Tell the new lender you want to transfer the balance

You can usually do this online by logging into your bank account. Some lenders will charge you a fee for the transfer.

ClearScore is a credit broker, not a lender, 18+, T&Cs apply

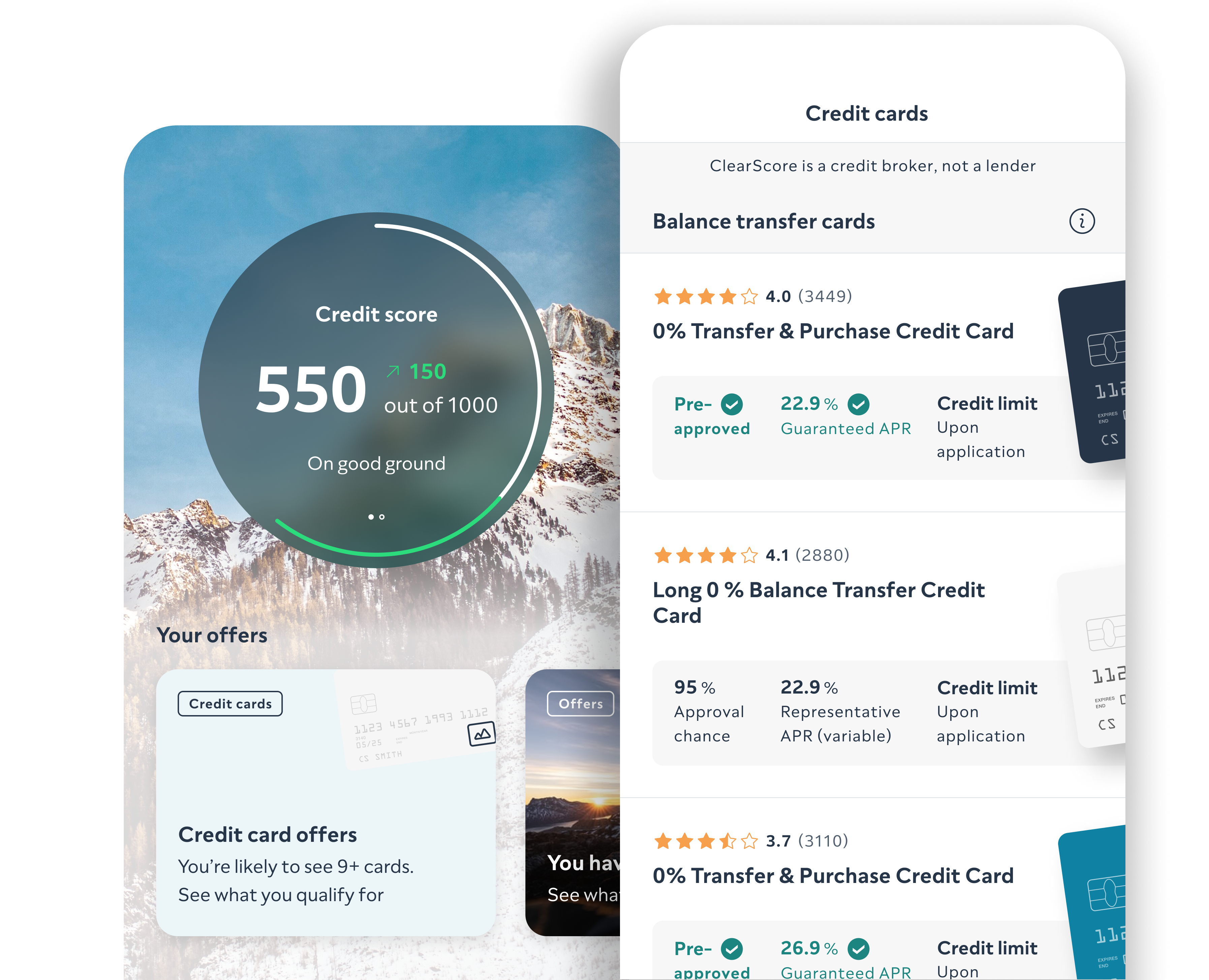

See if you could save on interest

Check your approval chances before you apply

Explore your full credit score and report – for free, forever

You could be comparing credit cards in just 60 seconds.

The offers you see are tailored to your score.

We’ll tell you your approval chance so you can apply confidently.

You could save on interest – tell us what you’re looking for and we’ll show you personalised offers for balance transfer credit cards.

Balance transfer cards let you transfer your existing credit card debt onto the new one.

