The smart way to compare credit cards

Find the credit card you’re looking for, with ClearScore

ClearScore is a credit broker, not a lender, 18+, T&Cs apply

Check your eligibility without affecting your credit score

Discover personalised offers and see your approval chances

Explore your full credit score and report – for free, forever

Compare up to 35 credit card lenders

Making it easy to find the right credit card for you

1. Check your eligibility today

You could be comparing credit cards in just 60 seconds.

2. Keep your credit score healthy

Checking and comparing offers never affects your credit score.

3. Sign up for even more offers

Not with ClearScore yet? Sign up to explore all your personalised offers and unlock your full credit score and report.

What’s a credit card?

A credit card allows you to borrow money to pay for goods and services with the promise that you’ll repay the card provider what you owe at a future date, usually with interest added.

It lets you spread the cost of what you buy

Every month, the lender will send you a bill – or statement – and you’ll need to pay back the money you’ve spent.

The lender can charge you interest on the money you carry over

If you carry over some of the balance to the next month, the lender can charge you interest.

Some credit cards come with 0% interest periods, but you should always check the annual percentage rate (APR) before you apply for a credit card.

How much you spend affects your credit score

That’s called credit utilisation – which just means how much of your available credit you use every month. Keeping your utilisation between 10% and 70% is a good way of showing you’re managing money responsibly.

Your personalised offers are here

When you compare credit cards on ClearScore, your offers are tailored to your credit score.

We’ll show you your approval chances before you apply – so you can be more sure of getting a ‘yes’. And, if other ClearScore users have taken out a credit card from that lender, we’ll show you how they rated them for things like the application process and customer service.

The different types of credit cards

There are lots of credit cards out there – find the one that works for you.

Balance transfer card

Balance transfer cards let you transfer your existing credit card balance onto another card. They usually come with 0% interest periods. You could use one of these cards to consolidate your debt and pay it off within the low- or 0% interest period.

Credit builder card

Credit builder cards help you build your credit score. The interest rates can be high and the credit limit low, but you could start to see your score improve if you keep up with the monthly repayments.

Reward card

Rewards credit cards let you earn things like cashback, points or air miles when you make certain transactions. The interest rates can be high and some rewards cards also come with a monthly or annual fee.

Purchase card

Purchase cards are designed for large purchases. You’ll be able to spread the cost over a few months – and the 0% interest period means you could save money on interest.

Travel card

Travel credit cards mean you either won’t be charged for using your card abroad, or the fees will be low. If you want to take out money at a cash machine in another country, you’ll usually be charged interest.

Money transfer card

Money transfer cards let you move money into your bank account. They can help if you have an overdraft on your current account, or if you need cash. Some other types of credit cards will let you transfer money. There’s usually a fee and the interest rates can be high.

Some lenders offer dual credit cards that come with a mix of benefits – like 0% on balance transfers and purchases for a fixed period.

The benefits of a credit card

A credit card can be a great way to spread the cost of everyday spending. And your purchases (between £100 and £30,000) are protected – you could get a refund, replacement or repair if something’s damaged or faulty.

You can spread the cost of your everyday spending. From holidays to large purchases, a credit card can help.

Some credit cards come with rewards – like cashback, air miles or travel insurance.

You can use it to build your credit score by paying back what you borrow on time and in full.

The risks of a credit card

Credit cards are a form of debt – it’s important make sure you can afford the repayments.

You could harm your credit score if you can’t keep up with the monthly repayments.

Using credit cards increases your debt which is why it’s important to budget in advance.

Some cards come with additional charges – like an annual fee or higher interest rates after a promotional period ends.

How to choose the right credit card for you

To help narrow down your options, think about these things before applying for a credit card.

Know what you want it for

Deciding what you’d like to use the card for – transferring your balance, building your credit score, or rewards, for example – is the first step.

See how much you could borrow

Comparing offers will give you an idea of how much you can borrow. Then, you can see which credit limit works best for you.

Check the interest rate

Some cards come with 0% interest for a few months. So make sure you know what the interest rate will be after the promotional period ends. Other cards will come with high interest rates from the start – but if you’re confident you can make the repayments in full every month, you won’t need to worry about the rate as much.

Look for additional fees

Rewards cards, for example, often come with an annual or monthly fee. And some other cards will charge you for taking out money at a cash machine. The lender should make it clear what fees apply in their terms and conditions.

Find out what your eligibility is

When you apply for a credit card, lenders will carry out a hard search – this will show on your credit report and be visible to other lenders. So, it’s a good idea to know what your chances are before starting the application process. At ClearScore, we’ll show you your approval chance for each credit card.

