APPLY WITH CONFIDENCE

Income checked

Credit score checked

Credit history checked

You can now apply with confidence, knowing that ClearScore has searched the market for great deals that are personalised to your financial position. You can view these options without damaging your credit score. We will also support you with tips on how to improve your score to get even better deals.

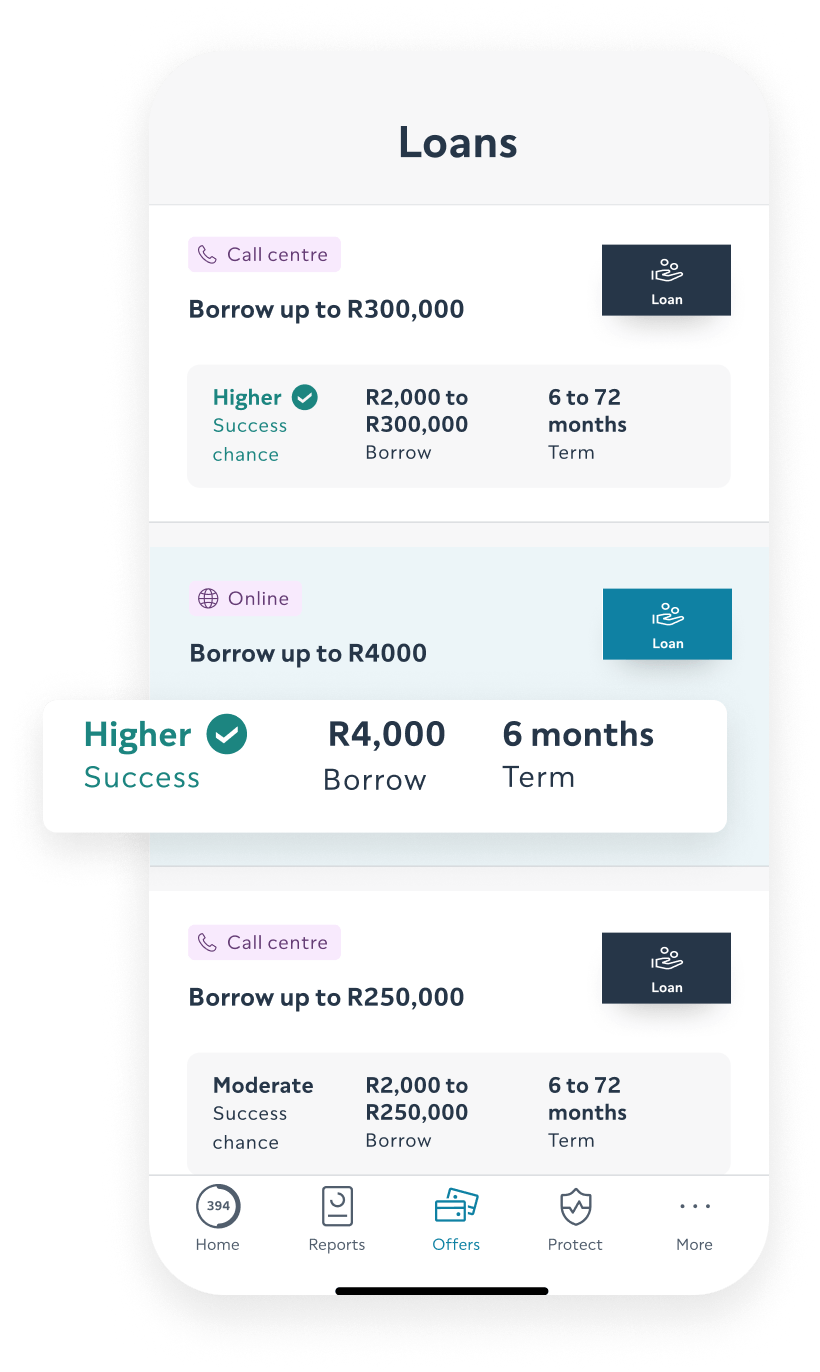

