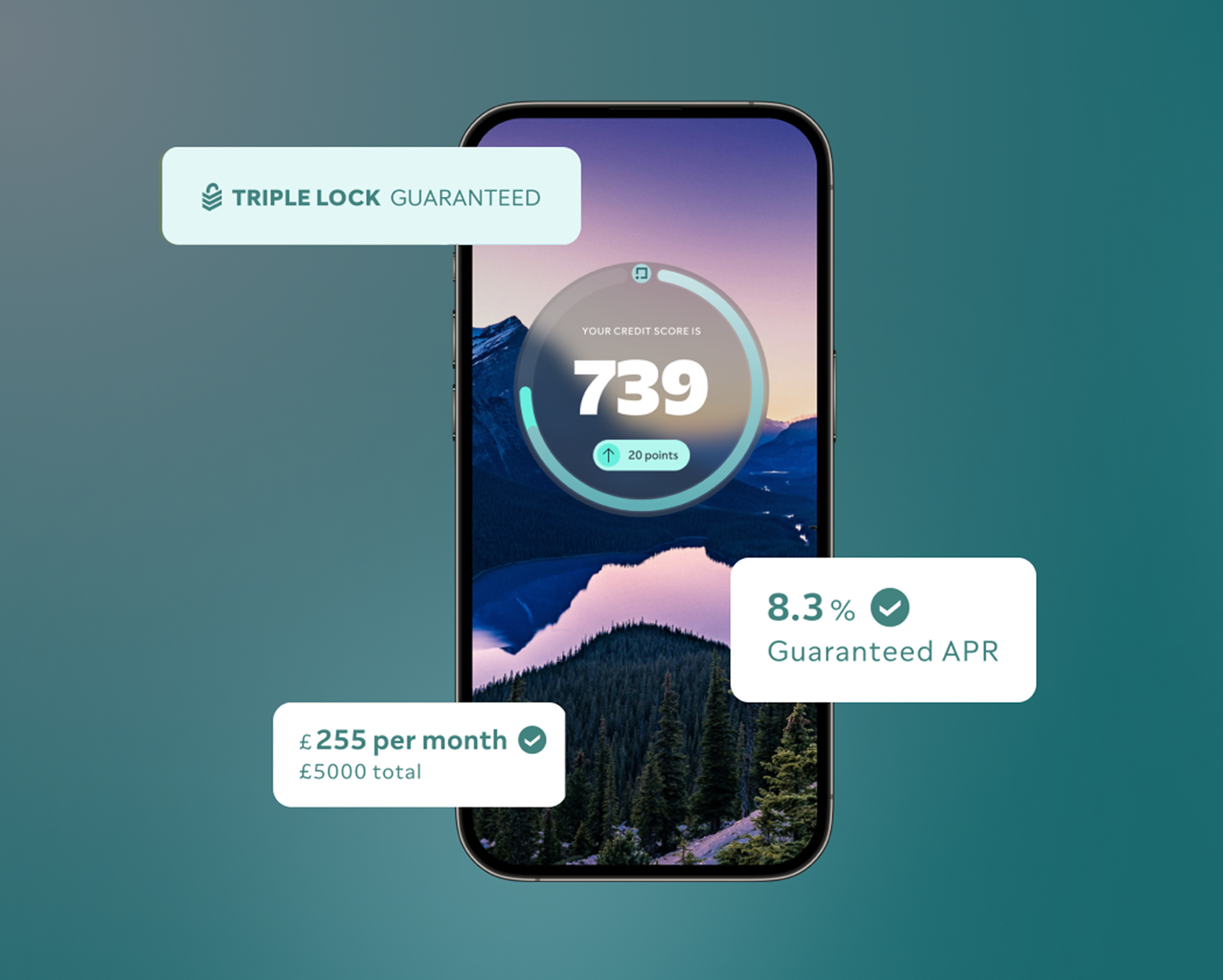

Check your loan eligibility today

You could start comparing loans straight away.

ClearScore is a credit broker, not a lender, 18+, T&Cs apply

Check your eligibility without affecting your credit score

Discover personalised offers and see your approval chances

Explore your full credit score and report – for free, forever

A loan is a sum of money you borrow from a bank, building society, or other lender.

You’ll pay it back over an agreed period of time, with interest. When you search for a loan on ClearScore, we’ll show you what the monthly repayments could look like to help you plan ahead.

And, if other ClearScore users have taken out a loan from that lender, we’ll show you how people found the application process and customer service.

You could start comparing loans straight away.

Checking and comparing offers never affects your credit score.

Not with ClearScore yet? Sign up to explore all your personalised offers and unlock your full credit score and report.

Use this calculator to see what your monthly loan repayments could look like.

£

%

The numbers you'll see are a guide only.

