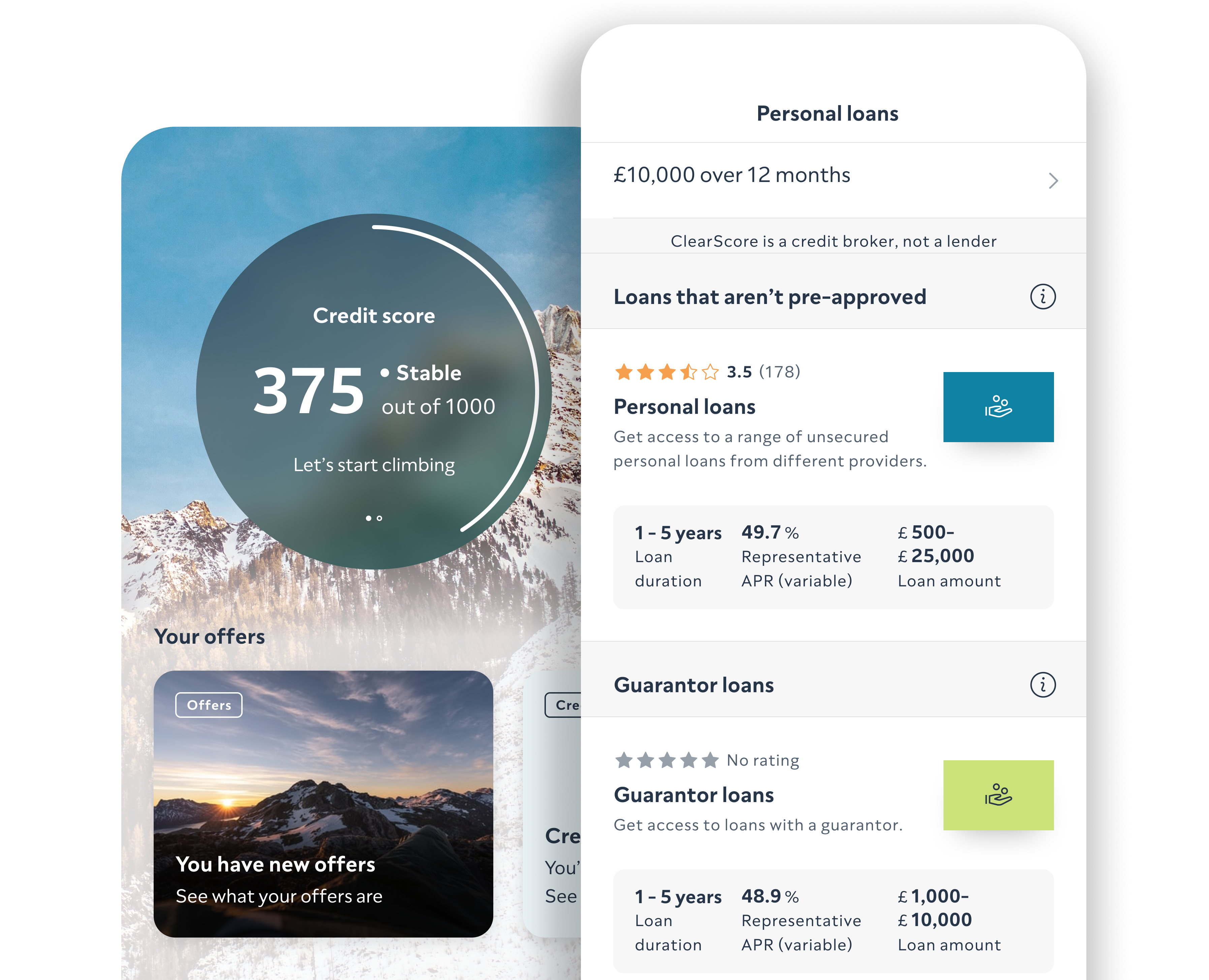

Personal loans

You might be able to get a personal loan from a specialist lender. Your choice of lenders might be limited and the interest rate could be high, but if you’re managing the loan responsibly could help you improve your credit score.

