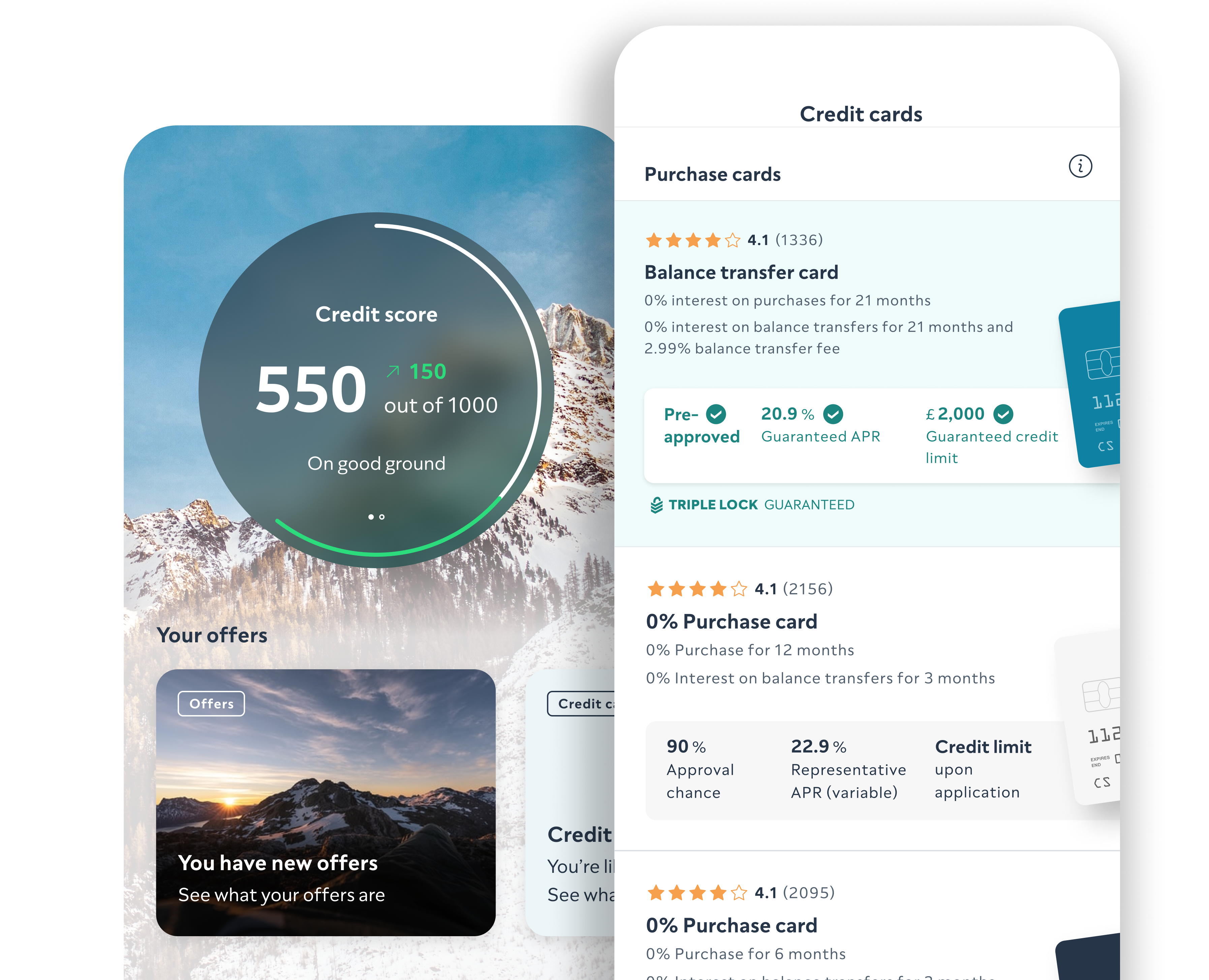

Feel confident you’ll be accepted

We’ll show you if you’re pre-approved so you can feel more confident about getting a ‘yes’.

Pre-approval doesn’t guarantee acceptance but, if you pass the lenders’ checks and your information on ClearScore is correct, you’ll get the credit card or loan.