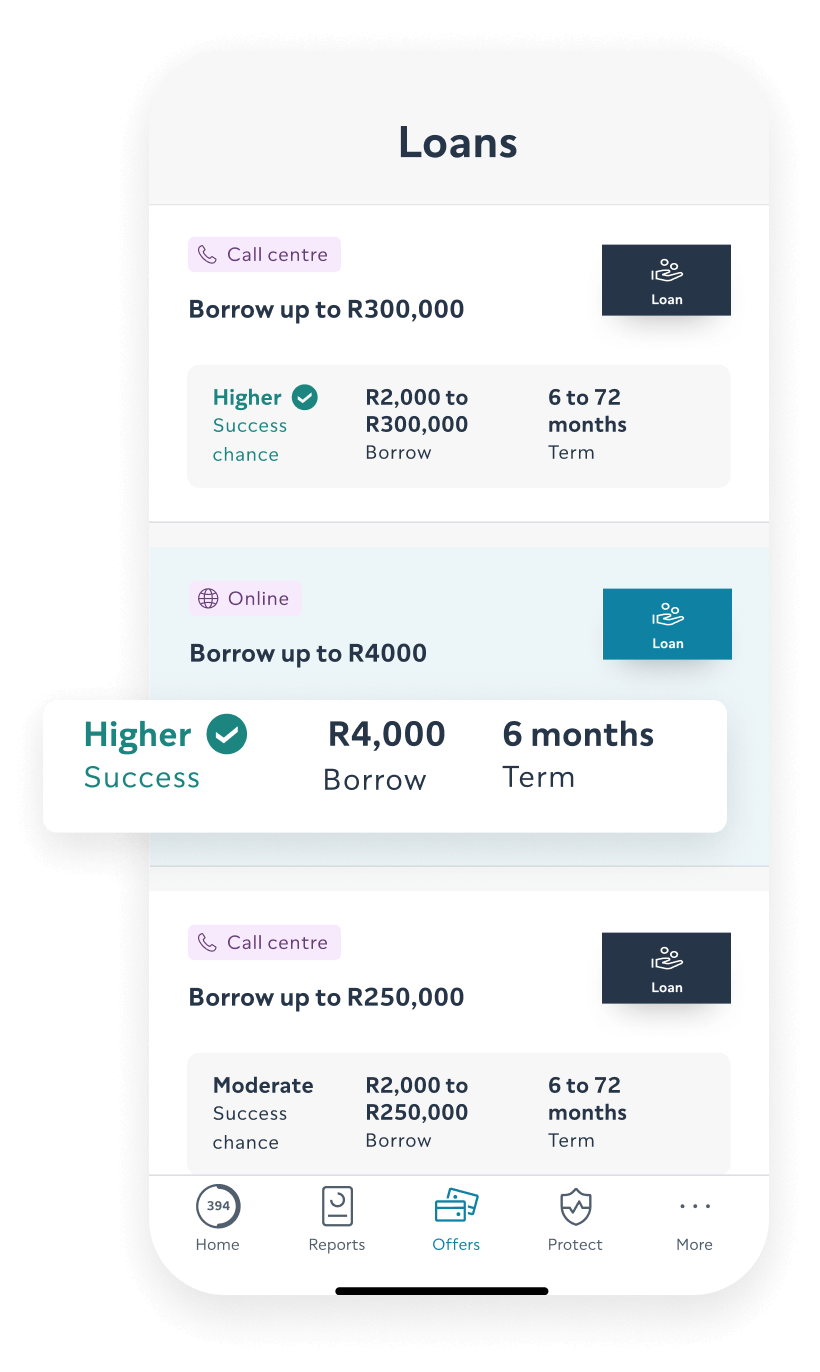

Personalised offers

We do the hard work so that you don't have to. We show you the offers that we think you will qualify for, including a personalised 'chance of acceptance' which is based on your income and credit history.

Market-leading credit providers

We work with more than 15 of SA's best lenders to find you the best offers, including Nedbank, Direct Axis, Standard Bank and Capitec.