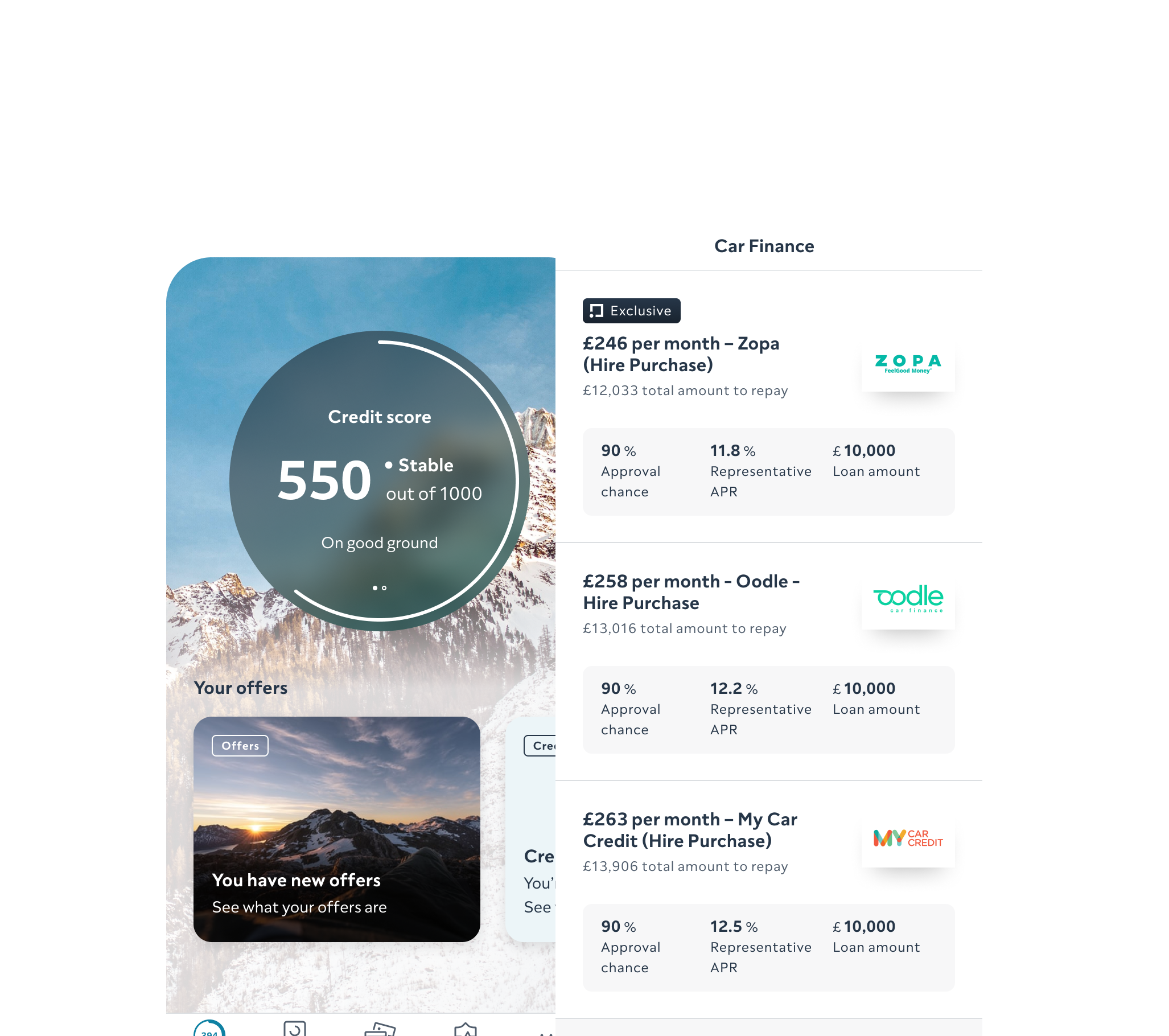

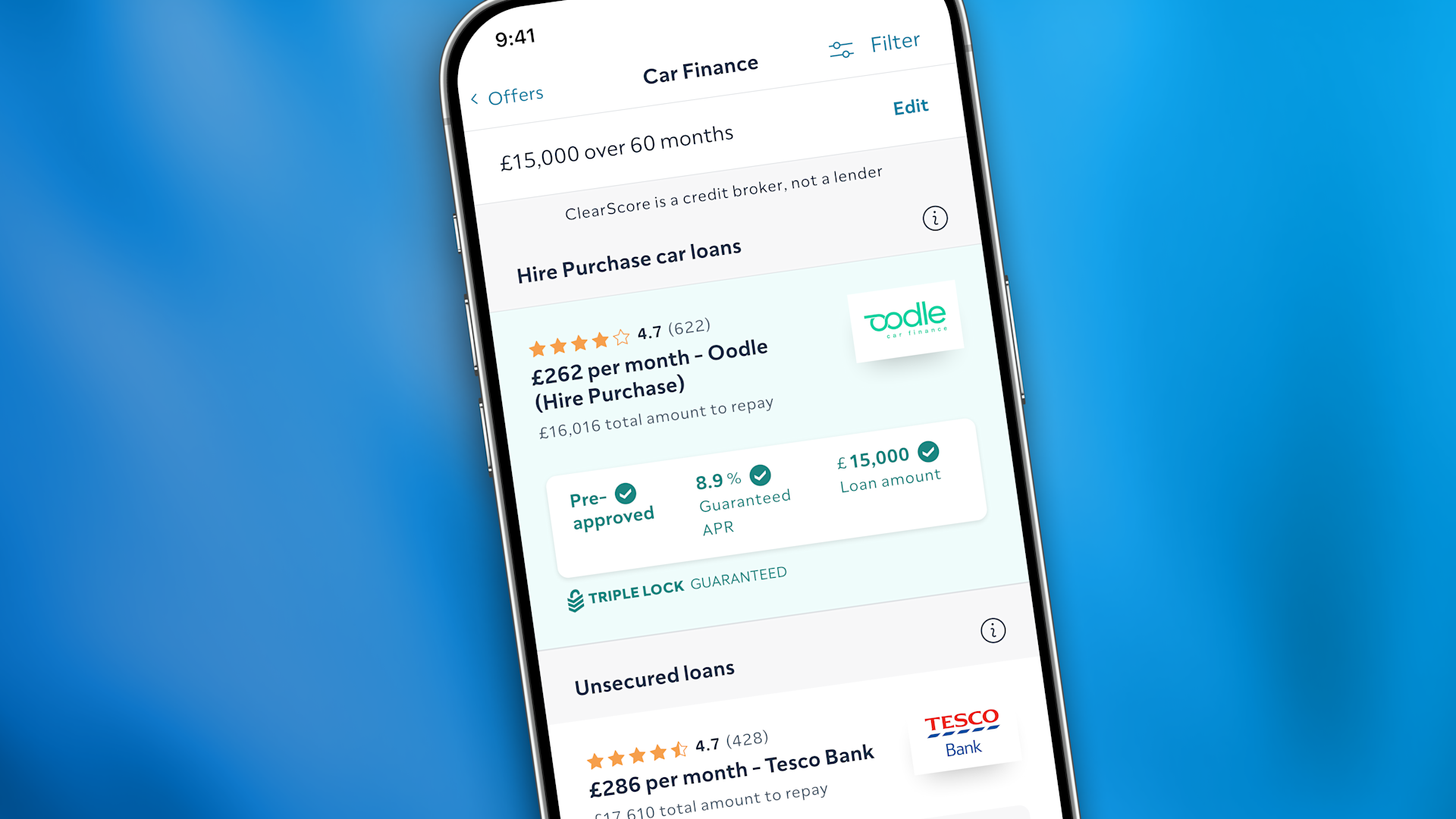

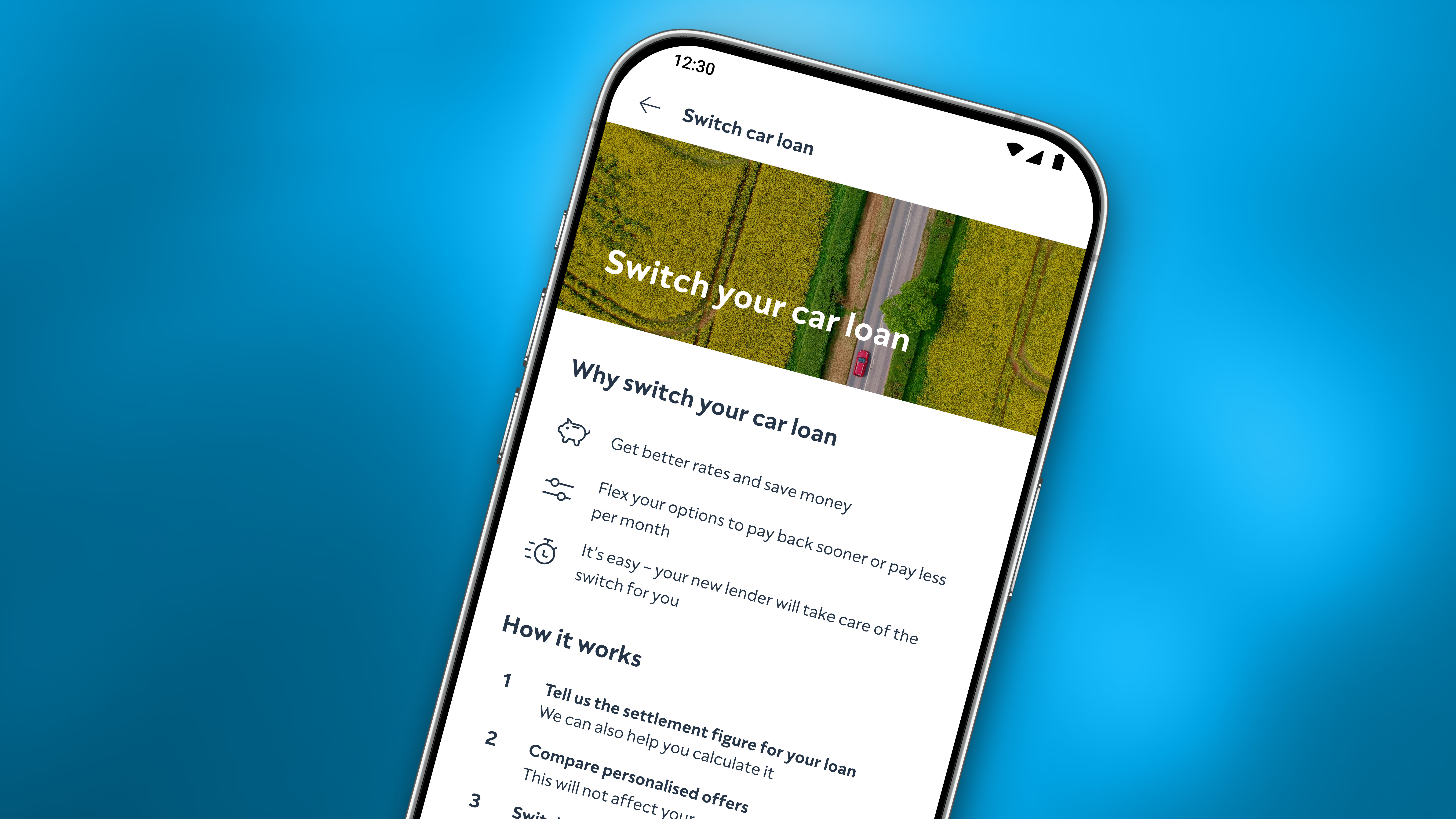

Hire Purchase (HP)

HP stands for hire purchase. If buying a new car isn’t affordable, Hire Purchase could help you pay for it in instalments. You’ll get the car and pay for it over a period of time, usually 3 to 5 years.

Once you’ve repaid the loan – the car�’s yours.