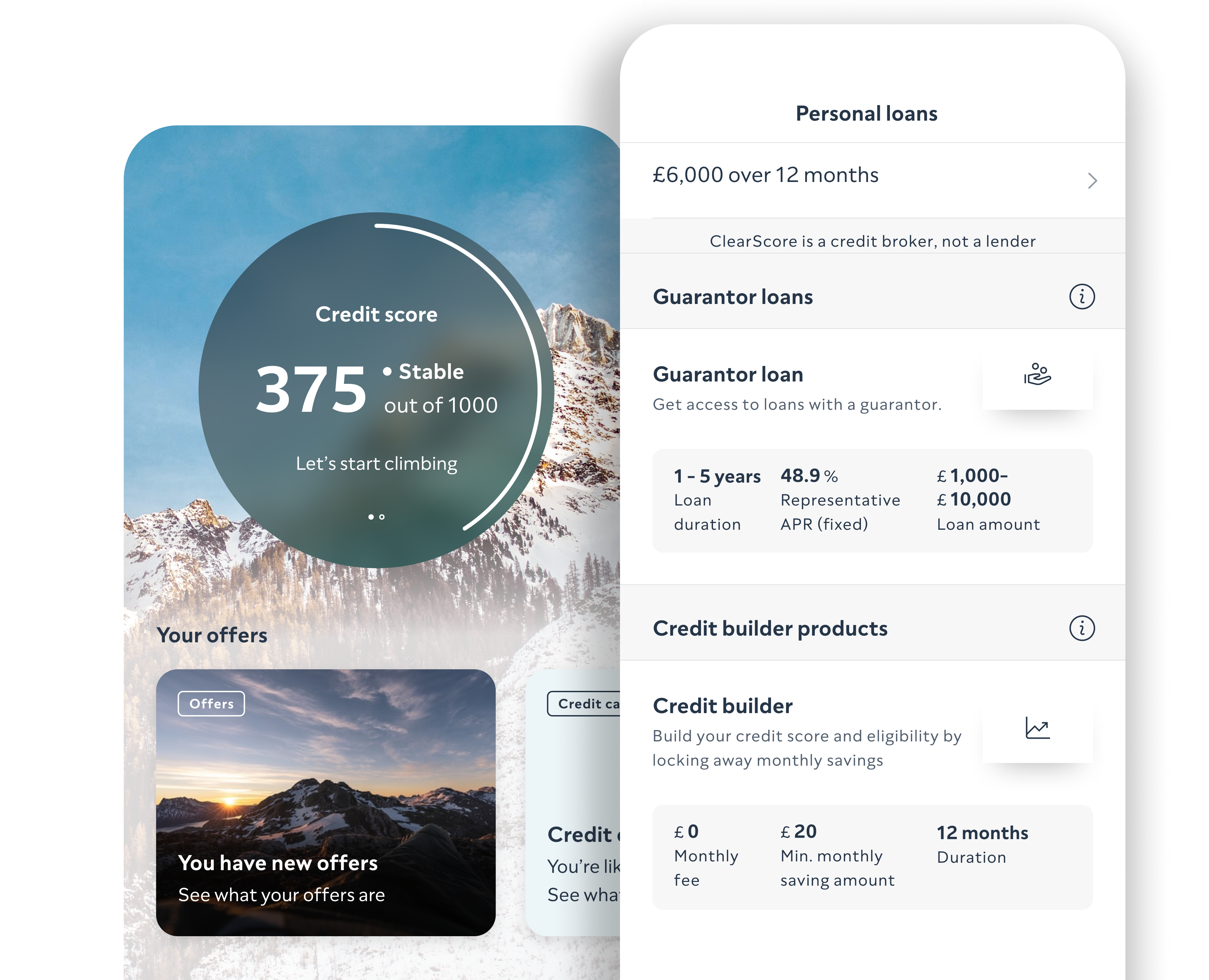

Find a guarantor loan

Check your eligibility for a loan before you apply and compare as many as you like without harming your score.

Representative 39.9% APR. ClearScore is a credit broker, not a lender, 18+, T&Cs apply.

Get a guarantor loan that works for you and your credit score

Check your approval chances before you apply

Explore your full credit score and report – for free, forever

You could be comparing credit cards in just 60 seconds.

The offers you see are tailored to your score.

We’ll tell you what your approval chance is, so you can apply with confidence.

Everyone’s situation is different – we’ll help you find the loan tailored to your credit score.

Just tell us what you’re looking for and we’ll show you personalised offers for guarantor loans.

Guarantor loans are usually for people with a bad, or no, credit score.

A guarantor loan could help you access the money you need. That’s because someone else in the agreement – the guarantor – meets the lender’s criteria and is responsible for repaying the loan if you can’t.

Some lenders specialise in loans for people with bad credit, so comparing your offers is a great place to start.

Representative 39.9% APR.

Missed payments, new accounts, hard searches and more – we’ll give you a heads-up so you can understand what's making your score move.

Every week, we’ll give you up to 10 insights to help you get to grips with your report. They’re filled with easy tips that could help improve your score and get it back on track.

From lower interest rates to higher credit limits or loan amounts, a higher credit score can give you access to better offers in the future.

We’ll show you offers tailored to you – and order them based on what might be right for you.

Get your credit score for free, forever.

Check your eligibility for a loan before you apply and compare as many as you like without harming your score.

