Sign up in a few easy steps

It only takes 3 minutes and you’ll get your credit score and report for free, forever.

ClearScore is a credit broker, not a lender, 18+, T&Cs apply

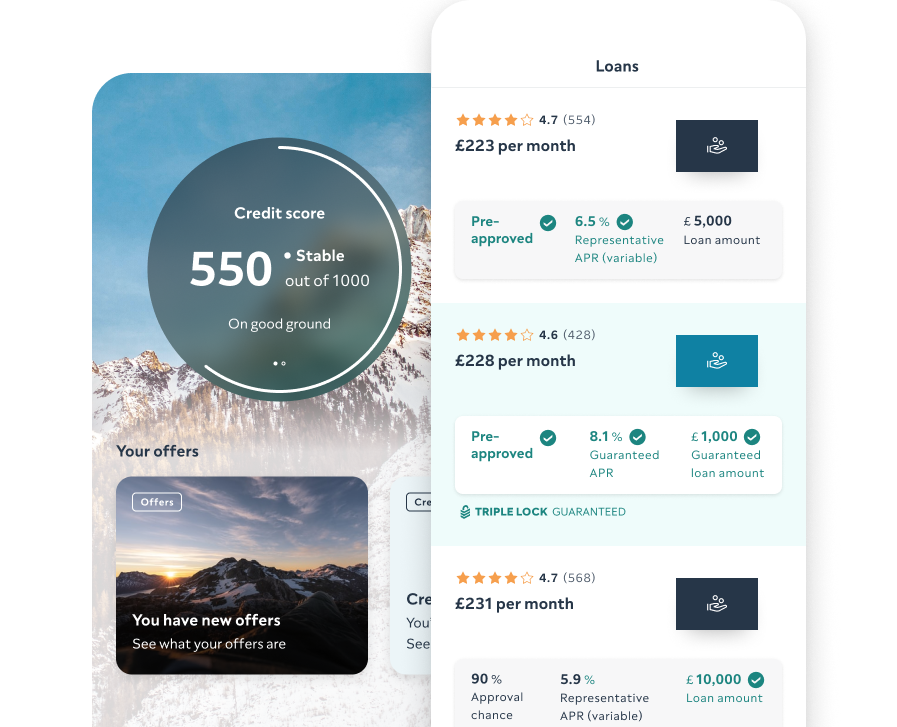

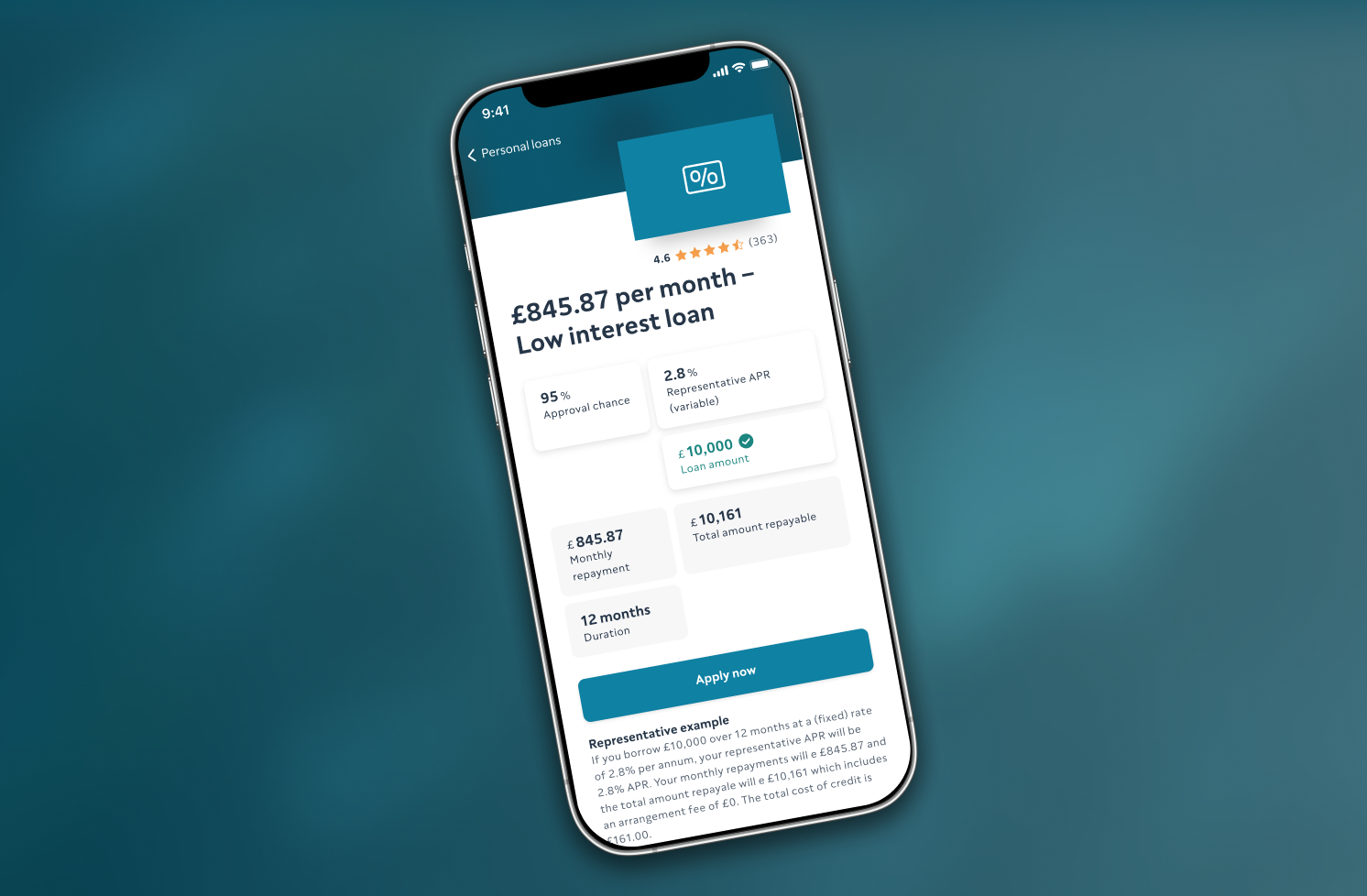

Look for the Triple Lock guarantee for guaranteed interest rates

Find exclusive money-saving offers if you’re eligible

Explore your full credit score and report – for free, forever

When you’re looking for any type of loan, it’s a good idea to check what the annual percentage rate (APR) is.

APR is the total cost of the loan over a year. It’s made up of the interest rate and other charges you might have to pay (like an annual fee).

So, a low interest loan means you’ll pay less overall.

It’s interest rate that the lender will typically give to at least 51% of people. That means up to 49% could get a higher rate.

Your actual APR may be higher than what you see.

We work with lenders to guarantee as many low interest rates as we can, so you can feel confident that what you see is what you get.

Tell us what you’re looking for and we’ll show you personalised offers.

It only takes 3 minutes and you’ll get your credit score and report for free, forever.

The offers you’ll see are based on your credit score and report. And we order them based on what might be right for you – not what makes us the most money.

The lender will usually ask you to give them some more information and then they’ll carry out a hard search on your credit history.

We work with lenders to bring you exclusive money-saving offers that you won’t find anywhere else.

If you’re eligible, you’ll see the exclusive offers when you start comparing loans.

We lock in the interest rate and loan amount – so you can be sure you’ll get the money you need.

Find out more about our Triple Lock guarantee.

Low interest loans can mean paying less overall.

With a lower interest rate, you’ll end up paying less overall for the loan.

A lower interest rate means lower monthly payments, making the loan more manageable.

More of your payment goes towards paying down the loan, meaning you’ll pay it off faster.

There are also some risks to low interest loans.

Taking on additional debt can be risky if you’re not able to manage it properly.

Some low interest loans may have fees and charges that can add up over time.

Taking out a new loan can have an impact on your credit score.

If there are easy steps you can take to improve your score before you apply, take them. That’s because a better score could mean better offers – like lower interest rates or higher loan amounts.

Every time you apply for credit, your score drops. It’s usually short-term if you manage what you’ve borrowed responsibly. So, it’s a good idea to wait for your score to improve before comparing new loans.

Checking things like your income, employment details, and address are still correct is key. Lenders use that information (as well as your credit history) to determine the loan amounts and interest rates they can offer you.

