Boost your Credit Health

From understanding how you look to lenders, to smart insights that let you know what’s new and what you could do next, looking after your Credit Health just got even clearer.

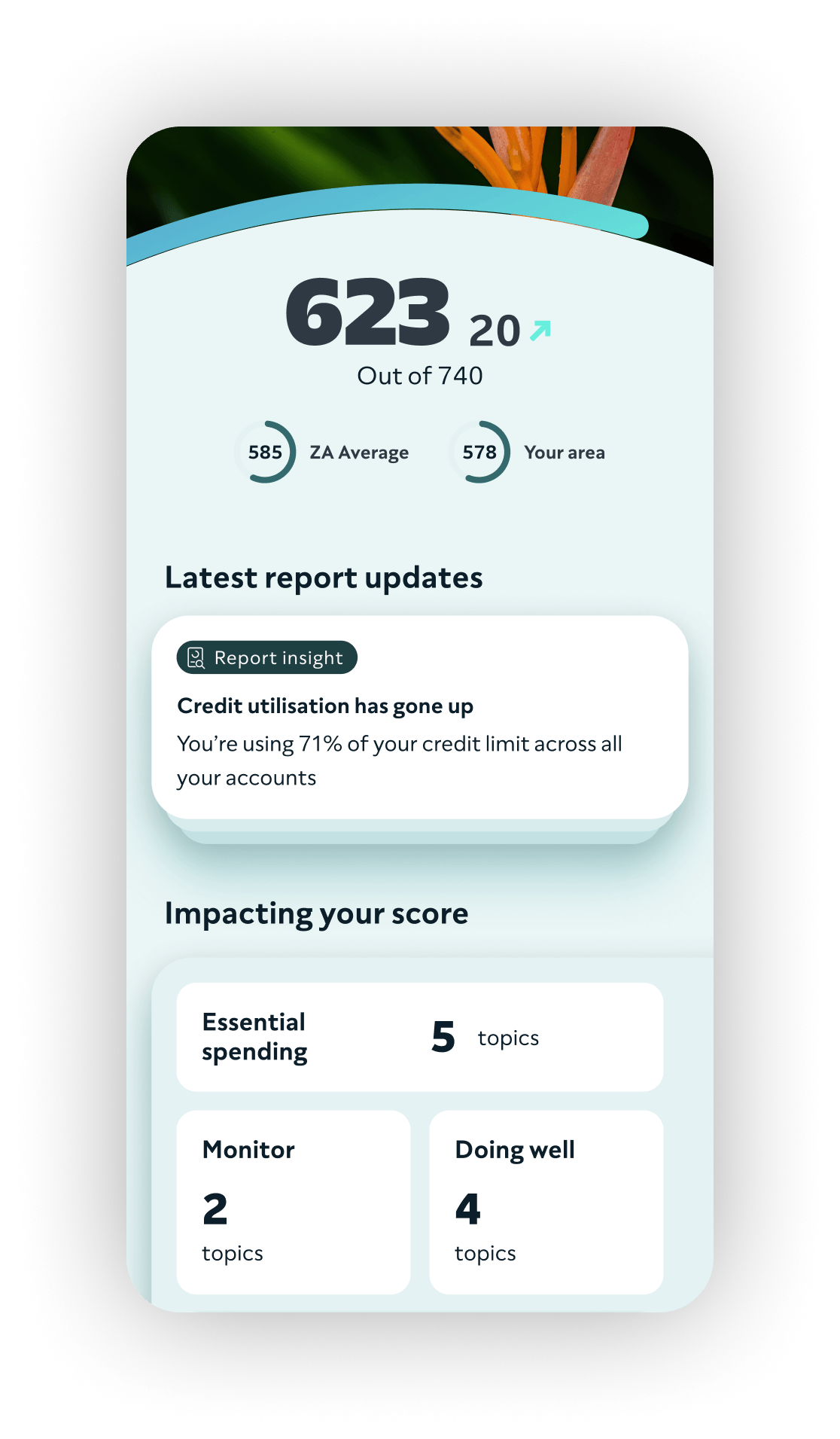

Your credit score is a number out of 740. It’s based on your credit report, which is a record of how you’ve managed credit in the past. We give you both of these for free, making it as easy as possible for you to start improving it.

