In this article

Get your dark web protection today

Check your online security in minutes. It’s free, forever.

Protect your online identity with ClearScore Protect

Free dark web-monitoring tool to check your security score

In this article

Get your dark web protection today

Check your online security in minutes. It’s free, forever.

One of the many great benefits of checking your credit report is to protect your identity. If a criminal starts to apply for credit in your name, this will show up on your report, acting like an early warning system so you can take action. Just last year I experienced how quickly ID theft can happen and the hassle and stress in recovering thousands of dollars. You can read more about my learning from that here.

Many of the identity protection products in the market include both credit report access, dark web monitoring and dedicated advice on fraud and security. They often charge over $120 a year for these services. I am delighted that we are now going to offer all our users free dark web monitoring and dedicated advice on how to protect your identity. I really hope that all our users will use this new feature which is free, forever.

The dark web is the name for the unregulated, anonymous part of the internet, often used for criminal activity. Often criminals use the dark web to buy and sell our personal information. This information comes from data breaches such as the hacks of Yahoo, LinkedIn, Equifax, Facebook or Zoom These hacks are, unfortunately, more and more common. When they happen criminals can get access to usernames, emails, passwords, and even sometimes financial data. They then sell this on the dark web.

Once these details have been posted on the dark web, other criminals use them to try and hack into accounts. They’ll try combinations of passwords and usernames to log in, or use the information to pretend to be your bank when they email or call you. This can lead to them attempting to take over your identity, taking out mobile phones, credit cards or finance in your name. Identity theft is a growing problem and the Australian Institute of Criminology reports that 1 in 4 Australians will experience Identity theft in their lifetime.

In late September 2022, Optus’s systems were breached by hackers in what was claimed as one of the largest and most sophisticated data breaches in Australia. Hackers were able to gain access to names, phone numbers, email addresses, physical customer addresses, date of birth, and driver licence numbers of the customers of the telecom giant.

While the exact number hasn’t been revealed, it is estimated that over 9 million customers were affected.

Hackers can either make confidential data of customers directly public or they can put the data for sale on the dark web to make quick profits.

Cybercriminals can then use this data to impersonate unsuspecting customers in order to obtain credit in their name, through credit card, loans, or any other credit products. These criminals use up the entire credit limit available or as much as they can, before the line of credit is withdrawn by lenders due to non-payments. People don’t even realise a credit product has been taken out in their name until they receive notifications about delayed payments or defaults. All of this can invariably lead to a decrease in credit score, making it difficult for you to get approved for new credit products.

We have teamed up with a team of cyber security experts who trawl the dark web secretly, undercover if you like, to download as much stolen information as possible. They have been investigating the use of the internet by criminals for over 20 years. They monitor thousands of criminal forums, websites and chat rooms to search for stolen data, and save it into a secure database. They are collecting more and more information every day - currently their secure database has over 41 billion data points in it.

At ClearScore we then search this database, securely and privately, and without ever revealing your information, to see whether your email address is associated with any information found on the dark web. We then tell you if we’ve found anything, and suggest what you should do about it. We can’t remove the information from the dark web, but we can make you aware so that you can change emails or passwords to keep yourself safe.

While the threat of identity fraud is serious, there is a lot you can do to protect yourself, and ClearScore is here to help. With ClearScore, you can monitor your credit report and your identity for free.

The service is super easy to use. You just need to verify your email address if you haven’t already, and then initiate the search. In a few seconds we’ll tell you whether any of your information has been compromised and what to do about it. We also give you security tips and recommend security products.

We’ll scan the dark web privately and securely for you every three months for free, forever. If we ever find anything then we’ll send you an email straight away to let you know. You can find ClearScore Protect inside your ClearScore account.

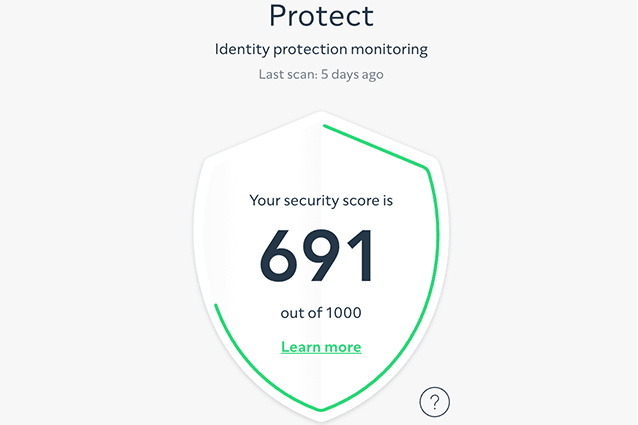

Check your security score: Your security score is a health check-up on your online protection. The higher your score, the stronger your security.

Find stolen passwords: Check to see whether any of your passwords have been stolen, and how to take action if they have been.

Strengthen your security: We give you tips on how to make your online security stronger. Tick them off as you learn more.

Stay updated on report changes: If there are any notable changes on your report that may be due to fraud, you’ll be informed.

The team has worked so hard to bring this feature. I hope we don’t find any of your information on the dark web, but if we do, we will help you take the right steps to protect your identity.

Thank you for being a user of ClearScore.

Steve

Stephen Smyth has worked in financial services since 1999, specialising in consumer credit. He has worked in banks and consumer credit companies in the United Kingdom, France, Spain, India, South African and has lived in Australia since 2013. He believes that people around the world can benefit from services liked ClearScore to make finances clearer, easier to understand and to find better deals to save money.