You can spread the cost of big purchases over a few months.

0% purchase credit cards

Get personalised offers for 0% purchase cards and spread the cost of those larger purchases

ClearScore is a credit broker, not a lender, 18+, T&Cs apply

Spread the cost of your larger purchases

Save on interest during the 0% interest period

Explore your full credit score and report – for free, forever

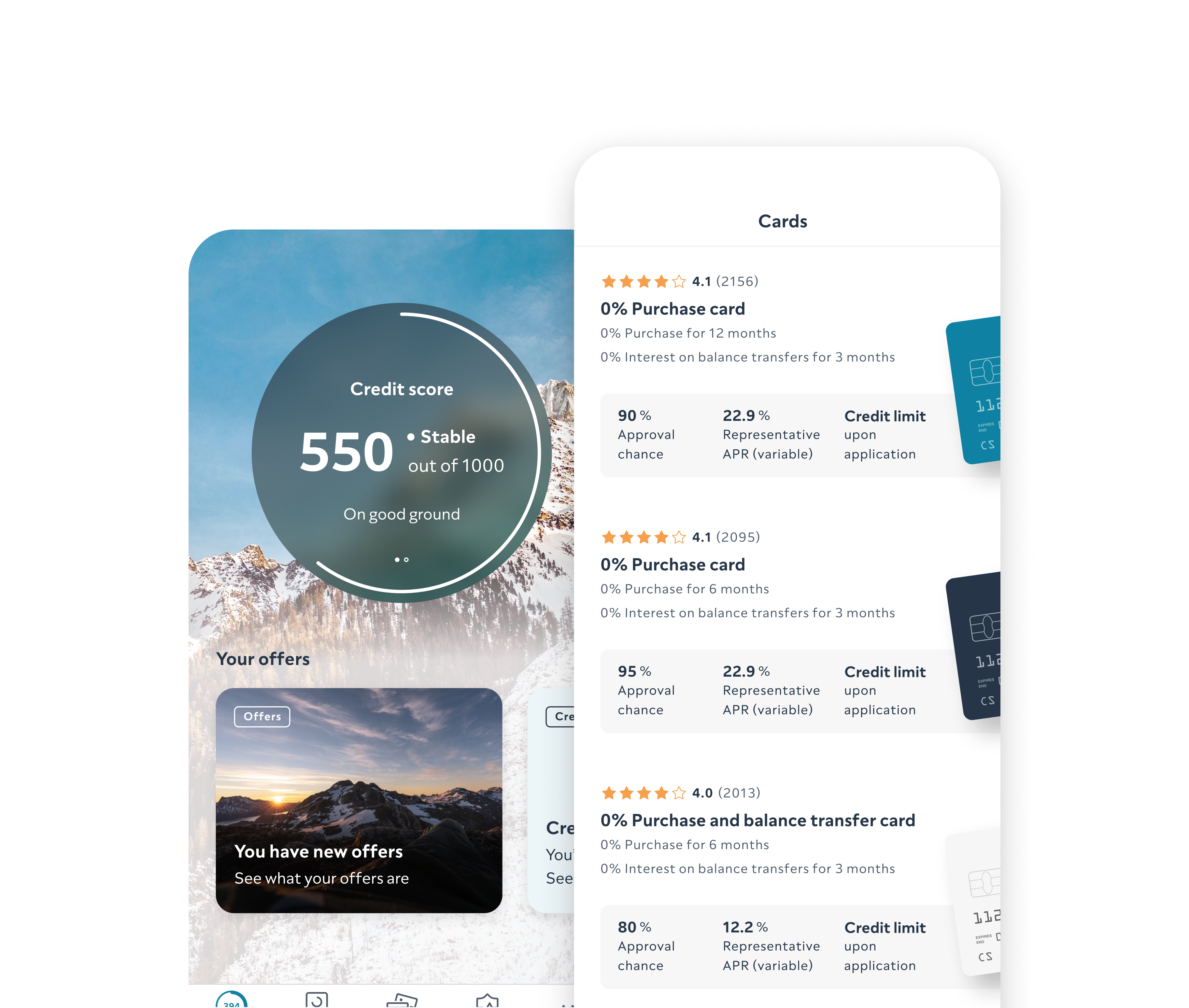

Finding a 0% purchase card is easy on ClearScore

1. Check your eligibility today

You could be comparing credit cards in just 60 seconds.

2. Compare your offers

The offers you see are tailored to your score.

3. Apply for your credit card

We’ll tell you what your approval chance is so you can apply with confidence.

You could save on interest while you pay off those bigger purchases.

Tell us what you’re looking for and we’ll show you personalised offers for purchase credit cards.

What’s a purchase credit card?

It lets you spread the cost of your purchase over several months

A 0% purchase credit card lets you spread the cost of larger purchases and save on interest. These cards usually come with a 0% interest period which means you won’t have to pay any interest on what you spend for a fixed period – usually between 3 and 12 months. So, if you’re looking to pay for an unexpected expense like a new fridge or boiler, or make a big purchase, a 0% purchase card could help.

