In this article

See your enquiries

Check your report to see if you have any enquiries on your profile.

What is a credit enquiry?

We have a look at what it means to have an “enquiry” on your credit report, and we consider the distinction between when a lender views your credit profile and when you do.

In this article

See your enquiries

Check your report to see if you have any enquiries on your profile.

Let’s have a look at what it means to have an “enquiry” on your credit report, and consider the different impacts on your credit score when a lender views your credit profile and when you do. So, what is a credit enquiry?

A credit enquiry is a request submitted by lenders or creditors for your or your business' credit information. It usually happens when you apply for a loan, a line of credit, or any other type of credit that needs the lender to evaluate your creditworthiness.

Credit enquiries provide several pieces of information including payment history and account balances to help the lender determine if they should approve your credit application.

It’s important to remember that while credit enquiries can have some impact on your credit score, they’re not as influential as other items such as total debt and payment history.

Learn more: What is a credit report? // What is a credit score?

When lenders evaluate your creditworthiness, credit reports are crucial. It’s important to understand what a credit report includes and how lenders look at them when considering credit enquiries.

Credit reports generally include information about your credit history, such as home loan payments and credit card balances. They also contain your credit score which is calculated based on the amount of credit accessed, payment activity, types of credit held and overdue accounts.

Lenders may look at a variety of factors when evaluating your creditworthiness, including:

- Credit score

- Current loan balance

- Debt-to-income ratio

- Past payment behaviour

Ultimately these factors help lenders determine whether or not you’re an ideal customer that they can trust to repay any money borrowed.

Learn more: This is what you will find on a credit report

When you apply for credit, your chosen lender will run a credit enquiry. This means that they’ll get in touch with one of the credit bureaus, such as Experian or TransUnion, and request your credit report.

To use a specific example, imagine you’re applying for a personal loan. After receiving your application, your lender will assess your affordability and run a credit check. Based on their findings, they’ll either accept or reject your application.

However, this interaction will leave a mark – or an “enquiry” – on your credit report, regardless of the outcome of your application. Every time a lender requests your credit report, a note will be made of this on your report, and your credit score will decline slightly.

This is nothing to be alarmed about since everybody’s scores constantly fluctuate. It only becomes a problem if you have multiple enquiries over a short period. For example, if one lender rejects your loan application and you apply to three more, then there will be four enquiries on your report altogether during the same month.

This will alarm any future lenders since it appears you are desperate for money but unable to pass the affordability test.

What is the affordability test and how do you pass it?

Affordability is a key consideration in credit decisions, where credit enquiries are made to assess how capable you or a business is of taking on a credit responsibility such as loan repayment. It involves looking deeper than the credit score and examining factors like income, expenditure, debts, and credit history.

It helps creditors work out what level of credit they can responsibly offer while also protecting you from taking on too much debt that you cannot afford to pay back later. A good measure of affordability helps credit providers make informed decisions while also providing an environment of safe lending practices with reasonable terms and conditions.

You can use the ClearScore affordability calculator to check how much credit you can afford and therefore the likelihood that your credit application is approved.

It’s essential to be mindful of your affordability when you apply for credit so that you can protect your credit score and report from taking an unnecessarily large dip.

If you have a look at your credit report, you’ll be able to see the different credit enquiries from lenders that are currently there and continue monitoring the activity on your report.

Learn more: Does a credit enquiry affect your credit score?

How hard or soft enquiries may affect your credit score is good to consider. A hard credit enquiry, also known as a hard pull, is when a lender requests your credit report from a credit bureau to make a lending decision.

A hard enquiry occurs with a credit application and can result in a temporary negative impact on your credit score. Home loan applications, car loans, or types of personal loans could initiate a hard enquiry.

A soft credit enquiry is when a business checks your credit report to make a non-credit-related decision about you. By contrast, it won't affect your score as it doesn't involve any loan application request.

Some examples of businesses that may conduct a soft enquiry are landlords, employers, and insurance companies. A soft credit enquiry looks into activities like pre-approved offers, employer screenings, and frequently requesting your credit report.

Examples of hard credit enquiries

- Home loan applications

- Car loan applications

- Certain types of personal loans

- Credit card applications

Examples of hard credit enquiries

- Pre-approved loan offers

- Employer screenings

- Landlord screenings

- Frequently requesting your own credit report

Checking your credit score is not classified as a hard credit enquiry. A hard enquiry from an external source happens when a lender considers offering you credit, such as a personal loan or a home loan. Their appraisal of your financial security makes it "hard" because they intend to give credit if you're suitable.