The credit card application process

With most lenders, you’ll be able to apply for a credit card online. It’s often faster than applying in person and the lender can usually tell you if you’ve been accepted straight away.

Compare your offers

The offers you’ll see are tailored to you.

We’ll ask you for some information to understand what you�’re looking for and show you the credit cards you’re likely to be eligible for.

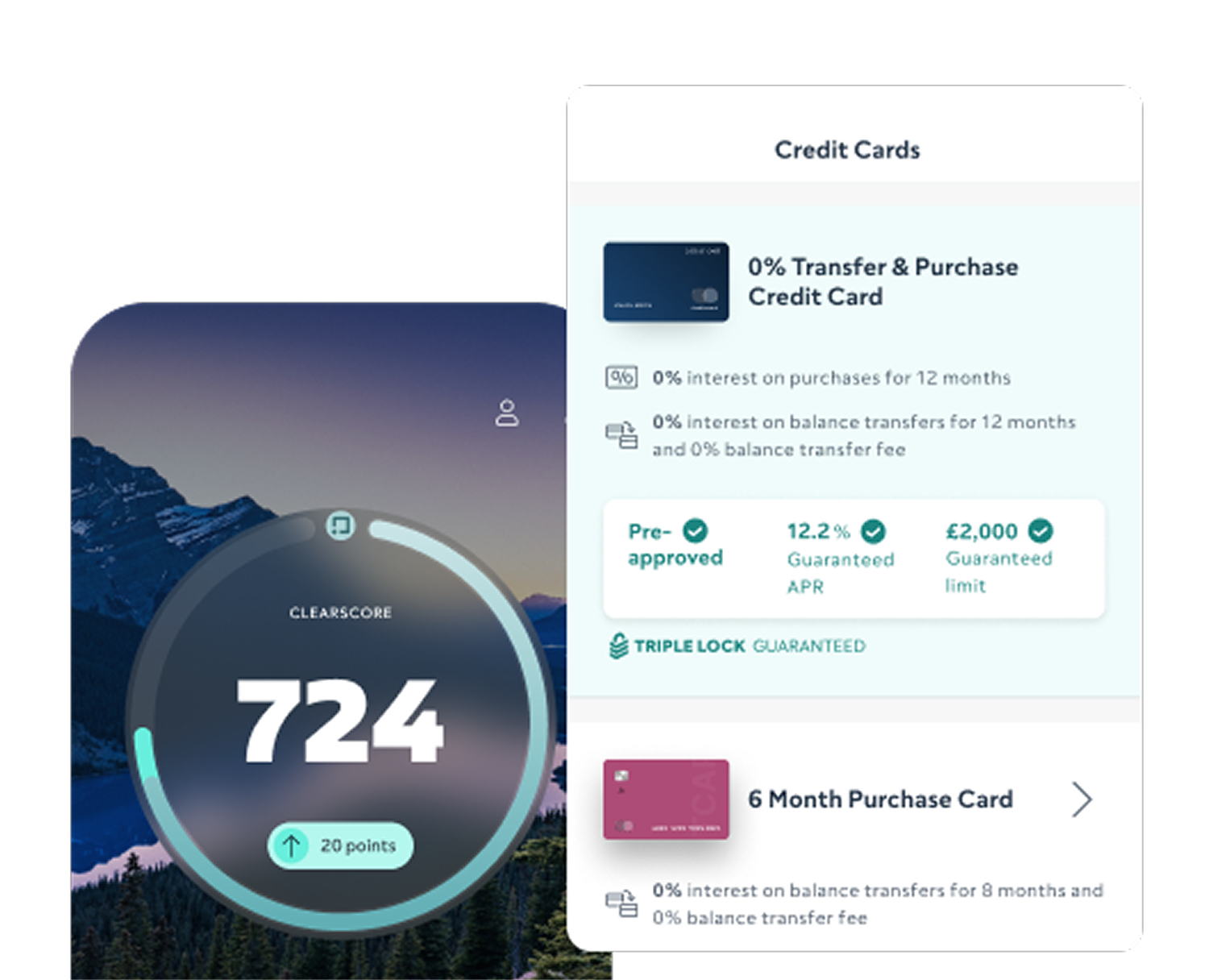

Look for the Triple Lock Guarantee

If you see 3 green ticks, it means your offer is pre-approved, and comes with a locked-in credit limit and interest rate. Helping you plan ahead and take control of your finances.*

Apply for your credit card

We’ll show your approval chances when you search for a credit card – saving you time and effort.

You might have to give the lender some more information and then they’ll carry out a hard search against your credit history.

