Sign up in a few easy steps

It only takes 3 minutes and you’ll get your credit score and report for free, forever.

18+, T&Cs apply

See loan offers that you actually qualify for, based on your credit score and report

Find loans from over 30 leading lenders in Australia

Check your loan offers without affecting your credit score

Only 1 in 2 Aussies are being funded for loans. Why? They are looking at generic lists of loans and not finding the right offers for their unique situation.

ClearScore uses your credit score and report data and asks you a few questions to show you personalised offers that you are eligible for.

This means we show you loans you are likely to be funded for. Our technology helps you find the right loan, so you're 47% more likely to be funded for a loan when you apply through ClearScore.

Save time and avoid unsuccessful applications with ClearScore Confidence.

It only takes 3 minutes and you’ll get your credit score and report for free, forever.

You'll only see relevant offers based on your score and report. And we order them based on how likely you are to be accepted – not what makes us the most money.

We'll show you your approval chances so you can confidently apply.

Loan amounts between $500 and $100,000

Loan terms from 1 to 5 years.

Get on the road faster with your next car purchase with a car loan.

You could use a lump sum to pay off your credit card or other debts and make one monthly repayment at a lower interest rate.

Celebrate your big day knowing you can pay it off in monthly instalments.

From emergencies to quick fixes, you could get access to the money you need with a loan.

Dreaming of a once-in-a-lifetime trip? You could spread the cost of your next adventure.

As long as you make the repayments on time and in full, you can build your credit score. And that can mean better offers for things like car finance, loans, credit cards, and more.

Don't borrow more than you need, as this can increase the total cost of your loan and make it harder to repay.

Feel confident about your loan repayments by planning your budget in advance.

Read the small print. Make sure you understand what you’re paying for by checking the interest rates and any additional charges.

Get a better idea of what you could be eligible for by comparing your offers first.

We use your credit profile to find financial products that might be a good fit for you.

What’s different about us: we make our recommendations based on what’s relevant for you, not on how much commission we get paid.

Don’t worry, even if you decide not to apply for a financial product, your score and report are still free, forever.

The higher your credit score, the more likely you are to be eligible for a credit card or loan. You could even get lower interest rates after improving it. Make the most out of ClearScore with three simple steps:

- See your credit score for free

- Find out how to improve it

- Compare credit offers that you may qualify for

No – checking loan or credit card offers on ClearScore will never harm your credit score.

No. We will never do anything to impact your credit score.

This is all free because we are paid by lenders. When you apply for a credit card or loan, lenders pay us a commission. But don't worry, we rank offers based on what's best for you, not on commission.

Checking your credit score means you can take steps to improve it. This means you’re more likely to be accepted for your next credit card or loan and get better deals. But there are two other great benefits to checking your score. You can:

Correct mistakes on your report

Sometimes credit bureaus have wrong information about you, which can harm your credit score. Easily fix any mistakes so you’re in the best position when you apply for credit.

Make sure nobody has stolen your identity

Your report shows you if any fraudsters have opened up cards or loans in your name. If they have, you can contact your lenders and the authorities. You can also use ClearScore Protect, our dark web scan, to look after your identity online.

Your credit score is a number out of 1000. It’s based on your credit report, which is a record of how you’ve managed credit in the past. We give you both of these for free, making it as easy as possible for you to start improving it.

When you sign up to ClearScore you can see your credit score and report for free. We show you credit offers across credit cards and loans that you may be able to apply for. We receive a commission if you take out a product with one of our lender partners. This article will explain how we make money.

In Australia, we provide access to your credit score and reports using illion and Experian, two of Australia’s credit bureaus. Both credit scores are out of 1,000.

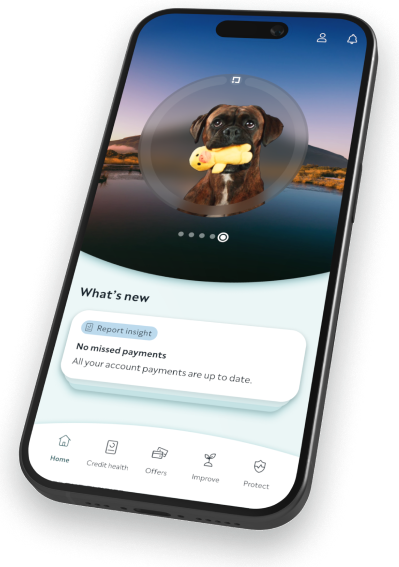

We're Australia's number 1 credit score and report app

Available on iOS and Android