In this article

Check your credit score today

Check your score and get tips to improve it. It’s free, forever.

What is Experian's New Score

Find out everything you need to know about Experian's new score and how it will impact your credit score.

In this article

Check your credit score today

Check your score and get tips to improve it. It’s free, forever.

At ClearScore we retrieve your credit scores from Experian and illion, two of the largest credit bureaus in Australia. Experian have updated how they generate your credit score. Their ‘New Credit Score’ is based on Comprehensive Credit Reporting and other enhanced ways of modelling data to estimate your probability of paying back a loan or a credit card. You might notice a change in your credit score as this new score replaces the previous Experian score.

The purpose of the new credit score is to create a more accurate view of how credit worthy you are for credit providers and make it easier for you to get the credit you deserve. In recent times, more data has been available on credit reports and this has allowed Experian to build a more accurate credit score.

For ClearScore users, we expect about 40% of people to see no immediate change in their credit score. A third of users will see a small change in their score (+/- 50) but this is unlikely to be noticeable against regular monthly changes. About 12% will see a score change greater than 100 and this could influence what credit providers are willing to lend to you.

If you see a large change in your credit score it may affect which lenders will offer you credit. This can mean more choice and lower interest rates if your score is higher or fewer offers and higher interest rates if your score decreases.

Don’t panic if your score gets worse in the short-term. The principles of what you need to do to have a good credit score have not changed:

- Pay your loan repayments on time

- Don’t default on loans

- Don’t apply for too much credit all at once, especially short-term loans

A credit score is a number that describes how credit worthy you are. The higher the credit score the more likely you are to get a loan.

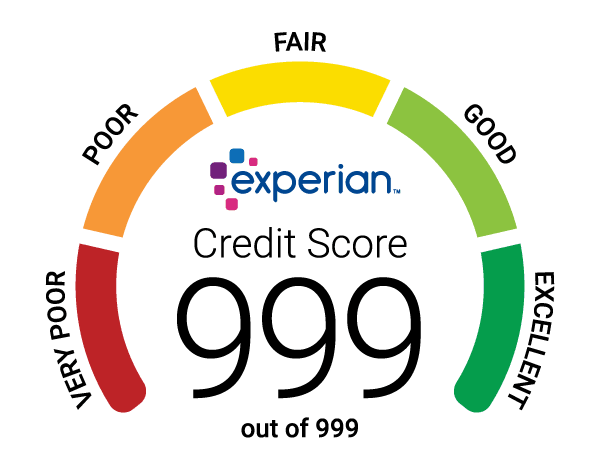

Experian’s credit score varies from 0-1000. Experian groups the scores into 5 categories of credit worthiness:

Credit score | Experian band | ClearScore name |

|---|---|---|

0-549 | Below average | Raise your game |

550-624 | Fair | On the up |

625-699 | Good | On good ground |

700-799 | Very good | Looking bright |

800-1000 | Excellent | Soaring high |

Credit scores are created using the data available in your credit report. It is an algorithm that predicts the likelihood that you will default on loan (or that you will pay back a loan if you are more a glass half-full person!). A high score means you are likely to pay back any loan or credit card that you take out. A low credit score means that there is a higher chance you won’t be able to repay a loan. Lenders are much less likely to lend to you if you have a low credit score.

The model that Experian uses holds information on how millions of people have borrowed money in the past. Using this data, the model can create a score individually for you that predicts the likelihood that you will pay back a loan based on your credit report data.

Certain credit scores imply that you will find it hard to get a lender that will lend to you. This varies from lender to lender, but most lenders won’t consider applicants with below average (<549) or fair scores (550-624). If your score improves and you move into Good (625-699), Very Good (700-799) or Excellent (800+) you might see more offers or better interest rates.

For more information on credit scores and how to improve your credit score, click here.

Experian’s new credit score is based on their latest model that creates a credit score based on how you manage your loans and credit cards. It is a better model because it uses extra data now available on the borrowing behaviour of millions of consumers.

The increased power of the Experian credit score comes from the additional data that has been made available under the Comprehensive Credit Reporting (CCR) regime that enables lenders to report positive and negative consumer borrowing behaviour.

Tristan Taylor, head of the credit bureau for Experian, called out two particular areas that CCR and the new Experian score is affecting people’s scores.

This first point is important, it shows that getting a good credit score is increasingly based on showing that you have a history of taking out credit and managing it well. This doesn’t mean that you should borrow for the sake of it, but it does show that there can be a benefit in having a credit card or a car loan that you manage well. It will help you get home loans or personal loans at the best interest rates in the future.

In addition, Tristan stated “We’ve also updated how different types of enquiries impact your credit score. If you have lots of enquiries for short-term loans, often referred to as payday loans, this can have a more negative impact on your score than enquiries for a credit card or home loan.”

What types of credit that you have applied for is increasingly important to lenders. Many lenders see short-term loans as an indicator of higher credit risk. As the popularity of Buy Now Pay Later products grow, lenders are also increasingly considering how many BNPL accounts you have in their decisions . For more information on how Afterpay or other BNPL providers might impact your credit score, see here.

Comprehensive Credit Reporting (CCR) refers to a reporting system where credit providers, such as banks, are required to report data on your past credit history to the credit bureau in Australia. Under CCR credit providers share both negative and positive credit data on you. An example of negative data is not paying back a loan either because of default or bankruptcy. Positive data might be evidence that you have made all your payments on time.

