In this article

How to get a loan with a low credit score

What happens if you need a loan but you have a low credit score? What are your options?

In this article

Many people only find that they have a low credit score or problematic credit history when they apply for their first loan. If this is the case for you - don’t panic. There are lending options for everyone – including loans designed for people with low credit scores or issues with their credit histories. So, how do you get a loan with a low credit score?

In this article, we look at some basics about low credit scores, bad credit, and how to improve your credit rating to help you get the loan you want.

There are two main reasons you have a low credit score that might affect your ability to get a loan.

- You’re considered a “thin file” customer.

- You have bad credit.

There’s a popular misconception that a low credit score makes it impossible to get a loan. However, options are available for you to get a loan with a low credit score, even if you have bad debt or a “thin file.”

Whenever you apply to borrow money, lenders will check your credit report before they agree to lend you money. A credit report is a record of your behaviour when it comes to borrowing. It includes how much money you’ve borrowed, if you’ve paid it back and whether you’ve done this on time (we go into more detail about this in our article on credit reports).

If you have bad credit it means you’ve probably struggled to pay back your debts and a mark has been left on your report by a lender. This might be for a number of reasons, for example:

- You haven’t made the monthly repayments on time

- You’ve missed the repayments altogether

- You’ve been declared bankrupt

- You’ve had a court judgment against you

There are personal loans specifically designed for people with poor credit histories. Lenders offering these types of loans tend to charge higher rates of interest because they’re taking on a bigger risk with the people they’re lending to. These lenders will consider your income and ability to repay your loan when considering your application.

- Loans for bad credit tend to be an expensive way to borrow money. Before you take out this kind of loan, you should make sure you’ve considered all of your options after speaking with your lender or a debt counsellor.

- If you do take out this type of loan you should try and pay it back as quickly as you can in order to avoid expensive interest rates.

- Try not to apply for multiple loans at once. This could damage your credit score and make it harder for you to be accepted by a lender who may view you as a risky borrower. Every time you apply for credit, a “credit application” search will be carried out and a mark will be added to your report.

- Instead, use a “soft enquiry” to see how likely you are to get a loan before you apply – these kinds of checks won’t damage your credit report. You can check which loans and offers you’re eligible for on Clearscore.

If you take out a loan for bad credit and you’re able to make all your payments on time and in full, it can help your credit rating. It will show lenders you can borrow responsibly and be trusted to pay back your debt. This means that if you need to borrow again you might be able to take out a loan at a lower interest rate.

On the other hand, if you take out a loan for bad credit and you fail to repay it, this could have a negative impact on your credit score – more so than if you had problems repaying a standard loan. This damage is likely to hinder your chances of being able to borrow again in the future.

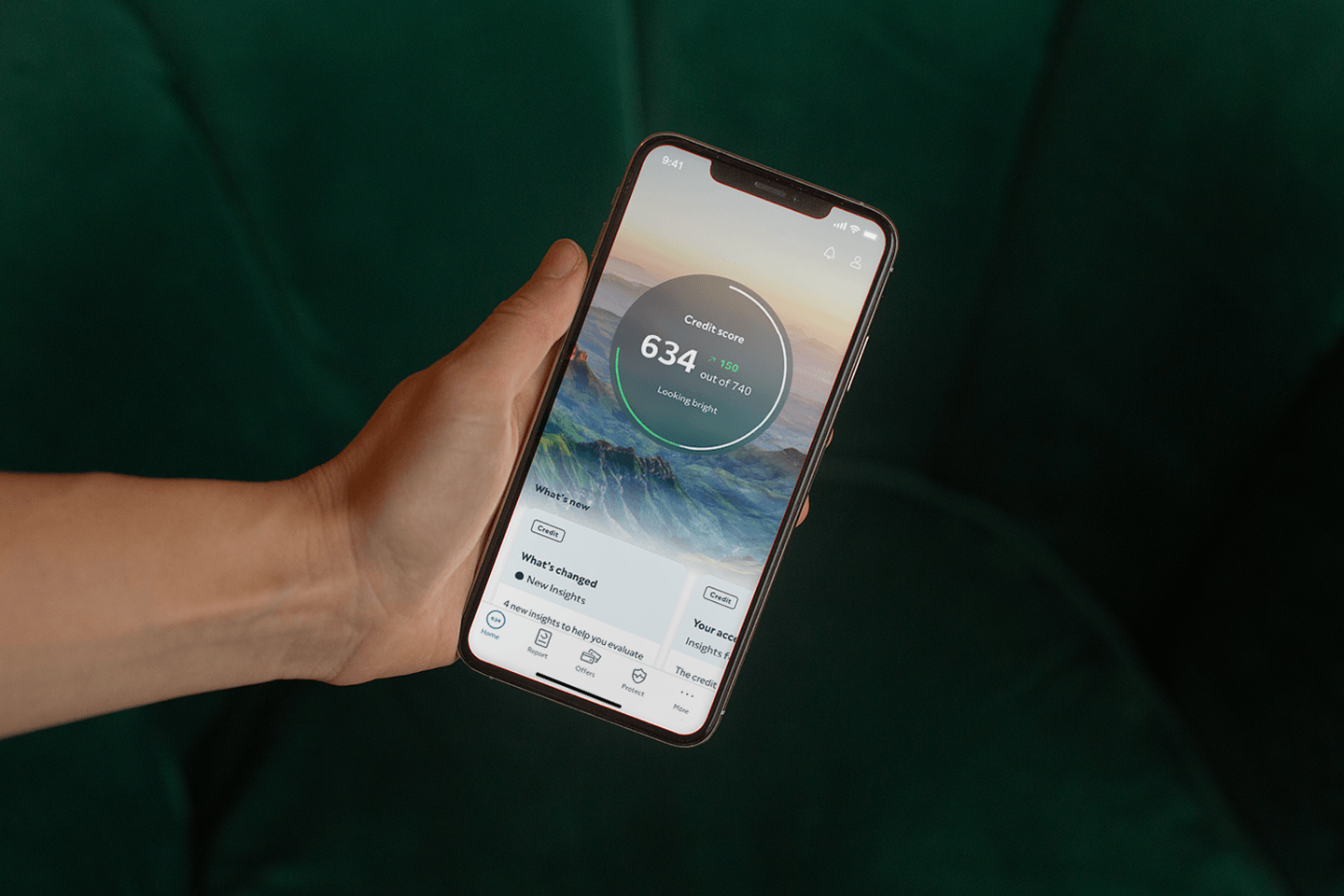

Unfortunately, the best loan rates and offers will only be given to people with high credit scores. The good news is that you can start to build up your credit score at any time to get yourself on the right path for a cheaper loan. You can find out more in our articles on how to improve your credit score and understanding what influences your credit score.

- Check your credit report regularly, making sure all the information you expect to be there is present and correct.

- You can also read our five-minute checklist on how to take charge of your credit report each month.

- If you borrow money, pay it back on time and (if possible) in full each month

- Try to avoid using too much of your credit limit

With more than 9 years of experience working in fintech and e-commerce, Anna is helping people all over the world change the way they manage their finances.