The 0% interest period means you won’t start building up interest on any of the balance you carry over. It can last anywhere between 6 months and 2 years.

Balance transfer cards are usually meant for credit card debt, but depending on the provider, you might also use them for other types of debt.

Learn more: Balance transfer cards explained

You can transfer your credit card balance in a few easy steps.

You can usually do this online by logging into your bank account. Some lenders will charge you a fee for the transfer.

It should take a couple of days. Keep an eye on your existing payment schedule in case you need to make a repayment while you wait.

When the transfer is complete, you can start paying off the balance in line with the new terms.

Remember – you still need to make the minimum monthly repayments and keep an eye on the 0% interest period. When it ends, you’ll need to pay interest on any balance you carry over month to month.

Join 19 million people worldwide – sign up today.

There are a few different types of balance transfer cards out there – find the right one for you.

These cards come with 0% interest periods. That means if you carry over the balance to the next month, you won’t be charged interest.

This means the lender won’t charge you money to transfer your existing credit card debt onto the new card.

These cards let you transfer your balance and continue to make purchases, usually at a low interest rate.

You can apply for a balance transfer card in the same way you’d apply for any credit card.

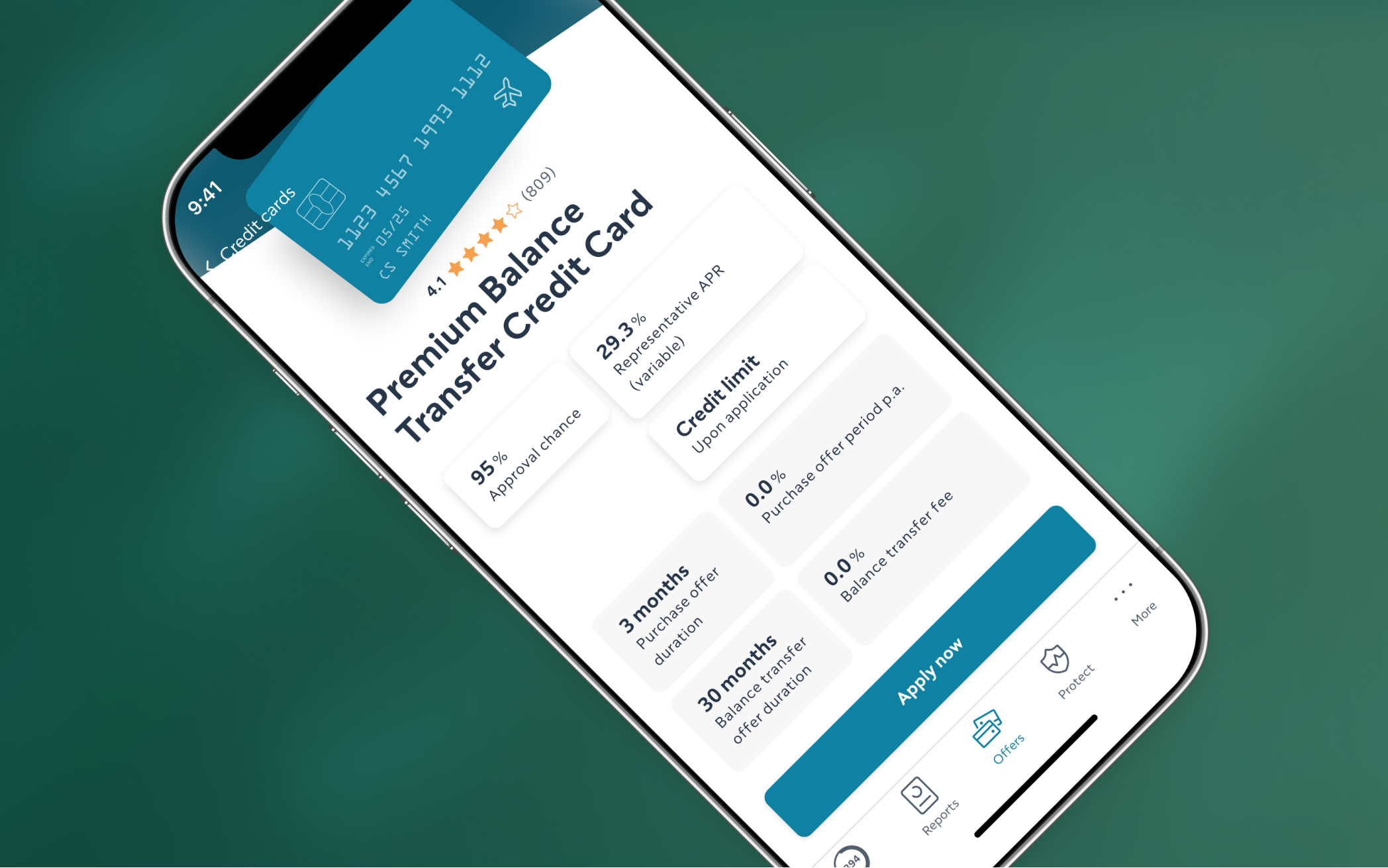

The offers you’ll see are tailored to you. We’ll ask you for some information to understand what you’re looking for and show you the balance transfer credit cards you’re likely to be eligible for.

If you see 3 green ticks, it means your offer is pre-approved, and comes with a locked-in credit limit and interest rate. Helping you plan ahead and take control of your finances.*

We’ll show your approval chances when you search for a credit card – saving you time and effort.

You might have to give the lender some more information and then they’ll carry out a hard search against your credit history.

If you’re approved, it shouldn’t take long to get your card in the post. You’ll be able to use your new credit card as soon as you activate it.

*Pre-approval doesn’t always guarantee acceptance and is subject to lenders’ checks of your credit status.

As soon as the 0% interest period is over, you’ll need to start paying interest on any balance you carry over on a monthly basis.

Some cards will come with a transfer fee. Work out if the amount you’ll save on interest is more than the amount you’d pay with the balance transfer fee.

Missing a payment or making a late payment can mean losing the promotional offer. If that happens, you’ll need to start paying interest.

See how much you could save with our balance transfer calculator.

Balance transfer credit cards can be a great way to consolidate your credit card debt.

0% interest periods can give you more time to repay what you owe – and you’ll save on interest.

The new card could come with better terms – and you could switch to it permanently.

Your credit score could improve if you borrow responsibly.

There are a few risks to think about before choosing a balance transfer card.