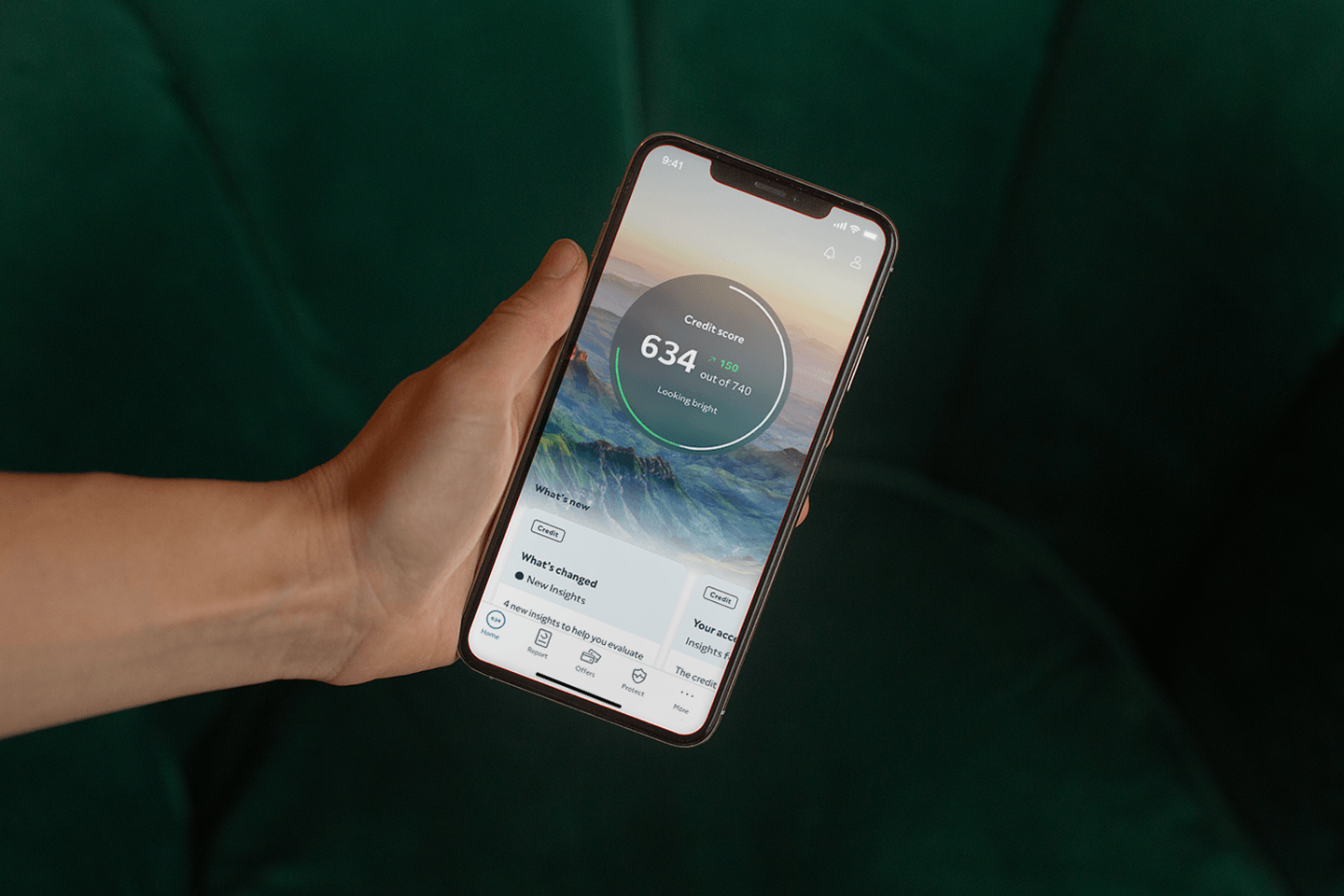

Considering the impact a credit enquiry from a lender has on your credit report, you may be wondering whether the same applies when you request your report. Such as when you log in to check your free score and report.

Luckily, this doesn’t count as a credit enquiry, and it will have absolutely no impact on your credit report or score.

It’s your right to have access to your credit profile, and there shouldn’t be any barriers in place to prevent you from keeping track of your credit score. As a result, you’re allowed to look at your credit report as often as you’d like – without it being noted on your report or forcing your credit score down.

By signing up with ClearScore, you’ll have immediate access to your credit report and you’ll be able to log in and visit it as often as you’d like. Similarly, suppose a party isn’t affiliated with a financial institution, such as a prospective employer or landlord, and they look at your credit report. In that case, it won’t count as a credit enquiry.

It will only be noted if the party looking at your credit report is doing so as part of an assessment to extend credit to you.

Hard enquiries remain on your credit report for up to two years, though most are only visible to other lenders and creditors for the first year.

Usually, hard credit enquiries won’t impact your capacity to obtain finance directly. However, if you receive frequent hard enquiries it may suggest to potential lenders that you've been applying for various kinds of finance, which may affect their decision about whether or not to offer you credit.

It's good to be aware of hard enquiries and that you understand how they impact your overall financial standing.

Removing hard credit enquiries from your credit report is a good step when maintaining your credit score.

The process starts with reaching out to the relevant lender or credit provider to determine their policies on removing hard enquiries.

If they're willing to remove the hard enquiry then you’ll have to follow their specific process accordingly.

Additionally, it's also helpful to contact a credit reporting agency to confirm if the hard enquiry has been removed successfully from your report. These steps can help to ensure that your credit score is unaffected.

Besides allowing you to keep tabs on the growth of your credit score, there are several other benefits to regularly checking your credit report. These are some of the most important benefits:

- Get ahead of fraud & identity theft: If your credit card details have been used by fraudsters to make large purchases or your personal details have been stolen to take out large loans, you will be able to see this on your credit report. You will notice that your debt utilisation has unusually increased, and you will find suspicious enquiries from lenders you’re unfamiliar with.

- Notice mistakes on your report: Both lenders and credit bureaus are fallible, and they occasionally make mistakes. It’s possible that they mix up your personal details with another borrower, and place their credit behaviour on your report. This could have a negative impact on your credit score, and the sooner you bring this to their attention, the sooner it can be resolved.

- Keep track of your accounts: There’s a lot of useful information that you’ll find on your credit report, including a list of your open accounts. Here, you will see the current balance of each account, as well as each one’s credit limit. It will also show you your credit utilisation, which you should keep below 30%.

You will be able to reap all of these benefits by joining ClearScore. Sign up today to start taking control of your credit profile.

Isabelle is a freelance finance writer and journalist in Cape Town. She helps make managing your personal finances calm, clear and easy to understand.