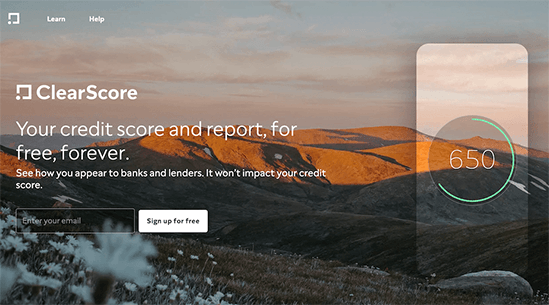

Check your credit score today

Check your score and get tips to improve it. It’s free, forever.

Who is ClearScore?

Find out who we are, how we're helping people around the world, and how we make money.

Check your credit score today

Check your score and get tips to improve it. It’s free, forever.

Founded in the UK, ClearScore offers a free service that helps you manage everything related to your credit in one place. Today, millions of people across South Africa, Canada, Australia, and New Zealand use ClearScore to better understand and improve their financial health.

With a ClearScore account, you can view your credit score and the full details of your credit report - a record of your current and past borrowing. This includes things like home loans, credit cards, personal loans, and car finance, helping you stay informed and in control of your financial decisions.

We aim for ClearScore to be the first place you check when looking for financial products. In your ClearScore account, you can explore options for credit cards, personal loans, car loans and home loans.

. 1. Credit reports and scores

ClearScore gives you free access to your credit score and full credit report, which may include details of:>

- Current and past loans, credit cards, overdrafts and mobile contracts

- Payment history and repayment behaviour

- Borrowing limits and balances

This data helps you understand how lenders might view your creditworthiness before you apply for products such as mortgages, personal loans or car finance.

2. Comparing financial products

ClearScore allows you to compare and apply for financial products directly.

You can explore personalised offers based on your credit profile for:

- Credit cards

- Personal loans

- Car loans

- Home loans

- More products launching soon

Compare personalised credit offers tailored to your credit profile. ClearScore uses soft credit checks and provides “Triple Check” to take the worry out of applying for credit.

Remember: Before taking out any loan, you should always make sure you can afford the repayments.

Know where you stand with Triple Check

With ClearScore, you can see credit cards and loans you’re more likely to be approved for before you apply.

Triple Check uses your credit profile and lender criteria to match you with offers that fit, helping reduce uncertainty and unnecessary credit checks. That means you can apply with greater confidence, knowing your chances of approval are high.

Personalised, not generic: Credit offers are sorted by what may be most relevant to you, using credit file data and other signals, rather than what pays the most commission.

Up-front eligibility and rates: You can see your likelihood of acceptance and potential rates before applying, helping you compare with confidence and avoid unnecessary hard searches.

Holistic data advantage: ClearScore's platform can combine credit bureau data with self-stated data insights to present affordability metrics like essential spend, disposable income and debt-to-income, which may lead to better-matched comparisons.

Easy-to-use labels: Flags such as "ClearScore Exclusive," "Easy application" and "Triple Qualified" help highlight meaningful differences between similar products during comparison.

Beyond price comparison: Our long-term vision is to provide guidance that helps you decide what to do next financially, not just which product has the best APR today.

Transparent experience: Browse offers without impacting your score, access wide lender coverage, and discover exclusive deals - all designed to build trust in side-by-side comparisons.

ClearScore began from the belief that the financial market should work better for everyday people. Our CEO and co-founder Justin knew from his experience working for major banks that the credit market can favour lenders.

Many people only discover their credit report when they're rejected for credit. Others may be offered less favourable deals because of details in their credit report. Being aware of the information in your credit report can help you find more suitable offers for home loans, car loans and other credit products.

The most competitive offers are typically reserved for people with a strong track record, represented by a higher credit score. But remember — a good credit score isn't just for the wealthy. It's achievable for anyone.

Where should you start? Check out our guide on how to improve your credit score.

ClearScore is free for you to use. When a customer applies through ClearScore for a financial product and gets approved, we receive a commission from the provider.

We don't expect all our customers to apply for financial products through ClearScore — there's absolutely no obligation to take out any offer. But those who do help us keep doing what we do best. This commission revenue supports ClearScore's ability to keep offering its core credit services free of charge.

Important information:

Your credit score and report can help you understand your credit position, but lenders use their own criteria when making decisions. Product availability and terms depend on your individual circumstances. Using ClearScore to check your score won't impact your credit file.

Lucy has a wealth of personal finance knowledge, and is one of our in-house experts.