Representative 39.9% APR. ClearScore is a credit broker, not a lender, 18+, T&Cs apply

Check your approval chances before you apply

See what the monthly repayments are and budget in advance

Explore your full credit score and report – for free, forever

You could be comparing credit cards in just 60 seconds.

The offers you see are tailored to your score.

We’ll tell you what your approval chance is, so you can apply with confidence.

You could still get a loan even if you have a bad credit score.

Tell us what you’re looking for and we’ll show you personalised offers.

It’s designed for people who have a bad credit score or a poor repayment history.

People with low credit scores are deemed riskier for lenders to give money to, so these loans can come with high interest rates.

There are specialist lenders that handle loans for bad credit, so you may not come across household names if you’re looking to apply for one.

If you have a history of missing payments, you might need to have a loan secured with your home or other assets, or ask someone to guarantee your loan.

If you have a bad or low credit score, you could still get a loan.

You might have to pay more interest but, at ClearScore, we work with lenders who specialise in helping you find the best loan for your score.

Some of our lenders will offer secured loans which could increase your chances of being approved.

Representative 39.9% APR.

There are a few different types of loans for bad credit – it’s important to find the right one for you.

You might be able to get a personal loan from a specialist lender. Your choice of lenders might be limited and the interest rate could be high, but if you’re managing the loan responsibly could help you improve your credit score.

If you’re a homeowner or have another asset in your name, getting a secured loan might be an option. You risk losing your assets if you can’t make the repayments. But, because the lender has that extra security, they might be able to offer you lower interest rates or a higher loan amount.

A guarantor loan is a type of unsecured loan. That means you’re not using something like your car or your home as collateral in case you can’t make the repayments. Instead, the lender asks you to provide a guarantor – usually a relative or close friend. If you miss your repayments, the guarantor may have to take responsibility for the loan and pay back what you owe.

Join 19 million people worldwide – sign up today.

A bad credit score suggests to lenders that it’s riskier to lend to you. So, you’ll probably be offered a smaller loan with a high interest rate. That’s why comparing offers before you apply is key – you can see if the total loan amount covers what you need before you apply.

When you compare loans on ClearScore, we’ll show you what the monthly repayments could look like. Giving you the chance to plan ahead and understand what your expenses could be during the loan term.

As long as you make the repayments on time and in full, you could see your credit score improve over time. And a better credit score could mean better offers in the future. Try not to apply for more than one line of credit within 6 months because hard searches can impact your score.

The amount of money you can borrow depends on things like your credit score and credit history. Lenders will use that information to determine how much they’re willing to let you borrow.

That’s why comparing offers before you apply is a great way to see what you’re likely to be eligible for.

If you have a bad credit score, there are lenders who could help you get the money you need.

You can improve your credit score by paying back the loan on time and in full.

You can build your credit history by proving you can manage money responsibly.

If your credit score is low, you’re more likely to be accepted for this type of loan.

All loans are a form of debt so there are some risks you should be aware of.

Loans for bad credit usually come with high interest rates.

If you miss the repayments your credit score can worsen, which impacts your future options. And, if you’ve secured your loan, you risk losing your assets.

Taking out a loan increases your amount of debt – that might not be right for you if you have other lines of debt already.

You can apply for a loan for bad credit in the same way you’d apply for a standard loan.

The offers you’ll see are tailored to you.

We’ll ask you for some information like how much you’d like to borrow and for how long, what you plan to use the loan for, and what your total monthly spending is.

The lender will usually ask you to give them some more information and then they’ll carry out a hard search on your credit history.

If you’re approved for the loan, the lender could send you the money within a few days. You’ll usually have a cooling-off period – it's a good idea to check with the lender how long you'll have to change your mind.

We’ll show you what the monthly repayments, annual percentage rate (APR), and your approval chances are before you apply. Helping you plan ahead and feel more confident about getting a ‘yes’.

Your credit score is made up of all the things in your credit report. That means your payment history, how much of your available credit you use, how long you’ve had credit for and how often you apply for new credit accounts affect the number you see.

There isn’t a specific number that makes your credit score ‘bad’. Generally, the higher your score, the easier it is to get something like a credit card or loan.

That’s because lenders are more likely to lend money to someone with a track record of paying back the money they owe.