There might be a transfer fee, so understand how much you’ll need to repay in total.

The interest rates can be high after the 0% interest period ends.

If you can’t make the minimum repayments, you risk losing the promotional 0% interest offer.

If you have a bad or low credit score, you could still get a balance transfer card. You might be offered a lower credit limit and the 0% interest period might not be as good.

But, at ClearScore, we work with lenders who specialise in helping you find the best credit card for your score.

Find out more about credit cards for bad credit.

Representative 34.6% APR.

Whether you’re adding a new account, removing an old one, or just changing how much credit you use – you’ll find it here.

We’ll show you whenever they've been opened or updated over the past 7 years. You can even see how much of your available credit you’ve used and what the loan balance is. Everything you need, all in one place.

Your offers are personalised to you. And we’ll show your approval chance so you can feel confident about applying.

The 0% interest period could last anywhere between 6 months and 2 years. It depends on the lender, type of card, and your credit score and history.

When the 0% interest period is over, you’ll start paying interest on any balance you carry over every month. Remember, missed or late payments can mean losing the 0% interest promotion before its original end date.

Taking out any credit card can impact your credit score. The lender will carry out a hard search against your credit report. It’s common for a hard search to affect your credit score but, as long as you borrow responsibly, the impact should be short-term.

A money transfer card is useful if you want to transfer money from a credit card into your bank account – to pay off an overdraft, for example. It’s a different type of card to a balance transfer card. There’s usually a fee to transfer money or your balance.

You can apply for a balance transfer card if you meet the minimum requirements – like being a UK resident and over 18 years old – but the offers you see will depend on your credit score and history.

There are lots of credit cards out there – it’s important to find the right one for you.

A 0% interest credit card lets you press pause on paying interest. That means you can use it for something like your everyday spending or to do a balance transfer, without paying the interest on the balance you carry over every month.

Purchase cards are designed for large purchases. You’ll be able to spread the cost over a few months – and the 0% interest period means you could save money on interest.

Rewards credit cards let you earn things like cashback, points or air miles when you make certain transactions. The interest rates can be high and some rewards cards also come with a monthly or annual fee.

Credit builder cards help you build your credit score. The interest rates can be high and the credit limit low, but you could see your score improve if you keep up with the monthly repayments.

Credit cards for bad credit are designed for people who have a bad credit score or a poor repayment history and usually comes with a low credit limit or high interest rates.

Travel credit cards mean you either won’t be charged for using your card abroad, or the fees will be low.