It can make budgeting easier

The main advantage of a 0% purchase credit card is that you won't have to pay interest on your purchases for a set period. This can help you spread the cost of big expenses over a few months and make budgeting easier. They're also useful for those who need to make a big purchase but don't have the funds available right away.

You still need to make the minimum repayments

During the 0% interest period, you'll need to make minimum monthly repayments to keep your account in good standing. Once that period ends, you'll start paying interest on any remaining balance, so it's important to pay off as much as you can before then. You could consider moving the remaining amount to a balance transfer card with a lower interest rate.

Do more with ClearScore

Get a preview of incoming changes

Whether you’re adding a new account, removing an old one, or just changing how much credit you use – you’ll find it here. So you can understand what makes your score move.

Take a closer look at your accounts

You can check out your payment history for the last 6 years. And we’ll show you when the account was opened and last updated. You can even see how much of your available credit limit you’ve used and what the loan balance is. Everything you need, all in one place.

Save time when looking for your next offer

We’ll show you offers tailored to you – and order them based on what might be right for you. And we’ll let you know what your approval chance is so you can feel confident about applying.

The benefits of 0% purchase credit cards

Purchase cards can help you spread the cost of unexpected, or larger, purchases.

You can save on interest during the 0% interest period.

Some cards come with additional perks like cashback or rewards.

The risks of 0% purchase credit cards

Just like any credit card, there are some risks to think about.

The interest rate can be high once the 0% period ends.

The 0% interest period can make it easier to spend more than you can afford – because you don’t have to worry about added interest for a few months.

If you miss the repayments, you risk losing the promotional offer. And your credit score can be impacted.

The application process

You can apply in the same way you’d apply for any credit card.

Compare your offers

The offers you’ll see are tailored to you.

We’ll ask you for some information to understand what you’re looking for and show you the credit cards you’re likely to be eligible for.

Look for the Triple Lock Guarantee

We’ll ask you for some information to understand what you’re looking for and show you the credit cards you’re likely to be eligible for.

Apply for your credit card

We’ll show your approval chances when you search for a credit card – saving you time and effort.

You might have to give the lender some more information and then they’ll carry out a hard search against your credit history.

Wait for your card to arrive

If you’re approved, it shouldn’t take long to get your card in the post. You’ll be able to use your new credit card as soon as you activate it.

*Pre-approval doesn’t always guarantee acceptance and is subject to lenders’ checks of your credit status.

Compare purchase credit cards

Join 19 million people worldwide – sign up today.

Eligibility for 0% purchase credit cards

To be eligible for a 0% purchase credit card, you typically need to have a good credit score and meet certain income requirements. You’ll also need to be over 18 and a UK resident.

When you compare offers on ClearScore, we’ll tell you what your approval chance is for every credit card we show you. So you can feel more confident about getting a ‘yes’.

