Plenti - Personal Loan

If you borrow $5,000 over 36 months at a fixed interest rate of 6.57%*:

$153

$5,523

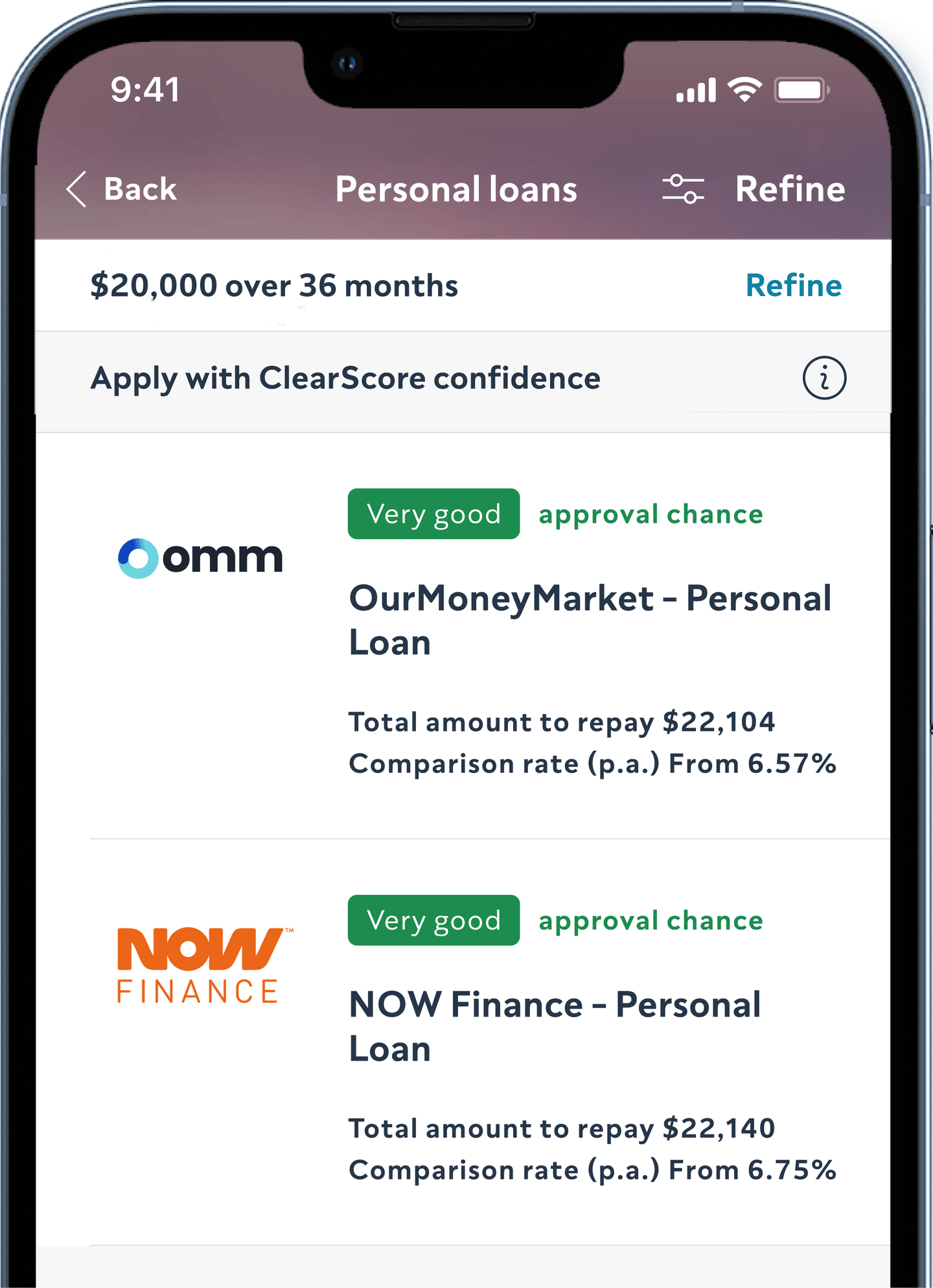

Our sophisticated technology uses your credit score and report data to indicate your likelihood of getting a loan before you apply for it. We also show you how to improve your score as a higher score can give you access to more credit offers and improve your chance of approval.

Sign up to get your free credit score and report today. Compare a range of loan offers for free, forever.

Comparing loans with ClearScore will not send your personal details to any lender.

We show you loans tailored to your credit score and help you understand your chances of approval on your loan applications.

Market-leading credit providers work with us to bring you great deals on personal loans and offers that are tailored to your credit score. We frequently show you updated offers from top lenders in the market, including NOW finance, OurMoneyMarket, Plenti, Wisr and SocietyOne.

Join ClearScore for free and log in to your account.

Check your offers to compare your personalised deals.

Apply with confidence.

The lenders we work with offer loans between $500 and $75,000 with interest rates per annum up to a maximum of 48% (comparison rate p.a 57.05%). The terms range from 3 months to 7 years. So we can show you personalised offers, we’ll ask you some questions when you search for a loan on ClearScore, like how much you’d like to borrow and for how long.

Here are two representative examples:

If you borrow $5,000 over 36 months at a fixed interest rate of 6.57%*:

$153

$5,523

If you borrow $10,000 over 48 months at a fixed interest rate of 6.75%*:

$238

$11,424

Yes, you can apply for a personal loan if you have a low credit score, but lenders may offer you a higher interest rate or could decline your application. You could build your credit repayment history and improve your score before applying for a loan.

Checking your personal loan offers on ClearScore will never affect your credit score. You can compare your loan deals in your Offers panel as often as you like, without affecting your score.

When you sign up to ClearScore you can see your credit score and credit report for free, forever. We work with Australia’s top loan and credit card providers to offer our users market-leading deals on a range of financial products. We never rank products based on how much commission we earn - our recommendations are based on your your credit profile and circumstances. ClearScore is supported by commercial arrangements with lenders and third parties that pay us a commission if you choose a product on ClearScore. Find out more here.

We bring you market-leading personal loans from a variety of lenders, including Plenti, Wisr, and SocietyOne.

A soft enquiry will occur when a lender assesses your eligibility for a product. Only you can see the soft enquires on your credit report, and they have no impact on your credit score. A hard enquiry is conducted by the lender after you apply for a credit product, which will leave a record on your report. It’s common for a hard enquiry to affect your credit score, but as long as you borrow responsibly the impact should be short term.

Yes, you can apply for a personal loan if you have a low credit score, but lenders may offer you a higher interest rate or could decline your application. You could build your credit repayment history and improve your score before applying for a loan.

Checking your personal loan offers on ClearScore will never affect your credit score. You can compare your loan deals in your Offers panel as often as you like, without affecting your score.

When you sign up to ClearScore you can see your credit score and credit report for free, forever. We work with Australia’s top loan and credit card providers to offer our users market-leading deals on a range of financial products. We never rank products based on how much commission we earn - our recommendations are based on your your credit profile and circumstances. ClearScore is supported by commercial arrangements with lenders and third parties that pay us a commission if you choose a product on ClearScore. Find out more here.

We bring you market-leading personal loans from a variety of lenders, including Plenti, Wisr, and SocietyOne.

A soft enquiry will occur when a lender assesses your eligibility for a product. Only you can see the soft enquires on your credit report, and they have no impact on your credit score. A hard enquiry is conducted by the lender after you apply for a credit product, which will leave a record on your report. It’s common for a hard enquiry to affect your credit score, but as long as you borrow responsibly the impact should be short term.