A guarantor loan is a type of unsecured loan. That means you’re not using something like your car or your home as collateral in case you can’t make the repayments.

Instead, the lender asks you to provide a guarantor.

The guarantor should only have to step in and pay the loan, as a last resort, if you can’t make the repayments yourself.

Guarantor loans are usually for people with a bad (or no) credit history. Lenders want to be sure the person they’re lending to can repay the money they owe, on time and in full.

So, they might still offer you a loan if someone else promises to pay it back, on your behalf, if you can’t make the repayments.

You can apply for a guarantor loan in the same way you’d apply for a standard loan.

The offers you’ll see are tailored to you.

We’ll ask you for some information like how much you’d like to borrow and for how long, what you plan to use the loan for and what your total monthly spending is.

Your guarantor becomes a third party to the loan agreement.

The lender will usually ask you to give them some more information and then they’ll carry out a hard search on your credit history (and they’ll probably do a soft search on your guarantor).

If you’re approved for the loan, the lender could send you the money within a few days. They might send it to your guarantor first. You’ll usually have a cooling-off period – it's a good idea to check with the lender how long you'll have to change your mind.

We’ll show you what the monthly repayments, annual percentage rate (APR), and your approval chances are before you apply. Helping you plan ahead and feel more confident about getting a ‘yes’.

Join 19 million people worldwide and sign up today.

Guarantor loans can be a good option if you’re not eligible for a standard loan.

You could borrow the money you need, even if you have a bad, or no, credit history.

You might be able to borrow more money than you would without a guarantor.

You could use the loan to build your credit score, by paying it back responsibly.

There are risks to think about when applying for a guarantor loan, for you and the guarantor.

The interest rate might be lower than a standard loan.

If you miss your repayments, the guarantor may have to take responsibility for the loan and pay back what you owe.

The guarantor’s credit history, score and report could be negatively impacted if the loan transfers to them.

Guarantors need to meet the lender’s criteria. That usually means meeting minimum requirements like being over 21 years old, having a good credit history and being financially stable.

Usually, a guarantor is a relative or a close friend – that’s because there are risks to think about when guaranteeing someone else’s loan.

Learn more about who can be a guarantor.

A guarantor is a third party in a loan agreement – that means they agree to take on the loan if the borrower can’t make repayments on time and in full.

If that happens, the loan would transfer to the guarantor’s credit report. That can impact future applications for credit – because lenders will look at someone’s full credit history and see what their expenses are.

Once a guarantor is added to a loan agreement, they can’t be removed until the loan is paid back in full.

There are some other options out there if you’re not sure a guarantor loan is right for you.

Credit Unions are not-for-profit. There’s a cap on the amount of interest a credit union can charge (usually less than 50% APR). You need to meet their criteria – like living and working in the area. So, if there’s one near you, you could see if they’d be able to offer you a loan.

Credit builder cards typically have high interest rates and lower credit limits than other cards. But, you could use it to improve your credit score – because a better credit score could mean better offers.

A secured loan is usually for homeowners – you use your home as security to get a large amount of money. If you can’t make the repayments, you risk losing your home.

Some lenders specialise in loans for people with a bad credit score or history – the interest rates might be higher than normal but they can sometimes help you build your credit score if you make the repayments on time and in full.

A short-term loan is usually for a smaller amount of money and is paid back within a year. They tend to be for unexpected expenses.

A payday loan is a short-term loan designed to help you cover your expenses while you wait for your next payslip. These can be risky because they usually come with high interest rates and late fees.

If you need debt advice, you can speak to charities like StepChange, National Debtline and Citizens Advice. You can also speak to MoneyHelper. You should let your lender know as soon as possible so they can speak to you about your payment options.

If your loan transfers to your guarantor, and they can’t afford to make the repayments, your lender could take steps to recover the debt. Your guarantor should speak with the lender to understand their payment options. Lenders should work with them to agree the best next steps, or refer them for independent debt advice.

When you apply for any type of loan, the lender will carry out a hard search against your credit report. It’s common for a hard search to affect your credit score but, as long as you borrow responsibly, the impact should be short-term. Being a guarantor shouldn’t affect your credit score, unless the borrower is unable to repay the loan and it transfers to you. The loan will then become a part of what makes up your score – alongside any other lines of credit you have.

Comparing your offers before you apply will give you the best idea of what interest rates and APR are available to you.

You can usually borrow between £1,000 and £10,000 with a guarantor loan.

Applying for a loan online is often faster than applying in-person. The application process itself shouldn’t take very long and lenders can often tell you if you’ve been accepted on the same day. You should then receive the money within a couple of days. Remember – the lender might send the money to you guarantor first.

There are lots of loans out there – it’s important to find the right one for you.

Using a debt consolidation loan to pay off your current debt could help you focus on one, more manageable payment.

Loans for bad credit are designed for people who have a bad credit score or a poor repayment history, but these loans can come with high interest rates.

You could still get a loan if you’re on benefits. Some lenders specialise in loans for people on benefits, or with a bad, no, credit history.

A personal loan – also called an unsecured loan – is a one-off sum of money that you pay back over an agreed term (number of months).

A secured loan is usually for homeowners – you use your home as security to get a large amount of money. If you can’t make the repayments, you risk losing your home.

With a car finance loan, there are a few different ways to pay for a new car, like UPL or hire purchase.