We’ll also let you know how you can improve your credit score. A higher credit score can give you access to more credit offers.

View credit cards

And join more than 3 million ClearScore users

Sign up for a free credit report and find credit cards most suitable for you

Better Score, Better Deals

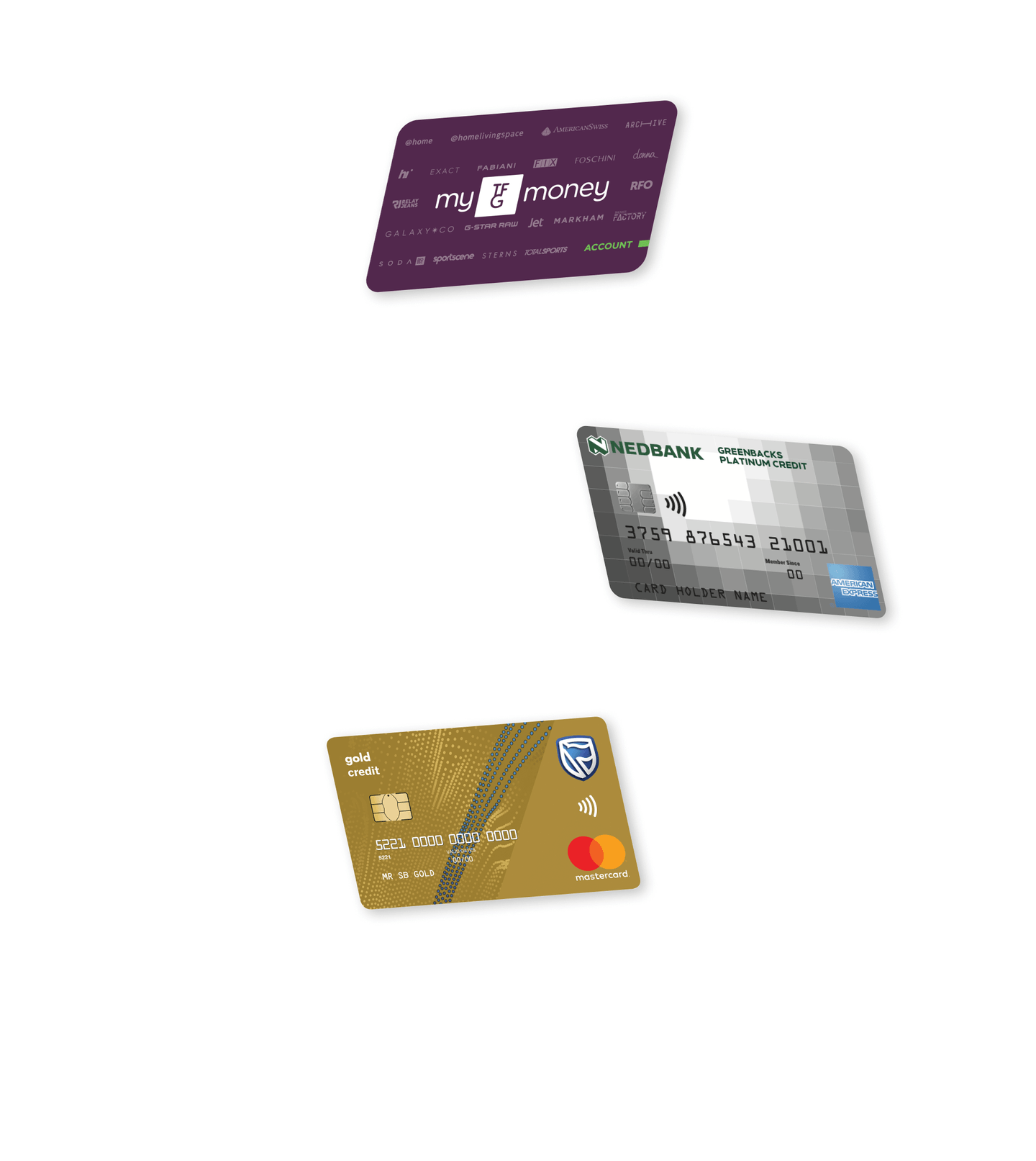

ClearScore connects you with market-leading credit providers to bring you great deals on credit cards and retail card accounts. We frequently show you updated offers from top credit card providers including Standard Bank, Nedbank and African Bank as well as a variety of retail accounts including Truworths, TFG, Identity, Game and more.

Finding the right credit card is simple on ClearScore

1. Sign up to ClearScore

Join ClearScore for free and log in to your account.

2. See credit card offers

Check your offers to compare your personalised deals.

3. Find the right credit card for you

See cards most suitable for you, based on your credit score.

Which type of credit works for you?

Switch & Save Credit card/ Balance Transfer

Changing banks seems like a complicated task when you have credit card debt, however you can transfer your remaining debt - from one or multiple other banks - into a single account

Credit cards

If used responsibly, a credit card can be a great tool to improve your credit score plus they often give you access to multiple rewards programmes

Digital credit card

This card exists entirely online and is made available in minutes, once you're approved.

Store cards

If you're new to credit or want to improve your score, a store card may be a great place to start. Store cards can only be used to purchase from a specific store or group of stores.

Frequently asked questions

Yes, you can apply for a credit card if you have allow credit score, but lenders may offer you a higher interest rate or could reject your application. You could take out other credit building accounts such as a cell phone contract or a store card.

When you sign up to ClearScore you can see your credit score and credit report for free, forever. We work with the SA’s top credit card providers to offer our users market-leading deals on credit cards. We may receive a commission if you take out a product with a lender. Find out more here.

A soft search will occur when a lender assesses your eligibility for a product. Only you can see the soft searches on your credit report, and they have no impact on your credit score. A hard search is conducted by the lender after you apply for a credit product, which will leave a record on your report. It’s common for a hard search to affect your credit score, but as long as you borrow responsibly the impact should be short term.

Checking your credit card offers on ClearScore will never harm your credit score. You can compare your credit card deals in your Offers panel as often as you like without affecting your score.

Can I apply for a credit card with a low credit score?

Yes, you can apply for a credit card if you have allow credit score, but lenders may offer you a higher interest rate or could reject your application. You could take out other credit building accounts such as a cell phone contract or a store card.

How does ClearScore work?

When you sign up to ClearScore you can see your credit score and credit report for free, forever. We work with the SA’s top credit card providers to offer our users market-leading deals on credit cards. We may receive a commission if you take out a product with a lender. Find out more here.

What is a soft and hard credit search?

A soft search will occur when a lender assesses your eligibility for a product. Only you can see the soft searches on your credit report, and they have no impact on your credit score. A hard search is conducted by the lender after you apply for a credit product, which will leave a record on your report. It’s common for a hard search to affect your credit score, but as long as you borrow responsibly the impact should be short term.

Does checking credit card offers harm my credit score?

Checking your credit card offers on ClearScore will never harm your credit score. You can compare your credit card deals in your Offers panel as often as you like without affecting your score.