Sign up in a few easy steps

It only takes 3 minutes and you’ll get your credit score and report for free, forever.

ClearScore is a credit broker, not a lender, 18+, T&Cs apply

Get the most out of your credit card

Enjoy your holidays without paying extra

Explore your full credit score and report – for free, forever

If you travel frequently, a travel credit card could be the one for you. It’s a type of rewards card, that usually comes with benefits that can help reduce travel costs or the cost of using your card abroad.

You could access things like bonus points, air miles, airport lounge access, travel insurance, and waived foreign transaction fees.

Many travel credit cards also come with sign-up bonuses that can be redeemed for travel rewards, like free flights or hotel stays.

Tell us what you’re looking for and we’ll show you personalised offers.

It only takes 3 minutes and you’ll get your credit score and report for free, forever.

The offers you’ll see are based on your credit score and report. And we order them based on what might be right for you – not what makes us the most money.

The lender will usually ask you to give them some more information and then they’ll carry out a hard search on your credit history.

If there are easy steps you can take to improve your score before you apply, take them. That’s because a better score could mean better offers – like lower interest rates or higher loan amounts.

See if the card comes with bonuses that work for you – like no transaction fees or air miles.

Some cards come with an annual fee. Make sure you factor that into your budget.

Sign up to ClearScore and get personalised travel card offers today.

You could enjoy your holidays without worrying about being charged extra for using your credit card.

You could access rewards like bonus points, air miles, airport lounge access or travel insurance.

Not all travel credit cards come with the same perks and rewards. So check what each one is offering before making your decision.

They could come with an annual fee or high interest rates.

Make sure you can afford the repayments and you know what the interest rates are. Look at the representative APR when you compare your offers.

If you travel a lot, a travel credit card can help you avoid additional transaction fees when you spend abroad. Other credit cards might be right for you if you don’t travel very much.

It’s the interest rate that the lender will typically give to at least 51% of people. That means up to 49% could get a higher rate.

Your actual APR may be higher than what you see. Learn more about what APR is.

If you see 3 green ticks, your offer is Triple Lock guaranteed. That means you can feel confident you’ll be accepted and you’ll get the money you need.

That’s because we lock in your credit limit or loan amount and the interest rates – before you apply.

Remember – pre-approval doesn’t guarantee acceptance but, if you pass the lender’s checks and your information on ClearScore is correct, you’ll get the credit card or loan.

Whether you’re adding a new account, removing an old one, or just changing how much credit you use – you’ll find it here.

We’ll show you whenever they've been opened or updated over the past 7 years. You can even see how much of your available credit you’ve used and what the loan balance is.