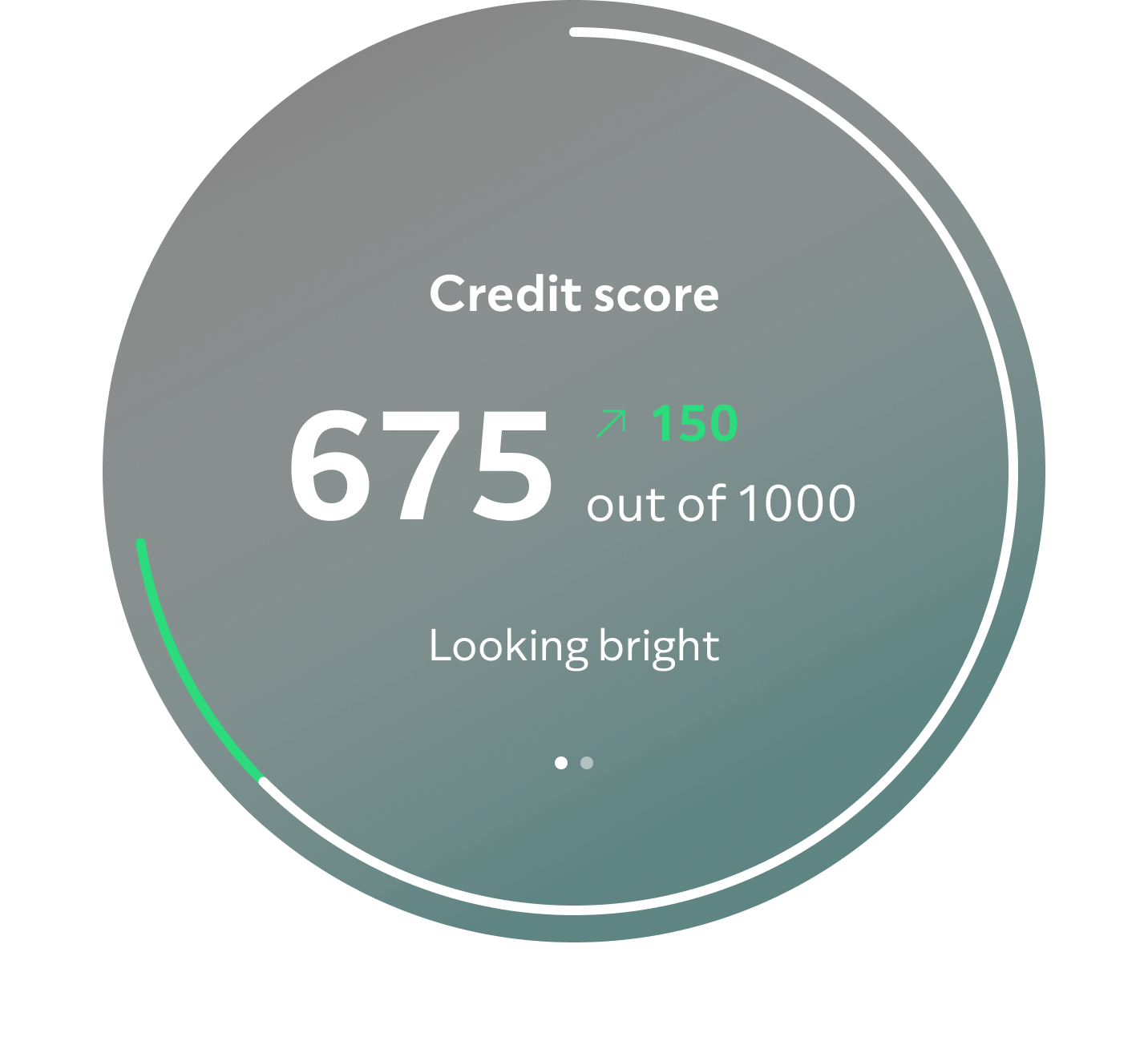

How can you check your credit score?

Sign up to ClearScore – it’s free, forever

We’ll show you a number out of 1000, so it’s easy to understand.

See what’s impacting your score

Every week, we’ll give you up to 10 insights to help you get to grips with your report. They’re filled with easy tips that could help improve your score and keep it moving in the right direction.

Find your 0% purchase credit card

Getting a 0% purchase credit card with bad credit

If you have a bad or low credit score, you could still get a purchase card. You might be offered a lower credit limit and the interest rate might not be as good when the promotional period ends.

But, at ClearScore, we work with lenders who specialise in helping you find the right credit card for your score.

Find out more about credit cards for bad credit.

Representative 34.6% APR.

Learn more about 0% purchase credit cards

Frequently asked questions

You can apply online – which is usually quicker – or over the phone or in-person. When you apply online, you can compare all your offers first. Which can give you a better idea of what’s available to you.

The length of the 0% interest rate varies depending on the card, but it typically lasts between 3 and 12 months.

Some purchase credit cards may come with fees, such as an annual fee, balance transfer fee, or late payment fee. Make sure to check the fees associated with each card before applying.

Some 0% purchase cards also offer a balance transfer feature, which allows you to transfer debt from other credit cards to the new card. But, there may be fees associated with balance transfers, so make sure to check the terms and conditions before applying.

Find out more about balance transfer credit cards.

Yes, you can pay bills using a purchase credit card. Just make sure to pay off your balance in full before the end of the 0% interest period.

Some 0% purchase cards will offer you cashback or other rewards while you spend.

Find out more about rewards credit cards.

A few things could happen if you miss a credit card payment – whether that’s by one day or longer. You might have to pay a fee (your lender will tell you) and the missed payment can appear on your credit report if you’re unable to pay within about 30 days. That could potentially affect your ability to get credit in the future – lenders look at your credit history to see if you have a track record of managing money responsibly. You could also lose the 0% interest offer.

If you can’t afford to pay your credit card statement, there are things you can do that could help. You should speak to your lender straight away and talk through your options with them. You can also reach out to charities like StepChange, National Debtline and Citizens Advice, if you’re worried about your finances.

Learn more about what happens if you miss a credit cards payment.

Other types of available credit cards

There are lots of credit cards out there – it’s important to find the right one for you.

0% interest credit cards

A 0% interest credit card lets you press pause on paying interest. That means you can use it for something like your everyday spending or to do a balance transfer, without paying the interest on the balance you carry over every month.

Balance transfer cards

Balance transfer cards let you transfer your existing credit card balance onto another card. You could use one of these cards to consolidate your debt and pay it off within the low- or 0% interest period.

Rewards cards

Rewards credit cards let you earn things like cashback, points or air miles when you make certain transactions. The interest rates can be high and some rewards cards also come with a monthly or annual fee.

Credit builder cards

Credit builder cards help you build your credit score. The interest rates can be high and the credit limit low, but you could see your score improve if you keep up with the monthly repayments.

Credit cards for bad credit

Credit cards for bad credit are designed for people who have a bad credit score or a poor repayment history and usually comes with a low credit limit or high interest rates.

Travel cards

Travel credit cards mean you either won’t be charged for using your card abroad, or the fees will be low.