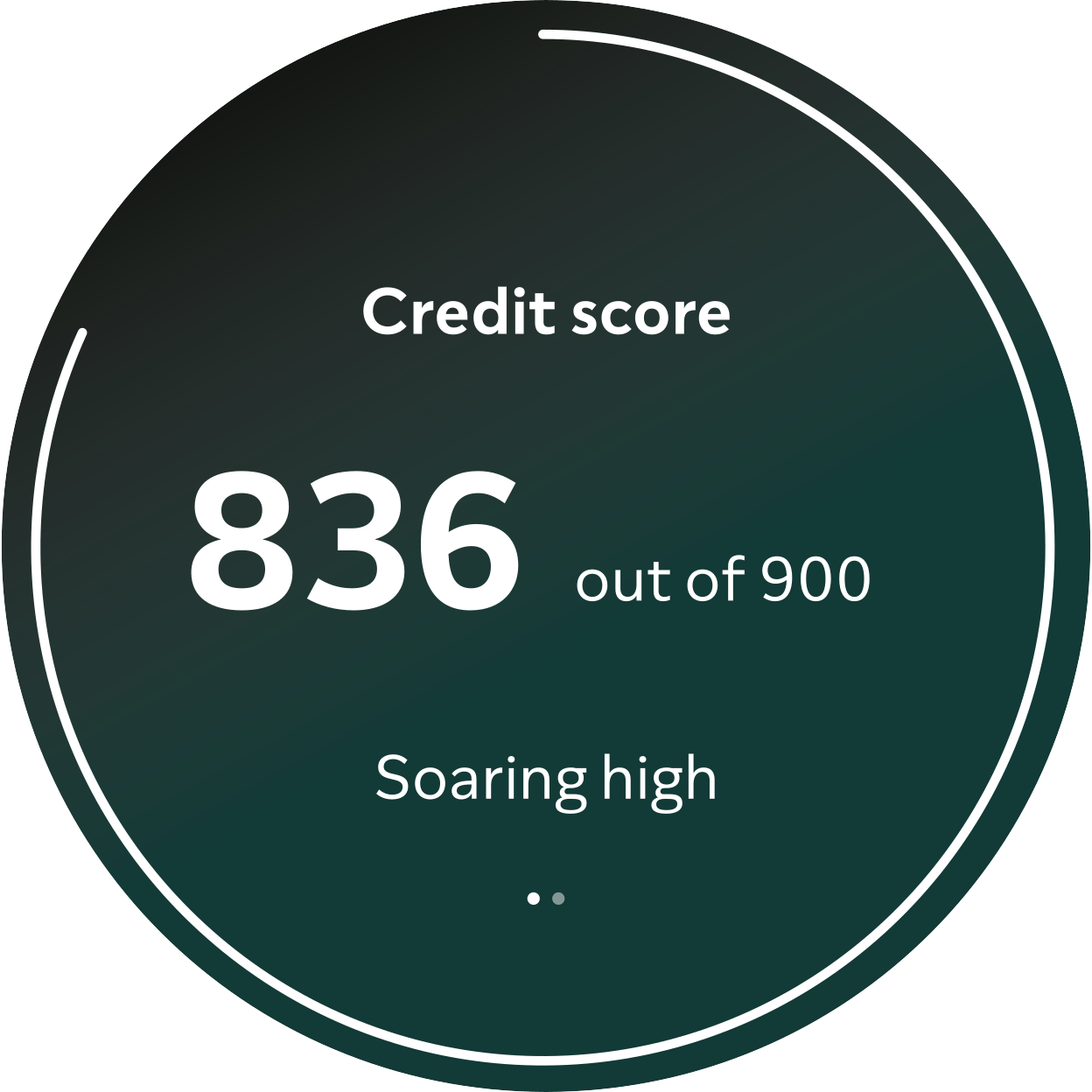

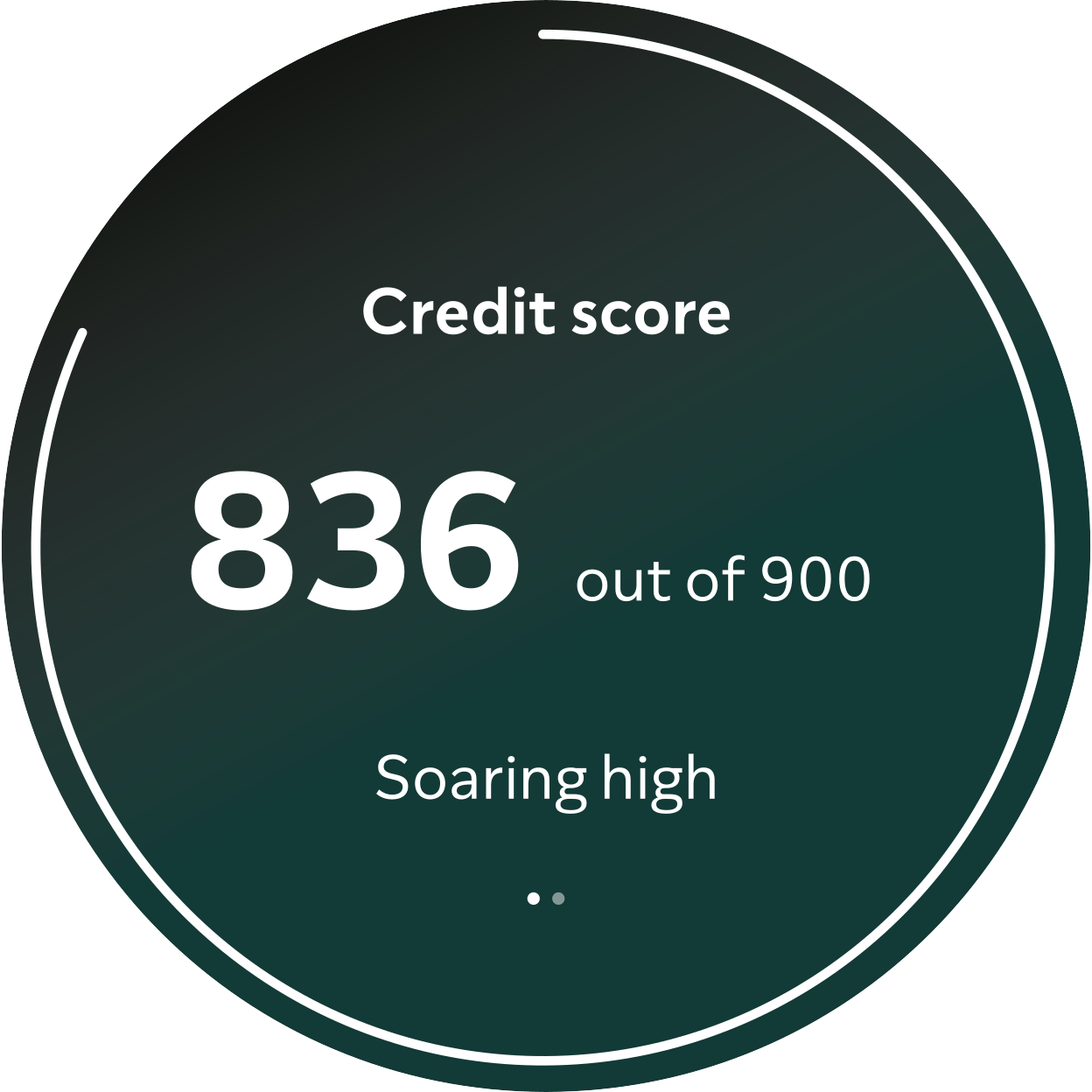

Your credit score is a number out of 900. It’s based on your credit report, which is a record of how you’ve managed credit in the past. We give you both of these for free, making it as easy as possible for you to start improving it.

The higher your credit score, the more likely you are to be eligible for a credit card or loan. You could even get lower interest rates after improving it. Make the most out of ClearScore with three simple steps:

See your credit score for free

Find out how to improve it

Apply for offers tailored to you

Checking your credit score means you can take steps to improve it. This means you’re more likely to accepted for your next credit card or loan and get a wider range of deals. But there are two other great benefits to checking your score. You can:

Correct mistakes on your report

Sometimes credit reference agencies have wrong information about you, which can harm your credit score. Fix any mistakes so you’re in the best position when you apply for credit.

Make sure nobody has stolen your identity.

Your report shows you if any fraudsters have opened up cards or loans in your name. If they have, you can contact your lenders and the authorities. You can also use ClearScore Protect, our dark web scan, to look after your identity online.

No. We will never do anything to impact your credit score.