Wait for your card to arrive

If you’re approved, it shouldn’t take long to get your card in the post. You’ll be able to use your new credit card as soon as you activate it.

*Pre-approval doesn’t always guarantee acceptance and is subject to lenders’ checks of your credit status.

See your credit card offers

Find the credit card tailored to your credit score.

Getting accepted for a credit card

Your chances of being accepted for a credit card depend on a few things, like your credit score and history.

Check your credit score before you apply

A better credit score could mean better offers – like higher credit limits or lower interest rates.

Make sure your report is up-to-date

Lenders check your personal information (like your address) when you apply for a credit card. Make sure the information in your report is accurate and up-to-date to speed up the application process.

Know your approval chances

We’ll tell you what your approval chances are for every credit card we show you – helping you feel more confident about getting a ‘yes’.

How do lenders decide to give you a credit card?

Lenders look at the information in your credit report to see if you have a history of managing money responsibly. If you’re new to credit, or you have a bad credit score, there are things you can do to build your score. If you can’t get a credit card, there could be a few different reasons and things you can do.

Getting a credit card with a bad credit score

You could still get a credit card, even with a low credit score. You might be offered a lower credit limit and higher interest rates but, at ClearScore, we work with lenders who specialise in helping you find the right card for you.

And, by making repayments on time and in full, you could start to build your credit score.

Representative 34.7% APR.

Do more with ClearScore

Get a preview of incoming changes

Whether you’re adding a new account, removing an old one, or just changing how much credit you use – you’ll find it here.

Take a closer look at your accounts

We’ll show you whenever they've been opened or updated over the past 7 years. You can even see how much of your available credit you’ve used and what the loan balance is. Everything you need, all in one place.

Save time when looking for your next offer

Your offers are personalised to you. And we’ll show your approval chance so you can feel confident about applying.

Learn more about credit cards

Frequently asked questions

A few things could happen if you miss a credit card payment – whether that’s by one day or longer. You might have to pay a fee (your lender will tell you) and the missed payment can appear on your credit report if you’re unable to pay within about 30 days. That could affect your ability to get credit in the future – lenders look at your credit history to see if you have a good track record of managing money responsibly. If your credit card came with a promotional offer – like a 0% interest period – you could lose that offer.

If you can’t afford to pay your credit card statement, there are things you can do that could help. You should speak to your lender straight away and talk through your options with them. And, if you need debt advice, you can speak to charities like StepChange, National Debtline and Citizens Advice.

The first thing you’ll need to do is pay off any outstanding balance. You can then get in touch with your lender and start the cancellation process.

Depending on how many other lines of credit you have and how you use them, cancelling a credit card can mean you see a drop in your credit score. That’s because your overall credit utilisation (how much of your total available credit you use) would change.

Yes – if you want to pay off your credit card early, you can. If you make a repayment before your statement closing date (not the payment due date), your credit utilisation would be lower. The closing date for your statement is roughly 21 days before your payment due date.

If you want to increase your credit card limit, you might be able to if you have a history of using your card responsibly. You can get in touch with your lender to see what your options are.

A credit card can be a good way to borrow money and build your credit score at the same time. Depending on the type of credit card you choose, you could spread the cost of your purchases, receive rewards for certain transactions, use the card abroad or just transfer your balance.

APR stands for annual percentage rate. When you take out a credit card, you’ll need to pay it back ‘with interest’ if you carry over a balance. This is where APR comes in – it’s made up of the interest rate and other charges you might have to pay (like an annual fee).

Credit card APR doesn’t include fees you might have to pay if you miss a payment or take money out at a cash machine.

The interest rate you’re offered is based on all the things that make up your credit score and report. Because credit cards are a type of unsecured credit, lenders might offer different interest rates to different people, once they assess how risky it is to lend to them. That’s why someone with no, or a bad, credit history might be offered a higher interest rate.

Your bank or building society might offer member-only cards or specific benefits. But there could be other offers available to you – that’s why it’s a good idea to compare your options before applying.

A joint credit card means there’s a main account holder and an authorised second user. This is different to a joint bank account because the responsibility for the credit card payments (and any debt that builds up) sits with the main account holder.

The requirements to get a joint credit card are the same as when you want to take out any other type of credit card. But the lender will usually do a soft search and want you to be over 18 if you’re going to be the authorised second user. Sometimes it’s a requirement for you to live at the same address or be a family member, too.

Learn more about taking out joint credit.

It could be that you don’t have a long enough credit history. Or, it could be that you owe money across other credit cards or loans, or have missed some payments recently. If you can’t get a credit card, have a look at these possible reasons why and what to do next.