APR means annual percentage rate. It's made up of the interest rate and other charges you might have to pay (like an annual fee). We've added a representative example already, but you can change it. Bear in mind that these numbers are intended as a guide only.

APR means annual percentage rate. It’s the total cost of the loan over a year. It’s made up of the interest rate and other charges you might have to pay (like an annual fee). We've added a representative example already, but you can change it. Usually, you’ll pay back your loan with interest – which is how lenders make a profit.

Representative APR is the interest rate that the lender will typically give to at least 51% of people. That means up to 49% could get a higher rate. Your actual APR may be higher than what you see.

We’ll show you if you’re pre-approved so you can feel more confident about getting a ‘yes’. Pre-approval doesn’t guarantee acceptance but, if you pass the lender’s checks and your information on ClearScore is correct, you’ll get the loan.

Loan amounts between £1,000 and £100,000.

Loan terms from 1 to 20 years.

From emergencies to quick fixes, you could get access to the money you need with a loan.

You could use a lump sum to pay off your credit card or other debts and make one monthly repayment at a lower interest rate.

Celebrate your big day knowing you can pay it off in monthly instalments.

As long as you make the repayments on time and in full, you can build your credit score. And that can mean better offers for things like car finance, loans, credit cards, and more.

Dreaming of a once-in-a-lifetime trip? You could spread the cost of your next adventure.

Spread the cost of what you owe, without using any of your assets as collateral, with a personal loan.

Move your debt into one, more manageable place with a debt consolidation loan.

Get a guarantor loan with the help of a friend or relative and access the money you need.

Looking to save on interest? We work with lenders to guarantee as many low interest loan rates as we can.

See what help is available when it comes to loans for people on benefits.

Usually for homeowners, a secured loan means using something you own as collateral.

If there are easy steps you can take to improve your score before you apply, take them. That’s because a better score could mean better offers – like lower interest rates or higher loan amounts.

Checking things like your income, employment details, and address are still correct is key. Lenders use that information (as well as your credit history) to determine the loan amounts and interest rates they can offer you.

Don't borrow more than you need, as this can increase the total cost of your loan and make it harder to repay.

Feel confident about your loan repayments by planning your budget in advance.

Read the small print. Make sure you understand what you’re paying for by checking the interest rates and any additional charges .

Get a better idea of what you could be eligible for by comparing your offers first.

If you meet the minimum requirements (like being at least 18 and a UK resident), can comfortably afford monthly repayments and don’t have any problems on your credit report, you’re more likely to be approved for a loan.

You might have to pay more interest, but we work with lenders who specialise in loans for people with a bad credit score.

Find out more about getting a loan with a bad credit score.

Representative 48.8% APR.

Whether you’re adding a new account, removing an old one, or just changing how much credit you use – you’ll find it here.

We’ll show you whenever they've been opened or updated over the past 7 years. You can even see how much of your available credit you’ve used and what the loan balance is. Everything you need, all in one place.

Your offers are personalised to you. And we’ll show your approval chance so you can feel confident about applying.

Yes – we work with lenders who specialise in helping people with a lower credit score find a loan. Learn more about getting a loan with a bad credit score.

The amount of money you can borrow depends on a few things like your income, expenses and credit score. That’s why it’s important to compare loans before you apply for one.

Yes, you can. But check if there are early repayment charges (ERCs) before you do.

If you take out a loan, sign into your Universal Credit account and report a change of circumstances. Depending on the loan, and your personal circumstances, your Universal Credit might be affected. Find out more about what help is available if you're on benefits.

If you've got money worries, know that you're not alone. It's a lot more common than you think. But it's important not to ignore these things and to seek support if you need it.

We’re working in partnership with StepChange to give you access to their free debt advice and support.

When you compare offers, lenders will do a soft search on your credit history. It helps them decide what sort of offer you could be eligible for. It’s only visible to you and doesn’t have an impact on your score. You can compare as many offers as you like without harming your credit score.

When you apply, the lender will carry out a hard search. It’s a full review of your credit history and stays on your report for a year. A hard search can affect your credit score but, as long as you borrow responsibly, the impact should be short-term.

Learn more about hard and soft searches.

Fixed APR means the annual percentage rate can’t change during your lending agreement. You’ll usually see a fixed APR on a fixed-term loan.

Variable APR means the annual percentage rate could change during the lending agreement.

No – checking your loan offers on ClearScore will never harm your credit score.

From time to time, we work with some of the UK’s top lenders to bring you exclusive offers. We show these as ‘Exclusive’ in ‘Offers’, so you’ll know which ones they are.

We work with over 45 lenders like Admiral, Natwest, 118 118 Money, Halifax and more.

When you sign up to ClearScore you can see your credit score and credit report for free. We work with lenders to offer our users market-leading deals on credit products. We may receive a commission if you take out a product with a lender. This article will explain how we make money.