Get your free credit score and report, updated monthly

When we say free, we mean it. No trials, we give you your credit score and report for free, forever.

When we say free, we mean it. No trials, we give you your credit score and report for free, forever.

You'll see clear insights about your credit score and how to improve it. A better score can increase your chance of accessing better credit offers and saving money.

And the best part? You can compare offers before you apply, without impacting your credit score.

If you've applied for credit, or opened a new account - you'll see the updates on your ClearScore report.

You’ll be able to spot mistakes and fraud quickly and get it fixed to protect your credit score.

You’ll get tips and insights to help you improve your credit score.

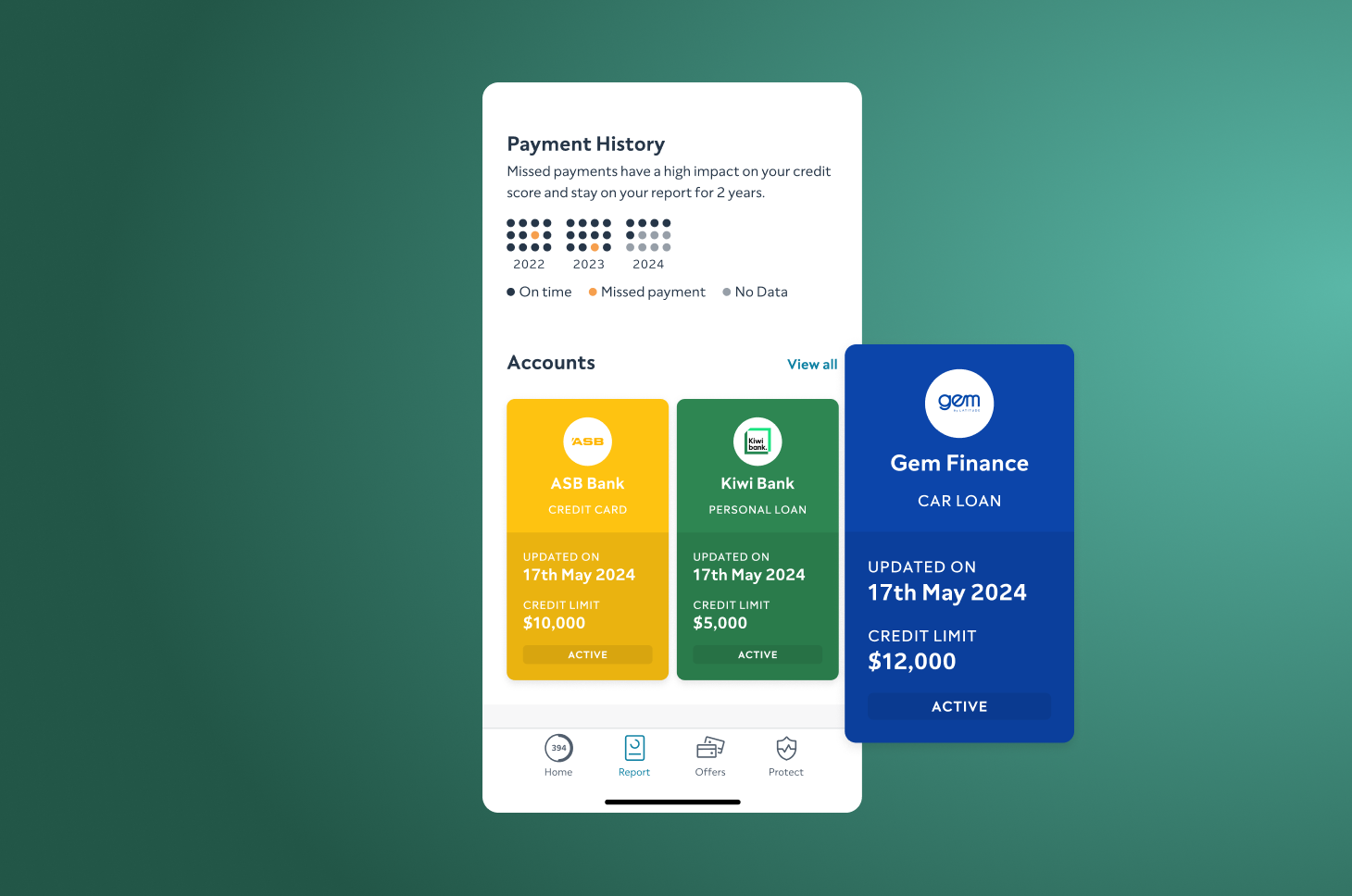

On time or missed – your payment history is easy to understand.

Short on time? See what you’re borrowing across credit cards, loans and utilities at a glance.

You can monitor all of your payments across all of your accounts in one place.