Get started on finding the right personal loan for you today with ClearScore.

Don't borrow more than you need, as this can increase the total cost of your loan and make it harder to repay.

Feel confident about your loan repayments by planning your budget in advance.

There are some other options out there if you’re not sure a loan is right for you.

Some credit cards come with a promotional or introductory offer – like 0% interest. It means you won’t have to pay interest on the balance you carry over for a number of months. Just make sure to keep up with the minimum monthly repayments.

Balance transfer cards let you transfer your existing credit card debt onto the new one. They usually come with 0% interest periods which means you won’t start building up interest on any of the balance you carry over.

A guarantor loan is another type of unsecured loan. If a friend or relative meets your lender’s criteria, they could help you get a loan by promising to make the repayments (as a last resort) on your behalf.

The amount you can borrow with a low interest loan will vary depending on the lender, your credit score, and personal circumstances. Generally, lenders will offer larger loan amounts to borrowers with good credit and a stable income.

To get the lowest interest rate on a loan, you’ll typically need a good credit score, a stable income and employment history, and a low debt-to-income ratio. You may also be able to secure a lower interest rate by providing collateral on a secured loan or looking into a guarantor loan.

It’s a good idea to compare your offers before you apply so you can get a better idea of what you’re eligible for.

In most cases, yes. Personal loans, in particular, can be used for just about anything, from home improvements to debt consolidation.

Fixed rate loans have a set interest rate that doesn’t change over the life of the loan. Variable rate loans, on the other hand, have an interest rate that can change over time based on market conditions. Both types of loans can be low cost, depending on the lender and other factors.

If you’re new to credit or working on improving your credit score, you might not see Triple Lock offers yet. Keep an eye on your report and seeing what’s impacting your credit score.

From time to time, we work with lenders to bring you offers you won’t see anywhere else. If you’re not seeing exclusive loan offers, it’s either because we’re not offering any at the moment or because you’re not eligible yet. Check your insights to see what you can do to improve your score and start seeing better offers.

If you need debt advice, you can speak to charities like StepChange, National Debtline and Citizens Advice. You can also speak to MoneyHelper. You should let your lender know as soon as possible so they can speak to you about your payment options. Learn more about what to do if you can't make a payment or miss a payment on a loan.