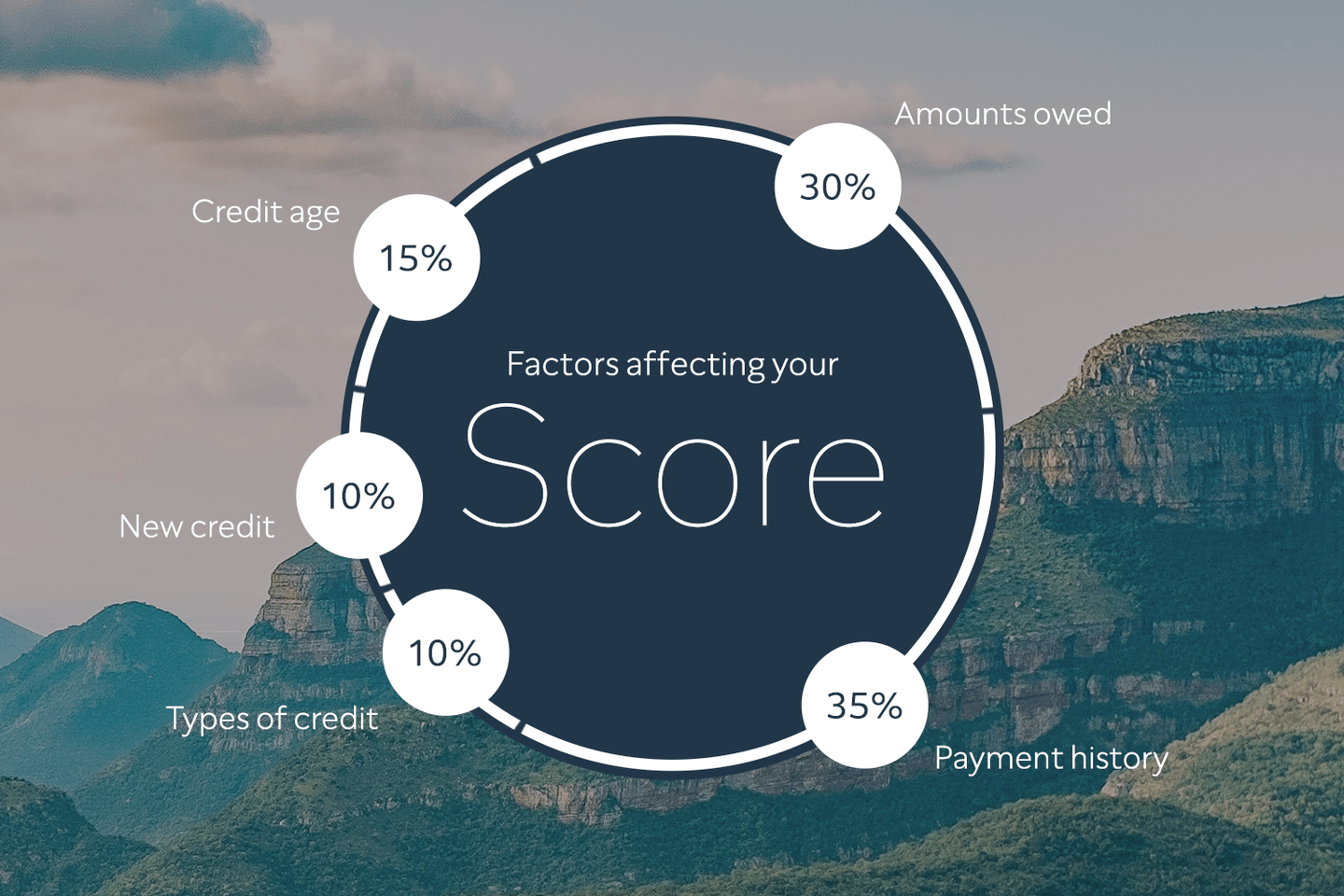

How is your credit score weighted?

Understand which factors influence your credit score – and to what degree – so you can grow it steadily. Read our article to find out the math of your credit score and how it's weighted.

Your credit score predicts the likeliness of you sticking to your debt obligations and allows lenders to make informed decisions before approving your credit applications. But improving your credit score is your responsibility. By understanding which factors influence it – and to what degree – you will be able to grow it steadily. This is how your your credit score is weighted:

This is the leading factor which determines your credit score. If you can prove that you diligently pay your accounts, then lenders will be confident in lending to you.

Your credit utilisation shows lenders whether you have maxed out your credit, or whether you’re only borrowing up to 30% of your available credit.

Otherwise known as your “credit age”, this shows lenders how long you have worked with credit. In this case, more experience will count in your favour.

Check your payment history, open accounts and the length of your credit history on ClearScore.

If you opened a new credit card and applied for a personal loan at the same time, it may give lenders the impression that you’re desperate. Keep your credit applications at least 6 months apart.

You may have demonstrated your maturity with short-term debt, but this is different to long-term debt. Lenders appreciate seeing you have experience with both.

See what you are eligible for on ClearScore. Get access to personal loans, credit and store cards, insurance, internet and more.

Isabelle is a freelance finance writer and journalist in Cape Town. She helps make managing your personal finances calm, clear and easy to understand.