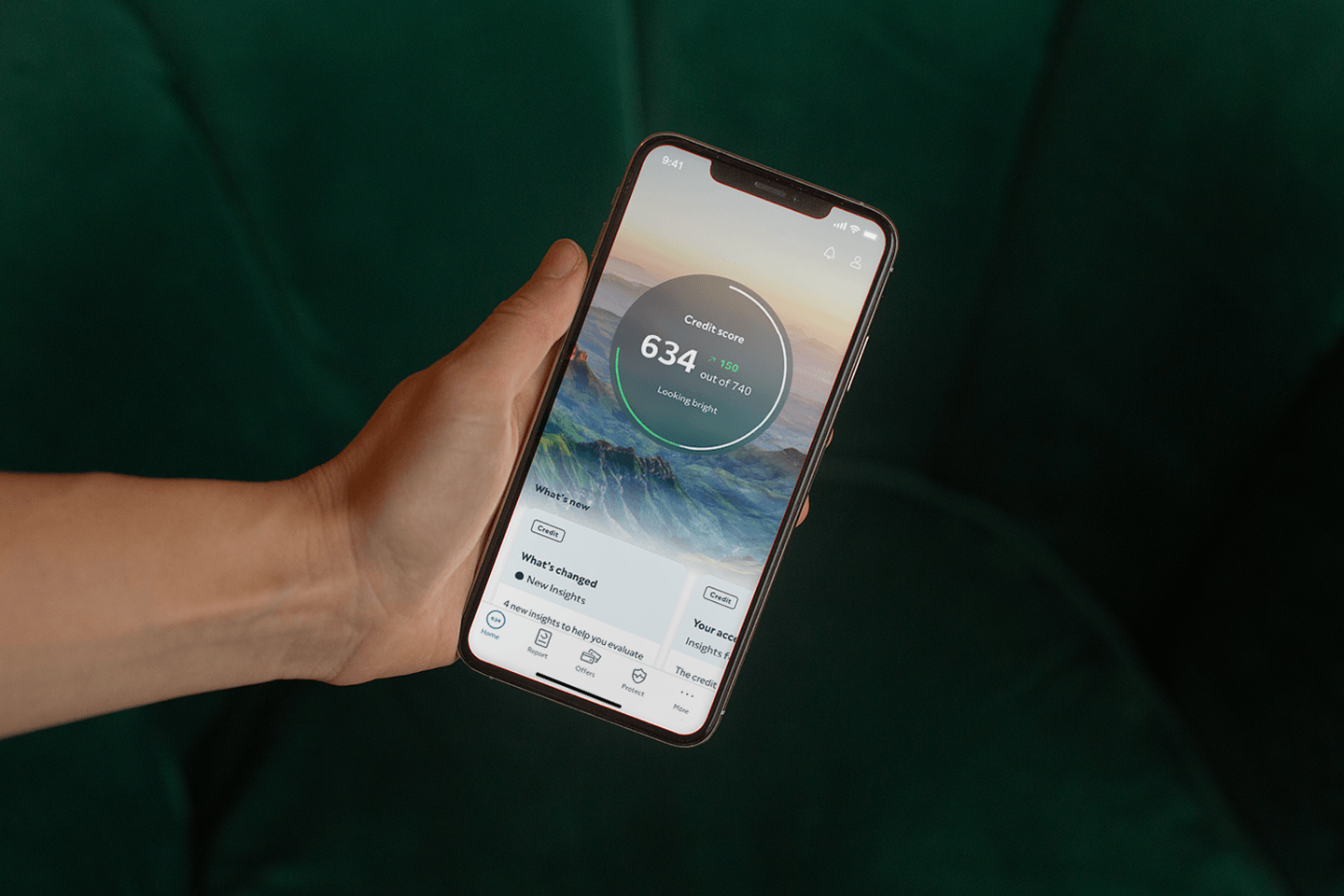

Get your free credit report and score

ClearScore allows you to access your credit report and score for free – forever.

Credit report vs credit score: what’s the difference?

We explain the differences between your credit score and credit report, and how they work together to create a picture of your financial health.

Get your free credit report and score

ClearScore allows you to access your credit report and score for free – forever.

While the terms credit score and credit report are often used interchangeably, they’re actually two different things. Both credit scores and reports are based on how you've handled credit in the past, but there are some key differences you should be aware of.

A credit report is a record of your borrowing history. It’s similar to your resume. However, instead of information about your work experience and educational background, it contains details about how you’ve borrowed money and paid it back.

Most of the information in your report comes from lenders. This information is compiled by companies that create credit reports – known as credit bureaus. Your credit report has three main parts:

1. Personal information

This section contains:

Your name

Your date of birth

Your address history

Your address is particularly important because credit bureaus use it to match up your credit history. Therefore, it’s important that all your financial accounts are registered at a single address.