Australia launched Comprehensive Credit Reporting in 2017 and this has increasingly changed what data is available on your credit report. In September 2019, the big 4 banks started sharing positive data.

The credit data that is available on your credit file is grouped into 6 broad areas

- Enquiries.

This records when you have made an application for credit and a credit provider will ask for your permission to check your credit file. This data is available for up to 5 years. - Repayment history.

This is the record of whether you have made all payments on your loans or credit cards. - Defaults, bankruptcies and court judgments.

These events severely impact your future ability to get credit. They last for 5 years on your credit history. - Type of credit account opened and name of credit provider.

This records what credit accounts you have such as Home Loan, Credit card or Personal loan. - Dates for opening and closing of accounts.

When you open and close a credit account will be recorded. - Credit limit on your current account.

This shows how much you borrowed or in the case of a credit card, what is the credit limit that represents the maximum you could borrow.

The amount of data available on your credit file evolves over time, not just based on your credit behaviour but also as more credit providers contribute data into the credit bureau.

As the data in the credit bureau evolves, the credit scores created by the credit bureau evolve. The aim of the credit score is to predict the probability that you will pay back a loan. As more data is included, the method for calculating the credit score changes slightly.

Credit reporting creates a benefit for lenders and borrowers. The debate on Comprehensive Credit Reporting in Australia involved a long process to balance the benefits of credit reporting against concerns and considerations around data privacy and security. In Australia, the amount of data shared on the credit bureau is lower than in other countries such as the UK and the United States. Many people feel that there is more benefit available to consumers with greater data sharing so the amount of data available on credit reports may continue to evolve over time.

The core benefit of credit reporting is that consumers can get rewarded for good borrowing behaviour with more choice of lenders and better interest rates. Credit reporting allows the statistical prediction of credit worthiness through credit scores and other data. If this enables people to know that you are highly likely to pay back a loan, you might get a much lower interest rate for a loan. This could save $1000s over the lifetime of a loan in interest payments.

Those who have been encountered difficulties in managing credit will find it harder to get credit with credit reporting, but this is often seen as a benefit in of itself. Firstly, by identifying people with poor credit scores, it is possible to exclude these people from products with very low interest rates. If it was not possible to identify and exclude these people, these products would not exist at all.

Although these two benefits seem to favour consumers with good credit histories, the advent of positive credit data in CCR helps provide a better framework for those with no credit history or a bad credit history. A responsible lender shouldn’t give a large loan to someone who has repeatedly defaulted on loans. However, if a person has defaulted on loans started to get access to smaller loans (often at higher interest rates) and manages them well, they will improve their credit score over time. Over the course of a few months, or a few years in the case of defaults, people with poor credit scores can get access to the very best products.

In summary, credit reporting creates a system that enables low interest rate borrowing products to exist. This saves people money. Credit reporting does exclude people from credit based but there is an argument that this enables responsible lending and the advent of CCR also allows people with poor credit histories to improve their credit scores faster.

Getting a better credit score is mainly common sense. If you manage credit well, make payments on time and avoid getting into too much debt and defaulting, you will get a good credit score over time. If you have made mistakes in the past, even defaults, then you can still recover your score over time.

In addition, to managing credit well for yourself it is important to use credit monitoring services like ClearScore regularly to check that there has been no fraud committed against your account. Fraudulently opened accounts will invariably lead to a negative impact on your credit score but it is possible to clean up issues not related to your own fault. ClearScore also offers a Protect service for free that enables you to see if your usernames and passwords have been compromised through data breaches. This can help you change passwords on key accounts to reduce the risk of identity fraud.

See our article here for more detailed tips on how to improve your credit score.

Experian’s new credit score is not the same as Equifax’s One Score although they share the same objective: to use CCR data to better predict the likelihood that you can pay back a loan. This probability is often referred to as credit risk: with a low credit risk being good (highly unlikely to default) and a high credit risk being bad.

In Australia there are three credit bureau.

- Equifax, formerly known as Veda

- Illion, formerly known as Dun and Bradstreet

- Experian

Each credit bureau has different methods for calculating a credit score. This is because each bureau might have different data (as not every lender provides data to every credit bureau) and use different methods for creating a score.

A credit score is a number that reflects the probability that you will pay back a loan, but there are several reasons why a bureau might have different scores

- Lenders sometimes prefer to keep using an older version of a credit score, so the bureau provides access to an old credit score as well as a new one

- Some credit scores might be built off different types of data for instance a score built with Comprehensive Credit Reporting data would be different from a score based purely on negative data.

Equifax’s One Score is a next generation credit score using positive and negative credit bureau data. Having a better credit scoring method is good for lenders and consumers wanting to take out a loan. Equifax states that using this score, lenders are able to accept more people who apply for a loan without increasing the level of credit risk. This is because the enhanced CCR data and other techniques better enable lenders using the Equifax One Score to identify the small percentage of people who may struggle with credit.

In general, it is interesting to track the different scores that you might have with different credit bureau, but the core of what you need to do to get a good credit score remains the same: don’t default on loans, make payments on time, don’t apply for too much credit at the same time.

Lloyd spreads the word about how awesome ClearScore is.