In this article

Browse short- and long-term loans

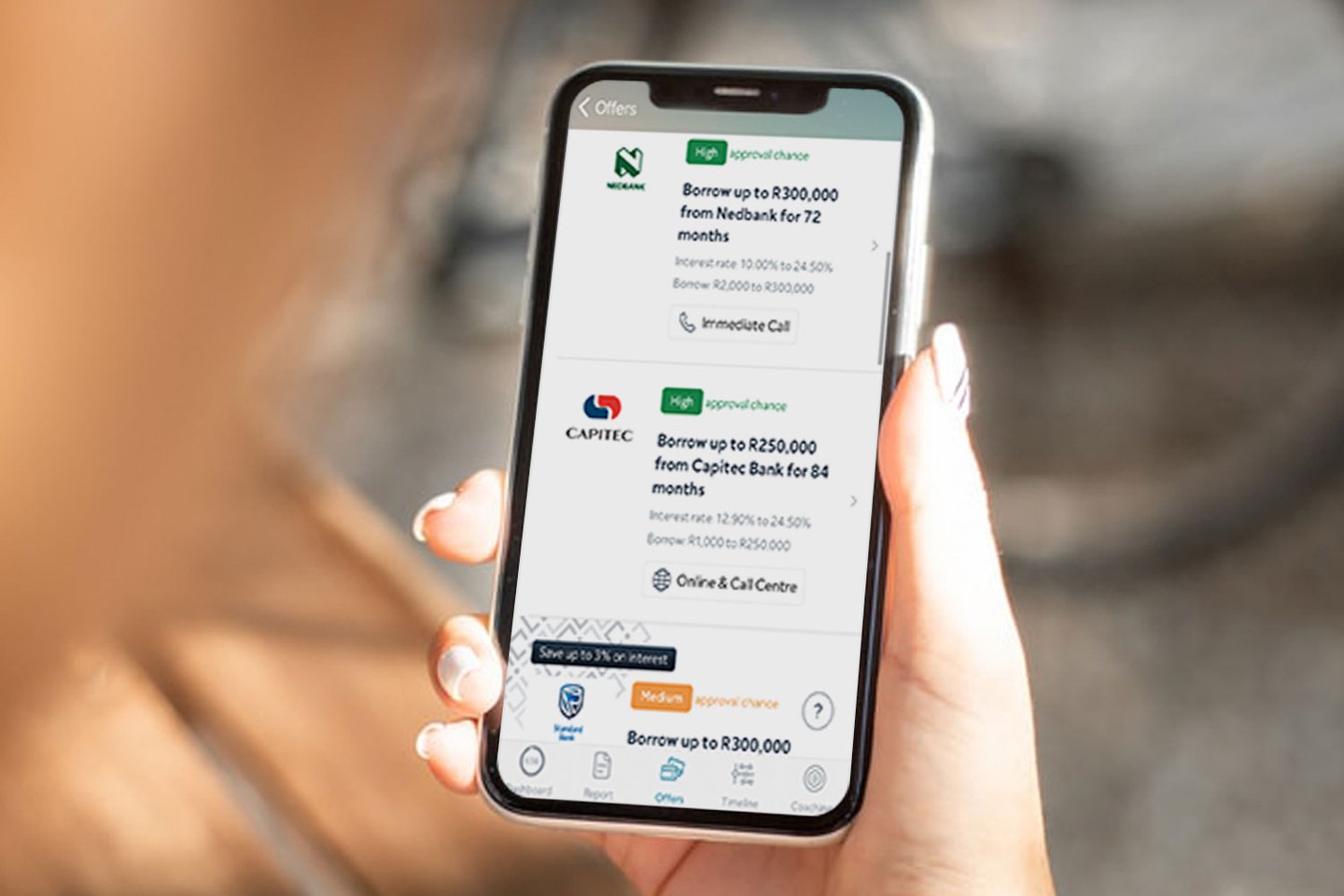

All the offers you see on ClearScore are tailored to your credit score and financial circumstances.

Short-term vs. long-term loan

Find out how short- and long-term loans differ from one another, and learn more about the benefits of each.

In this article

Browse short- and long-term loans

All the offers you see on ClearScore are tailored to your credit score and financial circumstances.

A loan can help when you need extra financial support. Perhaps you’ve had an unforeseen expense or want to grow your business and need additional capital. Either way, understanding the difference between short-term vs. long-term loans may help you find the right loan.

A short-term loan can help when you’re in a tight financial pinch. If you need to cover unexpected bills, such as an unplanned visit to your doctor or emergency car repairs, a short-term loan might be the right option. With this in mind, they can be great options for you to cover expenses that you might not otherwise afford.

Traditionally, long-term loans are for bigger financial responsibilities. As the name may suggest, they’re paid off over a longer period, whereas a short-term loan is repaid quickly – within a few weeks or months.

Here’s a closer look at the benefits of each type of loan.

1. You don’t need collateral

The loan doesn’t have to be secured with an asset like a house or car. Many credit providers offer shorter-term loans without needing any kind of collateral. Short-term lending is made more available for people who may not have the cash flow or resources necessary to take a longer-term loan.

Loan providers consider factors other than credit score and collateral when determining whether or not you’re eligible for a short-term loan, such as income and current debt load.