The higher your credit score, the more likely you are to be eligible for a credit card or loan. You could even get lower interest rates after improving it. Make the most out of ClearScore with three simple steps:

See your credit score for free

Find out how to improve it

Apply for offers tailored to you

Find out how likely you are to be accepted for credit in seconds. Build your credit confidence and get a wider range of deals, all through ClearScore.

From understanding how you look to lenders, to smart insights that let you know what’s new and what you could do next, looking after your Credit Health just got even clearer.

Switch between 3 months, 6 months, and a year to spot the trends in your credit healthy habits.

We monitor your credit report and let you know if something isn’t quite right, giving you peace of mind. Rest easy knowing your personal and financial information is being protected.

Let the experts at ClearScore coach you to better Credit Health. Discover our Improve section and enjoy videos articles designed to help you navigate the confusing world of credit.

When we share your report with you, you’ll get clear, personalised insights about your credit score and how you can improve it. An improved credit score could get you a greater range of deals with lower rates.

We find new and exclusive offers tailored to you, for free. After you get your credit score, you can look for credit cards, loans and more from trusted brands, knowing how likely you are to be accepted when you apply through ClearScore.

At ClearScore, we’re on a mission to help you get on in life by making finance clearer, calmer and easier to understand.

We give 20+ million people across the world free access to their credit score and report using Experian, a credit bureau with a score range of 0 to 740.

We also know taking out credit can be confusing. That’s why we personalise our offers, making credit decisions a little easier for you. It’s worth knowing that we sometimes make money when you apply for a card or loan with us.

We order your offers based on how relevant they are for you, never on how much we’re paid. With ClearScore there are no time-limited trials or hidden costs. Your score and report are free, forever.

Checking your credit score means you can take steps to improve it. This means you’re more likely to be accepted for your next credit card or loan and get a wider range of deals. But there are two other great benefits to checking your score. You can:

Correct mistakes on your report

Sometimes credit reference agencies have wrong information about you, which can harm your credit score. Easily fix any mistakes so you’re in the best position when you apply for credit.

Make sure nobody has stolen your identity.

Your report shows you if any fraudsters have opened up cards or loans in your name. If they have, you can contact your lenders and the authorities.

Your credit score is based on what’s in your credit report: a record of how you’ve handled credit up until now, as well as other factors.

If your report shows you’ve managed your credit well, for example, you're on time and not missing payments, your credit score is likely to be high.

If it shows you’ve made late payments, defaulted, or applied for a lot of credit in a short amount of time, your credit score might be lower.

At ClearScore, we’re on a mission to help you get on in life by making finance clearer, calmer and easier to understand.

We give 20+ million people across the world free access to their credit score and report using Experian, a credit bureau with a score range of 0 to 740.

We also know taking out credit can be confusing. That’s why we personalise our offers, making credit decisions a little easier for you. It’s worth knowing that we sometimes make money when you apply for a card or loan with us.

We order your offers based on how relevant they are for you, never on how much we’re paid. With ClearScore there are no time-limited trials or hidden costs. Your score and report are free, forever.

Checking your credit score means you can take steps to improve it. This means you’re more likely to be accepted for your next credit card or loan and get a wider range of deals. But there are two other great benefits to checking your score. You can:

Correct mistakes on your report

Sometimes credit reference agencies have wrong information about you, which can harm your credit score. Easily fix any mistakes so you’re in the best position when you apply for credit.

Make sure nobody has stolen your identity.

Your report shows you if any fraudsters have opened up cards or loans in your name. If they have, you can contact your lenders and the authorities.

Your credit score is based on what’s in your credit report: a record of how you’ve handled credit up until now, as well as other factors.

If your report shows you’ve managed your credit well, for example, you're on time and not missing payments, your credit score is likely to be high.

If it shows you’ve made late payments, defaulted, or applied for a lot of credit in a short amount of time, your credit score might be lower.

Enter your email address to sign up and see your credit score and report.

Use our clear, easy insights to find out what you can do to improve your score.

See how likely you are to be accepted for exclusive deals so you can apply with confidence.