In this article

ClearScore Australia Releases Confidence For Understanding Your Chances At Loan Approval

In this article

Key Points

ClearScore launches a new feature for its Australian users: ClearScore Confidence.

ClearScore Confidence helps users understand their chances of approval on their loan applications.

The feature is currently available for personal loans and will include car loans shortly, followed by credit cards at a later point.

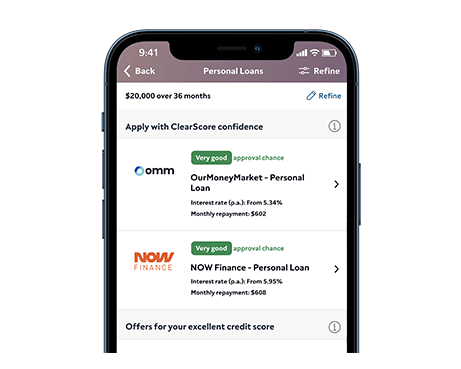

ClearScore Confidence is accessible through OurMoneyMarket, NOW Finance, Fair Go Finance and Money3, with more lenders soon to be announced.

ClearScore Confidence is the latest innovative feature to emerge from ClearScore, which transforms the way Australians look for loans.

The free feature provides consumers with an indication of the likelihood of their loan approval, eliminating any stress over possible rejected applications which can negatively impact their credit score.

ClearScore Australia’s General Manager, Lloyd Smith, stated: “We’re super excited to announce the launch of ClearScore Confidence. Aligned with our mission to empower Aussies to make better credit decisions, this ground-breaking feature will give our users confidence when it comes to applying for credit”.

ClearScore Confidence works through a combination of sophisticated algorithms and credit report data to indicate a user’s likelihood of approval on their loan application.

The estimation rating is demonstrated on a confidence meter design, indicating 'fair', 'good' and 'very good' ratings for loan approval.

While the ratings are not a guarantee of approval, they aim to estimate the chance of approval of a user's loan application.

By minimising the risk of rejection, ClearScore helps people avoid any negative impact on their credit scores when applying for loans.

ClearScore has launched this feature to empower the Australian consumer with assurance when applying for loans.

“Gone are the days of having to apply for a loan and hoping you may get approved – through ClearScore confidence you’ll be able to know upfront your likelihood of approval without negatively impacting your credit score. Our system uses your credit report data, so it’s as simple as signing up and logging into your dashboard to view your approval chance”, said Mr Smith.

“As Australia’s only completely fee free personal loan lender, NOW Finance are proud to be part of ClearScore’s journey, helping to increase transparency and simplicity in the Personal Loan sector” said David Norman, Chief Operating Officer at NOW Finance.

OurMoneyMarket’s Chief Executive Officer, Adam Sutherland, stated: “ClearScore is at the forefront of financial well-being within Australia and OurMoneyMarket is proud to be part of the journey”

Currently, ClearScore Confidence is available for Australian consumers looking for personal loans on OurMoneyMarket, NOW Finance, Fair Go Finance and Money3.

However, ClearScore is adding more lenders in the coming months and plans to integrate the feature for car loans within the next week.

With over 600,000 Australian users, ClearScore expects its latest feature to have extensive reach when empowering consumers looking for loans.

The launch of ClearScore Confidence is just one of the many exciting features that are set to roll out this year, as ClearScore aims to empower its Australian users to take control of their financial wellbeing.

“This is one of the many steps we are taking at ClearScore to provide more transparency and financial control to Australians,” said Mr Smith.

ClearScore's objective is to empower consumers to take control of their financial wellbeing by providing free access to their credit report, score and open banking data.

With 19 million users worldwide and over a million of those in Australia, ClearScore has established a trustworthy brand driven through an accessible platform that places the power in the hands of the consumer.

For all media enquiries, please contact Lloyd Smith at lloyd.smith@clearscore.com or +61 433 801 641.

Lloyd spreads the word about how awesome ClearScore is.