Sign up in a few easy steps

It only takes 3 minutes and you’ll get your credit score and report for free, forever.

18+, T&Cs apply

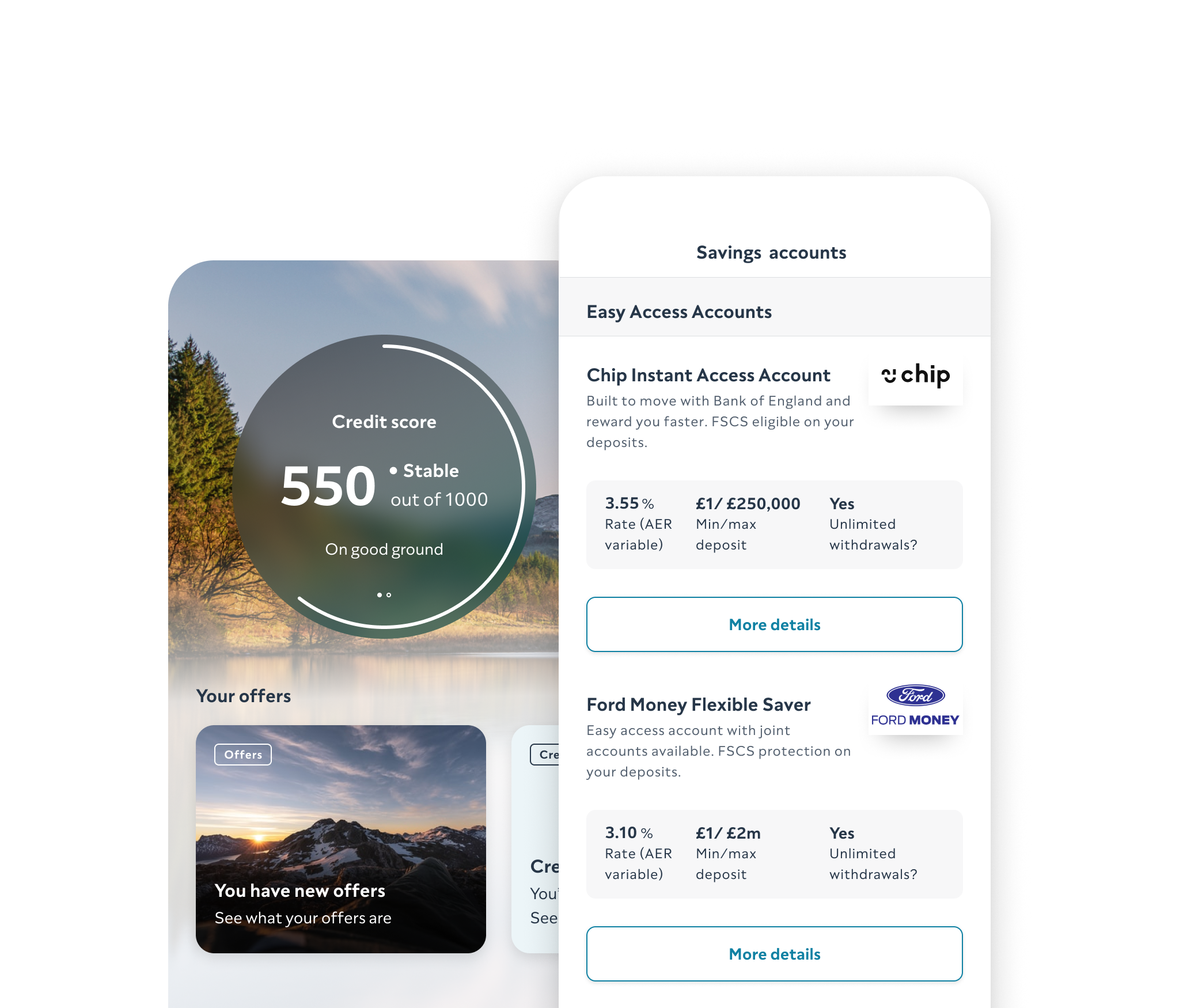

Choose from easy-access and fixed-rate options

Compare benefits and interest rates

Find a savings account in seconds

It only takes 3 minutes and you’ll get your credit score and report for free, forever.

We order them based on what might be right for you – not what makes us the most money.

Make your money work harder.

Whether you want to dip into your savings or lock them away, you can save in the way that works for you.

See the benefits and interest rates before you apply. Everything you need – all in one place.

You could find your new savings account today.

You can take money out when you like, usually without any restrictions or fees. The interest rate tends to be lower than a fixed-term or cash ISA, but you can access your money whenever you need it.

You’d need to leave your money in the account for a set period (usually between 1 and 5 years). And in return for keeping your money in the account, you’ll usually get a higher interest rate.

Savings accounts mean making the most of your money.

Each year, you’ll boost your savings by building up interest.

The different types of account can give you the flexibility to save in a way that works for you.

Your savings (up to £85,000) are protected under the Financial Services Compensation Scheme (FSCS).

Maybe you want to put some savings away but access the money in an emergency. Or, maybe you have a pot of money you never touch.

Easy-access could be right for you if you want to access your money when you like. Or, a fixed-term could be the one if you’re happy leaving your money in the account for a period of time.

The higher the interest, the more you’ll boost your savings.

Consider all these factors carefully to make an informed decision and take a step closer to achieving your financial goals.

Whether you’re adding a new account, removing an old one, or just changing how much credit you use – you’ll find it here.

We’ll show you whenever they've been opened or updated over the past 7 years. You can even see how much of your available credit you’ve used and what the loan balance is. Everything you need, all in one place.

Your offers are personalised to you. And we’ll show your approval chance so you can feel confident about applying.

It means you need to leave your money in the account for a set period. Usually that’s between 1 and 5 years.

If you need to access your savings before the end of a fixed term, you might have to pay a fee or you might lose out on some of the benefits of the account (like the interest rate). Be sure to read the terms and conditions of your savings account carefully before opening it.

Most savings accounts in the UK are protected by the Financial Services Compensation Scheme (FSCS). That means up to £85,000 of your savings are protected per person, per financial institution. This means that even if the bank were to be bankrupt, you would be able to get your money back (up to the protected amount).

Yes, you can open a savings account even if you have a bad credit score. Some banks may carry out credit searches to check your eligibility for certain accounts or benefits. It’s important to check the bank’s terms and conditions before you apply.

Yes, you can. Just so you know, the £85,000 FSCS protection limit applies to each financial institution. So, if you have multiple accounts at the same bank or building society, the limit is £85,000 in total. You might want to consider spreading your savings across different institutions if you’re already exceeding the limit at one.