Things like missed or late payments, bankruptcy, and not being on the electoral roll can lower your credit score. If you’ve never borrowed before, you won’t have built up your credit history, so you might not have a credit score just yet.

Your credit score is a good indication of what's going on in your credit history. And your credit history can help you get things like credit cards, loans and car finance. It can even make it easier for you to rent property, get a mobile phone contract, or even get a job.

So, it’s important to keep an eye on your score and see what you can do to improve it.

There are some simple steps you can take to improve your score.

Once you’re on the electoral roll, lenders can more easily check for proof of address – which can also speed up your application for a credit card.

If you spot any accounts you don’t recognise, or mistakes in your personal information, let the credit reference agency (like Equifax, Experian or TransUnion) know.

This can be helpful when you’re new to credit. Opening a bank account and paying your bills by Direct Debit means you can start building your credit history.

It’s a good idea to wait about 6 months between credit applications (so you can show you’re borrowing responsibly).

Credit utilisation – which just means how much of your available credit you use every month – impacts your score. Keeping it between 10% and 70% can show you’re borrowing responsibly.

If you think you’re going to miss a payment – for your credit card, loan or other expenses – let your lender know. That way, you can see what your options are in advance.

Missed payments, new accounts, hard searches and more – we’ll give you a heads-up so you can understand what's making your score move.

Every week, we’ll give you up to 10 insights to help you get to grips with your report. They’re filled with easy tips that could help improve your score and get it back on track.

From lower interest rates to higher credit limits or loan amounts, a higher credit score can give you access to better offers in the future.

We’ll show you offers tailored to you – and order them based on what might be right for you.

Get your credit score for free, forever.

At ClearScore, we show you your Equifax credit score, which ranges from 0 to 1000. There’s not one number that means you have bad credit. Your credit score is a useful indication of your creditworthiness, but lenders will look at other factors (like your income and debt levels) before deciding whether to lend to you.

There are things you can do to improve your credit score – like getting on the electoral roll or fixing mistakes on your report. Paying bills, credit cards and loans on time and in full can have a big impact on your score.

Comparing your options is a good place to start. You might be able to get a loan designed for people with bad credit. Other lenders might offer you a guarantor loan or a secured loan.

You can use a loan for bad credit for many things, like buying a new car, home improvements or as a debt consolidation loan, for example. How much you can borrow depends on your credit history.

At ClearScore, we show you your approval chance before you apply, so you can feel more confident about getting a ‘yes. But, if your application is rejected, it’s a good idea to wait about 6 months before applying for another one. That’s because lenders carry out a hard search against your credit history during the application process which can negatively impact your score. So – let your score improve again and compare your offers.

Yes – and when you compare offers on ClearScore, you can hit ‘apply now’ if that loan is right for you.

When you apply for any type of loan, the lender will carry out a hard search against your credit report. It’s common for a hard search to affect your credit score but, as long as you borrow responsibly, the impact should be short-term.

Loan applications typically involve 2 types of credit searches. When you compare offers, lenders will do a soft search – that’s only visible to you and doesn’t have an impact on your score. When you apply, the lender will do a hard search. It’s common for a hard search to affect your credit score but, as long as you borrow responsibly, the impact should be short-term.

If you need debt advice, you can speak to charities like StepChange, National Debtline and Citizens Advice. You can also speak to MoneyHelper. You should let your lender know as soon as possible so they can speak to you about your payment options.

Learn more about what to do if you can't make a payment or miss a payment on a loan.

There are lots of loans out there – it’s important to find the right one for you.

Using a debt consolidation loan to pay off your current debt could help you focus on one, more manageable payment.

You could still get a loan if you’re on benefits. Some lenders specialise in loans for people on benefits, or with a bad, no, credit history.

A personal loan – also called an unsecured loan – is a one-off sum of money that you pay back over an agreed term (number of months).

A secured loan is usually for homeowners – you use your home as security to get a large amount of money. If you can’t make the repayments, you risk losing your home.

With a car finance loan, there are a few different ways to pay for a new car, like UPL or hire purchase.

Guarantor loans are usually for people with a bad, or no, credit score because someone else in the agreement – the guarantor – meets the lender’s criteria and is responsible for repaying the loan if you can’t.