If you move into a new home, make sure you promptly inform your lenders so that they can update your information. This way, your credit report will be accurate and complete.

Besides giving you access to your credit score and report, ClearScore also connects you with credit deals that suit your profile. For the best results, make sure your personal information is up to date.

2. Open credit accounts

This is a list of the credit accounts you have open. You will be able to see how much debt you have on each of your accounts, as well as your credit limits and when you first opened them.

Whenever you engage with an account that’s credit-related, it will be listed here. This may include opening a new store or credit card, or taking out a loan. However, it may also include other, less obvious information, such as accounts with:

Utility providers: This includes paying for municipal services, such as water and electricity (if it’s not paid on a meter).

Internet service providers (ISPs): This may include the service provider for your internet connection, such as WebAfrica or MWEB.

Mobile phone networks: This refers to the network partner that you chose for your cellphone, such as Vodacom or MTN.

Strictly speaking, these are credit accounts too. However, not all providers will report this information to the credit bureaus. For example, one mobile phone network might report your diligent payment history to the bureaus, while another may not.

You can also view all of your account information through ClearScore. Sign up or login so that you can access your account information with ease.

3. Payment history

Your credit report will show whether you’ve paid your debt on time each month or whether you’ve made late payments – or missed them altogether. It’s incredibly important to pay your debt on time, since this factor can make up around 35% of your overall credit score .

We have another article that goes into more detail about what a credit report is. If you’d like to learn more, follow this link to get started.

If your credit report is like your resume, then your credit score is a quick summary of your career achievements. In other words, it tells lenders at a glance how likely you are to be accepted for credit – and how favourable your credit terms should likely be.

So, what’s a “good” credit score? Essentially, the higher your score is, the better. Having a high credit score suggests to lenders that you are more reliable, and therefore more “creditworthy”. This means that you can be trusted with credit and, as a result, you’re more likely to qualify for it.

One thing to bear in mind is that there's no universal credit score in South Africa. There are three main credit bureaus, and each of them have a different scoring method. This means that everyone has three credit scores – and the score you get may vary depending on where you look. At ClearScore, we’re partnered with Experian, and they give us the information that we present to you.

Credit bureaus have different maximum scores. Here are the credit score ranges from the main credit bureaus in South Africa:

Experian: 0 – 740

TransUnion: 0 – 999

Xpert Decisions Systems (XDS): 0 – 1,000

They have different scales, too. This means that your credit score may be 580 at Experian, 900 at TransUnion, and 650 at XDS – even though they considered similar information. This is nothing to worry about, as long as your information is accurate, this won’t affect your creditworthiness.

It's a good idea to check your credit score regularly so that you can be aware of any changes. You can click here to have a more in-depth look at what a credit score is and how it’s calculated. You can also find out what’s considered a good and bad credit score.

Your credit report is a detailed record of all your financial behaviour. A credit score is a number, calculated by credit bureaus, which sums up the information in that report.

Your credit report tells the story of how you’ve handled credit in the past. Looking at your report allows credit providers to answer important questions about your financial habits, such as:

How much debt do you currently have?

Do you usually pay your debt on time?

Do you tend to take on more debt than you can afford to repay?

These, and other, questions help credit providers decide:

- Whether or not to give you credit at all

- On what terms to give you credit (in particular, what kind of interest rate and repayment schedule they’ll offer you).

If you just look at all the information on your credit report, it's difficult to guess how a lender might interpret it. Your score sums up all the assorted information in your report into a single number. This makes it easier for you to see how you're doing in comparison to what lenders are looking for.

However, here’s a word to the wise: Your credit report isn’t the only data a credit provider will use to make a decision. The information you provide in your application, their past relationship with you, and other factors, such as your income, are important too.

Different providers also tend to work out their own credit scores. So, even if your Experian, TransUnion, or XDS scores are high, it’s no guarantee that you’ll get credit. However, it’s still a good indicator. On top of this, just because one provider turned you down doesn’t necessarily mean others will do so too.

Through ClearScore, you can access offers, such as loans and credit cards, from a range of lenders. We indicate on each whether you have a “moderate” or “high” chance of approval.

Your credit report is a record of your borrowing history. It contains your personal details and a list of your past and present debt. It also shows whether you’ve always paid your debt on time or missed repayments.

Your credit score is a number based on your credit report. The higher the number, the more attractive you appear to lenders. A lower number may reflect badly on your relationship with credit.

Your credit score doesn’t guarantee you’ll be accepted or rejected for credit. Individual credit providers tend to score you based on their own criteria, including your past relationship with them.

Hannah is currently studying for a Master's in Comparative Cultural Analysis. She knows all about personal finance, but as a student, she's an expert in money saving tips and tricks.