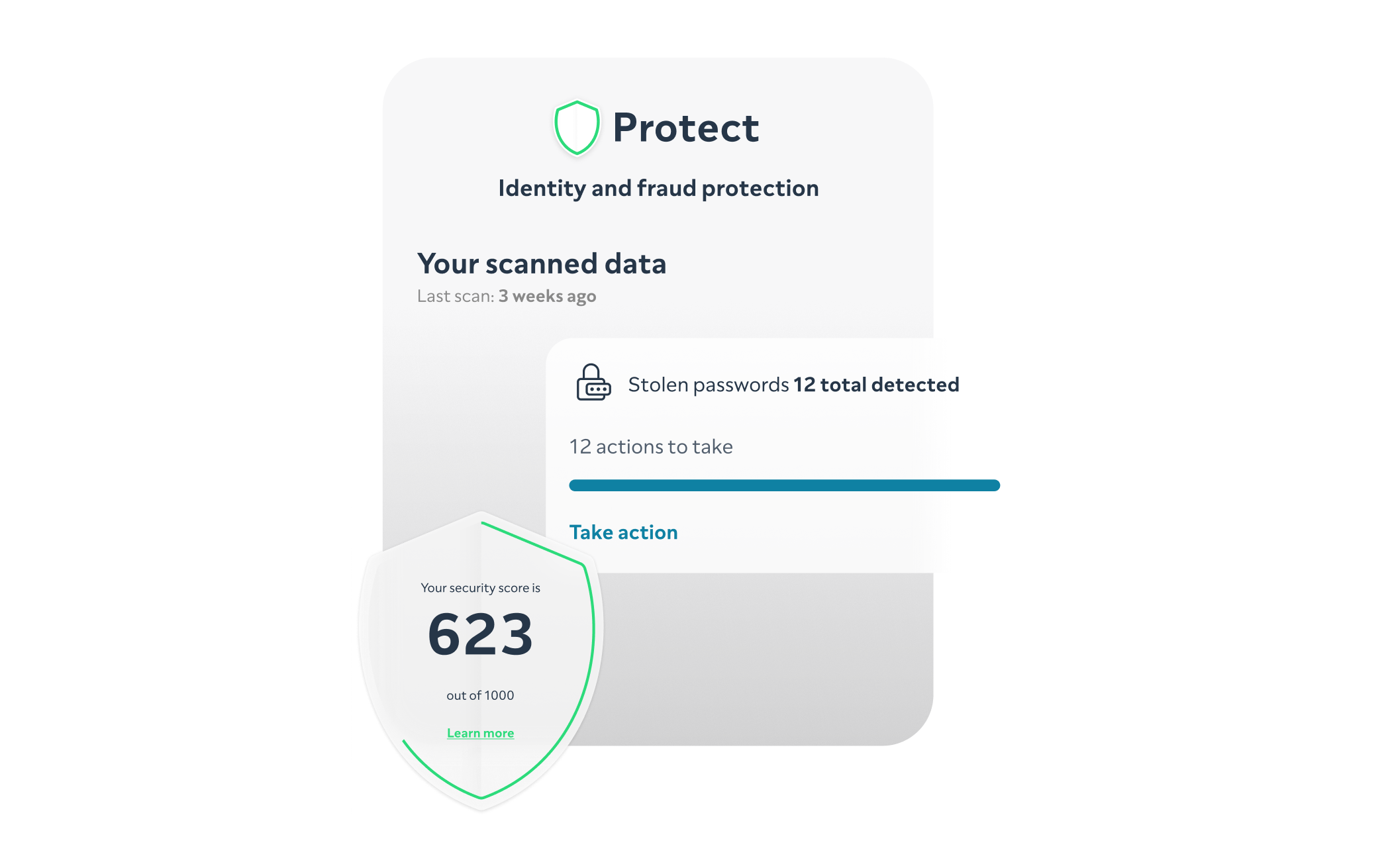

Signing up gives you free access to ClearScore Protect. We’ll look for any stolen passwords connected to your email address and keep you informed. So you can feel safe knowing your identity is protected against fraud.

Join the people who already trust ClearScore to help them improve their financial future.

Checking your credit score means you can take steps to improve it. This means you’re more likely to be accepted for your next credit card or loan and get better deals. But there are two other great benefits to checking your score. You can:

Correct mistakes on your report

Sometimes credit bureaus have wrong information about you, which can harm your credit score. Easily fix any mistakes so you’re in the best position when you apply for credit.

Make sure nobody has stolen your identity

Your report shows you if any fraudsters have opened up cards or loans in your name. If they have, you can contact your lenders and the authorities. You can also use ClearScore Protect, our dark web scan, to look after your identity online.

The higher your credit score, the more likely you are to be eligible for a credit card or loan. You could even get lower interest rates after improving it. Make the most out of ClearScore with three simple steps:

- See your credit score for free

- Find out how to improve it

- Compare credit offers that you may qualify for

No. We will never do anything to impact your credit score.

Your credit score is a number out of 1000. It’s based on your credit report, which is a record of how you’ve managed credit in the past. We give you both of these for free, making it as easy as possible for you to start improving it.

No – checking loan or credit card offers on ClearScore will never harm your credit score.

When you sign up to ClearScore you can see your credit score and report for free. We show you credit offers across credit cards and loans that you may be able to apply for. We receive a commission if you take out a product with one of our lender partners. This article will explain how we make money.