2. There's no long-term commitment

Lenders aim for you to settle the loan quickly – usually within three months. They are a great way to help your budget in the short term without committing to a long-term financial obligation

They can provide fast access to funds when there's an unexpected expense or gap in income and can have flexible repayment terms that can also fit your short-term needs.

They’re attractive because they don't require a permanent commitment: you could be out of debt and pay off your short-term loan in a few short weeks or months.

3. You immediately gain access to cash

Funds will usually enter your account within 24 to 48 hours. Short-term loans can be a great way to access money quickly.

Most credit providers offer access to approved funds in a few hours, offering a faster service than some traditional forms of lending

Fortunately, they usually have fewer requirements than other loans when considering your credit score and employment history, making them attractive if you’re likely to be denied a traditional loan.

1. Access to larger amounts of money

Long-term loan offers can be a great source of financial flexibility if you need larger sums of money. By structuring payments over an extended period, the loan provides access to funds you may not have been able to secure through other avenues.

This type of financing presents a smart opportunity for individuals or organisations looking for long-term support with their finances. Common long-term loans may include home loans, business lines of credit, and personal loans, allowing loan seekers to make decisions tailored to their unique situation.

Before considering this option, it’s important to make sure the long-term payment will be feasible in the long run.

2. Lower interest rates

Long-term loans are attractive options for those who seek to finance large purchases, as they typically offer lower interest rates than short-term loans.

A lower interest rate can be crucial in helping to afford long-term goals such as buying a home or car and dramatically reduces the long-term cost even if repayments extend over several years.

Ultimately it pays to shop around when sourcing long-term loan options, as different lenders have different offers available that could save you a great deal on your repayment costs.

3. Longer repayment period

Long-term loans offer extended repayment periods, allowing you to make smaller, gradual payments until your loan’s paid off. This long timeline for repayment can help reduce stress and the opportunity to create a payment plan that works best for you financially.

Learn more: Your guide to long-term loans

Access to less money

They provide access to smaller amounts of money than long-term loans, which involve substantial long-term payments spread over a long time. While the shorter duration and faster repayment schedules associated with short-term loans usually grant access to lesser amounts.

Can be difficult to qualify for

Since short-term loans are offered to people with less-than-perfect credit, it could be hard to qualify for one. To qualify for a short-term loan, you may need to have a cosigner or put up collateral if you’re already in a difficult financial position.

Learn more: Why your loan risks rejection

Higher interest rates

The interest rates on short-term loans are often much higher than the interest rates on long-term loans, making them quite expensive. Additionally, many short-term loans come with additional fees, such as origination fees or prepayment penalties.

You will need collateral

Long-term loans can provide long-term investments with the necessary funding, but they typically require collateral for the lender to feel secure when providing the loan. Collateral can be any item of value owned by the borrower, such as real estate or other financial assets.

It will take longer to gain access to cash

It’s good to consider the amount of time associated with loan accessibility; long-term loans may take days or weeks to process, meaning access to cash is slower when compared with shorter-term loan options. The processing time is crucial; delays in funding can cause obstacles and strains on plans developing over a long time.

The loan may not be flexible

Another disadvantage is that they may not be as flexible as shorter-term loans. For example, if you take out a five-year loan, you’ll likely be required to make payments for five years. However, if you take out a shorter-term loan, such as a three-year loan, you may have the option to pay off the loan early without penalty.

You could save on interest charges by paying off the loan sooner than the original terms specified.

Short-term loans are financial products that provide you or your businesses with short-term access to capital for various expenses. They’re often used to cover short-term cash flow gaps and to finance short-term upfront costs associated with a big project.

Many short-term loans can be completed quickly and without extensive paperwork, making them valuable when time is of the essence. Generally, short-term lenders are more flexible in their qualifications compared to those for longer-term loans.

They can help accommodate unexpected expenses and support the growth of your short-term objectives – though they come at a cost.

It’s essential to explore options carefully before requesting short-term financing, as it’s not always the best fit given high-interest rates.

Long-term loans are used for financing long-term projects or investments, making them ideal for you or your business when you need long-term funding. Typically, they have lower interest rates since they generally include repayment plans that cover long periods.

Moreover, long-term loans are a great tool to give you more access to the funds needed to finance large purchases or achieve long-term goals.

With longer terms allowing for flexible repayment plans and reasonable interest rates, they’re an excellent solution when you need funds for long-term projects or investments.

Compare loans with ClearScore to make sure that you find the best loan to meet your financial needs.

Short-term loans | Long-term loans |

|---|---|

May not require collateral | Requires collateral |

Short-term commitment | Long-term commitment |

Almost immediate access to cash | Takes longer to process and access to cash may take time |

Only have access to smaller loan amounts | Access to larger loan amounts |

May have higher interest rate | May have lower interest rate |

Payment terms could be more flexible | May have less flexible payment terms |

Helps achieve short-term goals | Helps achieve long-term goals |

Usually used to finance smaller unexpected expenses | Usually used to finance bigger long-term expenses |

A better understanding of short-term vs. long term loans means that you can make an informed choice on the right kind of loan for your needs. Sign up today to ClearScore, where we offer short-term and long-term loans from leading partners around South Africa.

We’ll match you with offers you’re most likely to be approved for; based on your credit report and account information.

Isabelle is a freelance finance writer and journalist in Cape Town. She helps make managing your personal finances calm, clear and easy to understand.