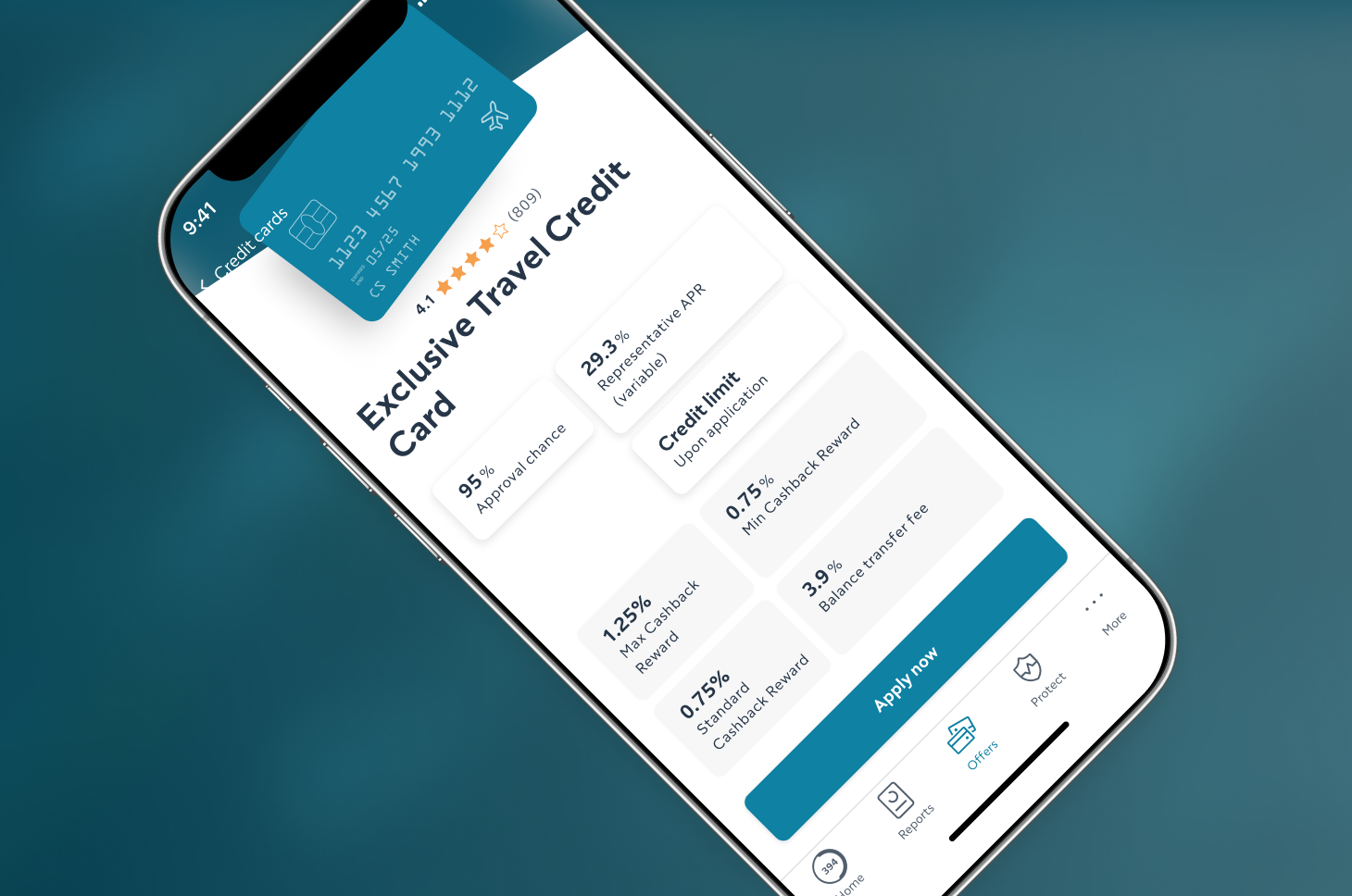

Your offers are personalised to you. And we’ll show your approval chance so you can feel confident about applying.

There are some other options out there.

From your weekly food shop to filling up the car – rewards cards are designed to boost the benefits from your everyday spending. When you make certain transactions, you’ll earn things like cashback, air miles, or points.

You load prepaid cards with money before using it. They can be a good option if you want to stick to a budget while traveling.

They allow you to access your current account funds without having to carry cash. Lots of banks offer debit cards with no foreign transaction fees, so they can be a good option for travel.

It can depend on the lender and the way you apply. Applying online is usually quicker than applying in person at a bank. Check the information in your credit report is accurate because lenders use that information to decide whether to lender you money.

The exchange rate you get with a travel credit card will depend on the lender and the currency exchange rate at the time of the transaction.

Most travel credit cards offer competitive exchange rates that are close to the market rate, which can help you save money when you travel abroad.

Some cards even offer no foreign transaction fees, making them a great option for international travellers.

You can use it in the same way you’d use it at home, making it a great option if you don’t want to carry lots of cash with you.

It’s usually less expensive to pay in the local currency. That’s because your lender will handle the exchange rate.

Whilst travel cards can come with no additional transaction fees, there is usually a fee for taking out cash at an ATM. The terms and conditions should make it clear what the lender charges.

Yes, you can typically use your debit card abroad. Some come with low transaction fees or other benefits. Check with your lender before you travel.

There are lots of credit cards out there – it’s important to find the right one for you.

Rewards credit cards let you earn things like cashback, points or air miles when you make certain transactions. The interest rates can be high and some rewards cards also come with a monthly or annual fee.

Purchase cards are designed for large purchases. You’ll be able to spread the cost over a few months – and the 0% interest period means you could save money on interest.

A 0% interest credit card lets you press pause on paying interest. That means you can use it for something like your everyday spending or to do a balance transfer, without paying the interest on the balance you carry over every month.

Balance transfer cards let you transfer your existing credit card balance onto another card. You could use one of these cards to consolidate your debt and pay it off within the low- or 0% interest period.

Credit builder cards help you build your credit score. The interest rates can be high and the credit limit low, but you could see your score improve if you keep up with the monthly repayments.

Credit cards for bad credit are designed for people who have a bad credit score or a poor repayment history and usually comes with a low credit limit or high interest rates.